- Recent research from Glassnode highlights that the majority of BTC investors remain profitable, with over 87% of the circulating supply held in profit.

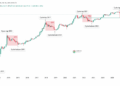

- Glassnode’s analysis using the market value to realized value (MVRV) metric reveals that Bitcoin continues to show significant profitability, up over 120% from its purchase price.

New research indicates that Bitcoin remains “largely profitable” despite months of sideways price action. In the latest edition of its weekly newsletter, The Week On-Chain, published on June 18, analytics firm Glassnode debunked myths regarding investors’ unrealized losses.

Bitcoin (BTC) is currently trading around $66,409, moving within a narrow range, as reported by Crypto News Flash. Glassnode described the current BTC price behavior as “establishing equilibrium,” highlighting several on-chain metrics that suggest Bitcoin is in a period of consolidation rather than capitulation.

“Sideways price movement tends to manifest as investor boredom and apathy, which appears to be the dominant response across all Bitcoin markets,” the report noted. The Glassnode Researchers noted:

BTC prices are consolidating within a well-established trade range. Investors remain in a generally favourable position, with over 87% of the circulating supply held in profit, with a cost basis below the spot price.

Researchers used the market value to realized value (MVRV) metric to show that, on average, a given amount of BTC is still up by over two times, or 120%, compared to its purchase price in USD terms. Currently, the one-year average MVRV value stands at 86%. “The MVRV Ratio remains above its yearly baseline, suggesting that the macro uptrend remains intact,” noted Glassnode.

Bitcoin Trading Volumes Take A Hit

Despite strong investor profitability, the volume of transactions on the Bitcoin network has significantly declined since the all-time high (ATH), indicating a reduced appetite for speculation and increased market indecision. A similar trend is observed in the spot volume traded across major centralized exchanges, highlighting a strong correlation between on-chain network settlement volumes and trade volumes, and reflecting a sentiment of investor boredom.

Bitcoin short sellers are likely hoping the asset won’t reach $70,000 soon, as a significant amount of liquidations are at risk if it does. According to CoinGlass data, a substantial $1.67 billion in short positions will be liquidated if Bitcoin returns to $70,000, a level it has been trading below since June 8.

Pseudonymous crypto trader Ash Crypto noted in a post on June 17 that there is a significant accumulation of Bitcoin short liquidations occurring at higher price levels, per the Crypto News Flash report.

Bitcoin’s open interest (OI), representing the total value of all outstanding Bitcoin futures contracts across exchanges, has declined by 10.99% since its peak on June 7, now standing at $33.55 billion.

Willy Woo, a popular crypto analyst, proposed that a significant liquidation event could pave the way for Bitcoin to achieve new all-time highs. The analyst noted:

We need a solid amount of liquidations still before we get the all clear for further bullish activity. I know it sucks, but BTC is not going to break all time highs until more pain and boredom plays out.

Credit: Source link