Bitcoin (BTC) mining difficulty is set for a new all-time high (ATH), cutting into the profit margins of BTC miners that are still estimated to increase the computing power of the network even more despite the price of BTC has been stuck in a range recently.

The measure of how hard it is to compete for mining rewards, known as mining difficulty, is estimated to rise 18.5% in less than a day, per mining pool’s BTC.com estimations (14:07 UTC).

It would be the highest rise since late October 2017’s 21.39%, following the almost 13% drop on May 1.

Furthermore, this rise would bring the difficulty to 24.42 T, which would be a new ATH, taking the place of 23.58 T recorded in mid-April this year.

Meanwhile, BTC is trading at USD 56,627 and is up by 2% in a day and 3% in two weeks. Following the drop from its ATH in April, the price corrected upwards, but has been trading between USD 54,000 and USD 59,000 since the beginning of May.

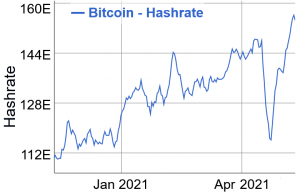

Per BitInfoCharts.com, hashrate, or the computational power of the network, has continued rising since the start of this month, when the previous adjustment happened – following what was already a significant jump. Overall, since May 1, the 7-day simple moving average hashrate went up 12%.

The mining difficulty of Bitcoin is adjusted around every two weeks (that is, every 2016 blocks) to maintain the normal 10-minute block time. The 7-day simple moving average block time on May 11 was a bit more than 8 minutes.

Meanwhile, according to Igor Runets, the CEO and Co-founder of BitRiver, a major provider of colocation services for cryptocurrency mining in Russia, and CIS countries, this increase in mining difficulty will not affect the plans of miners to purchase more mining equipment or mine with the devices they have already deployed.

“The global chip shortage has constrained the growth of hashrate, although the demand for mining continues to increase. So a lot of this appetite for mining is left unattended due to the supply constraint on the side of miner makers,” he told Cryptonews.com.

Runets estimates that the Bitcoin hashrate will continue to increase and break new all-time highs this year as more mining machines that were purchased several months in advance are being delivered and deployed.

Also, analytics firm Coin Metrics said in their weekly report, that “a proxy for network security, growing hash rate is a healthy sign for Bitcoin’s continued growth.”

“Additionally, the rebound shows that the network is resilient and able to quickly recover after unexpected outages,” they added.

The analysts argued that the changing macroeconomic conditions seen in 2020 and early 2021 helped fuel BTC’s rise and bring more institutional investors. And while the first quarter of 2021 was rather loud, the second quarter so far turned quiet for BTC, despite some altcoins surging. “Now macroeconomic conditions could be shifting in BTC’s favor once again,” it said.

The USD weakened during April and last week, which could be beneficial for BTC, at least in the short-term, as it has historically risen during times that the dollar has weakened.

Furthermore, the BTC market is in a healthier position than it was a few months ago, said Coin Metrics. BTC perpetual futures open interest has reset to its lowest levels in months, suggesting that “leverage has been flushed out of the system,” giving the market “a healthier foundation for the next leg up.”

Despite retail investors “pouring” into small-cap cryptoassets, the adoption continues to grow, while major technological and privacy improvements, along with fees reductions, are on the horizon with the activation of the Taproot upgrade.

The number of addresses holding relatively small amounts, BTC 0.01-1, has grown by 710,000 since the start of 2021, surging in April. On-chain transfer value also surged last month to its highest levels ever, with a total of USD 447bn, said the report, compared to USD 366bn in March and USD 319bn in February. This signifies growing adoption as well.

Coin Metrics concluded that,

“Given the positive momentum on most fronts Bitcoin could be in for another surge during the second half of the year.”

Meanwhile, according to ByteTree, in the past week, miners have held more coins than they’ve sold. However, this hasn’t been the case in the past 12 weeks or in the past day. Miners usually build their inventory during market weakness and sell into strength.

____

Learn more:

– Russian Crypto Miners Brace for Computer Chip Crisis Fallout

– Proof-Of-Bitcoin Needed As Critics & Competitors Unite To Play Climate Card

– A Closer Look at the Environmental Impact of Bitcoin Mining

– Bitcoin Mining in 2021: Growth, Consolidation, Renewables, and Regulation

Credit: Source link