Bitcoin (BTC) mining difficulty may be knocked out of its just recently gained all-time high this weekend, back to a March level.

If this adjustment goes as currently (16:00 UTC) estimated by mining pool BTC.com, mining difficulty – which is the measure of how hard it is to compete for mining rewards – will drop 13.58%. This will land it to 21.64 T, the lowest it’s been since mid-March.

This would be only the third drop in the mining difficulty this year, and the largest one.

Additionally, it comes after the latest all-time high (ATH) of 25.05 T, hit during the last adjustment two weeks ago. This was the strongest move upwards since October 2017.

All of this is happening amidst the latest selloff seen in the crypto markets, which pulled BTC down by 43% from its April 14 ATH of USD 64,804 (per CoinGecko) to USD 36,813 at the time of writing.

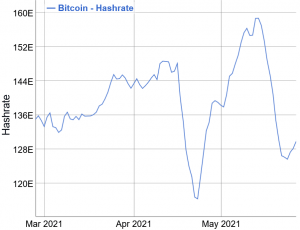

Meanwhile, according to BitInfoCharts.com, hashrate, or the computational power of the network, had dropped around 21% between the previous adjustment and May 24. In the three days after that, the 7-day simple moving average hashrate went up 3% to nearly 130 Eh/s.

The mining difficulty of Bitcoin is adjusted around every two weeks (that is, every 2016 blocks) to maintain the normal 10-minute block time. The 7-day simple moving average block time on May 27 was just above 12 minutes.

Looking at the data provided by ByteTree, miners have spent more coins than they held in the past several weeks. In the past day, however, they held BTC 38.

____

Learn more:

– Analysts See ‘Seismic shift’ In Bitcoin Mining Amid Chinese ‘Crackdown’

– Chinese Miners Block Mainland IP Access as Beijing’s Purge Intensifies

– No Legal Bitcoin Mining in Iran Until Late September

– Green Investments Help Bitcoin Miners Amid Possible Regulatory Crackdown

– ‘Next Great Miner Migration Will be Away from China’ – Poolin Exec

– Bitcoin Mining Council: Promotion, Cabal, Attack on BTC, or Pointless?

– A Closer Look at the Environmental Impact of Bitcoin Mining

– Bitcoin Mining in 2021: Growth, Consolidation, Renewables, and Regulation

Credit: Source link