Bitcoin (BTC) market capitalization may be overstated by USD 151.5bn, according to data from the crypto intelligence firm Coin Metrics. And the same may well go for the token’s forks, the company suggested.

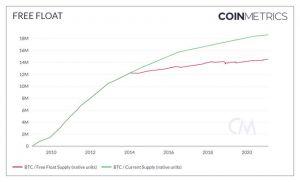

Coin Metrics arrived at this staggering figure by looking at how many coins may actually be on the market. Per a tweet from the firm, Coin Metrics said that it was “widely understood that whilst there are 18.6m bitcoin in existence, many are lost and not available to the market anymore.”

Instead, the firm introduced a free float supply model, claiming that contrary to more conventional figures, “a more realistic representation” of bitcoin’s supply would be 14.5m.

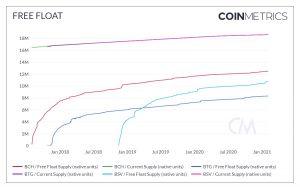

Furthermore, when the float methodology is applied to Bitcoin forks, specifically bitcoin cash (BCH), bitcoin SV (BSV), and bitcoin gold (BTG), Coin Metrics argues that this “generates an even starker difference in what is most commonly reported as the supply of these assets vs. what is more likely their supply in markets.”

The company claimed:

- BCH’s commonly reported supply is 18.65m, while its free float supply is 12.5m;

- BSV’s reported supply is nearly 18.5m, while its free float supply is closer to 10.8m;

- BTG’s reported supply is also around 18m, but its free float supply is the lowest of all: at just above 6m.

Coin Metrics concluded,

“This implies that the market cap of bitcoin and its forks can be overstated by simply adopting the total on chain supply. This might have investability and market sizing implications for those benchmarking the total market cap of bitcoin/crytpoasset.”

According to the data compiled by the firm:

- BTC’s commonly reported market cap is USD 691.33bn, while its free float market cap is USD 539.83bn – a USD 151.5bn discrepancy;

- for BCH, it’s USD 7.9bn vs. USD 5.3bn – a USD 2.6bn discrepancy;

- for BSV, it’s USD 3.42bn vs. USD 1.98bn – a USD 1.44bn discrepancy;

- and for BTG, it’s USD 207.1m vs. USD 92.86m – a USD 114.24m discrepancy.

The issue of whether the market capitalization BTC standards should be adjusted downwards as a result of the findings would be “for the community to decide on,” said the firm.

Using market capitalization data to diagnose the health of digital assets has been popular among traders for years but, as reported, many experts have argued that it may not actually be an adequate gauge, after all.

They argue that the metric can be misleading and does not best determine a cryptocurrency’s value. In some instances, market cap data can even create a false sense of value when it comes to cryptocurrencies, the experts said.

____

Learn more:

Why Market Capitalization is Not the Best Metric To Evaluate Crypto?

How to Make Market Capitalization Measure Great Again

4 Reasons Bitcoin May Hit USD 1-5 Trillion Market Cap in 10 Years

Credit: Source link