Bitcoin (BTC) buyers have maintained support at the Jan. 24 low of $32,900, and then held above $35,000 over the past few days. Short-term momentum is improving on intraday charts, which could keep buyers active into the weekend.

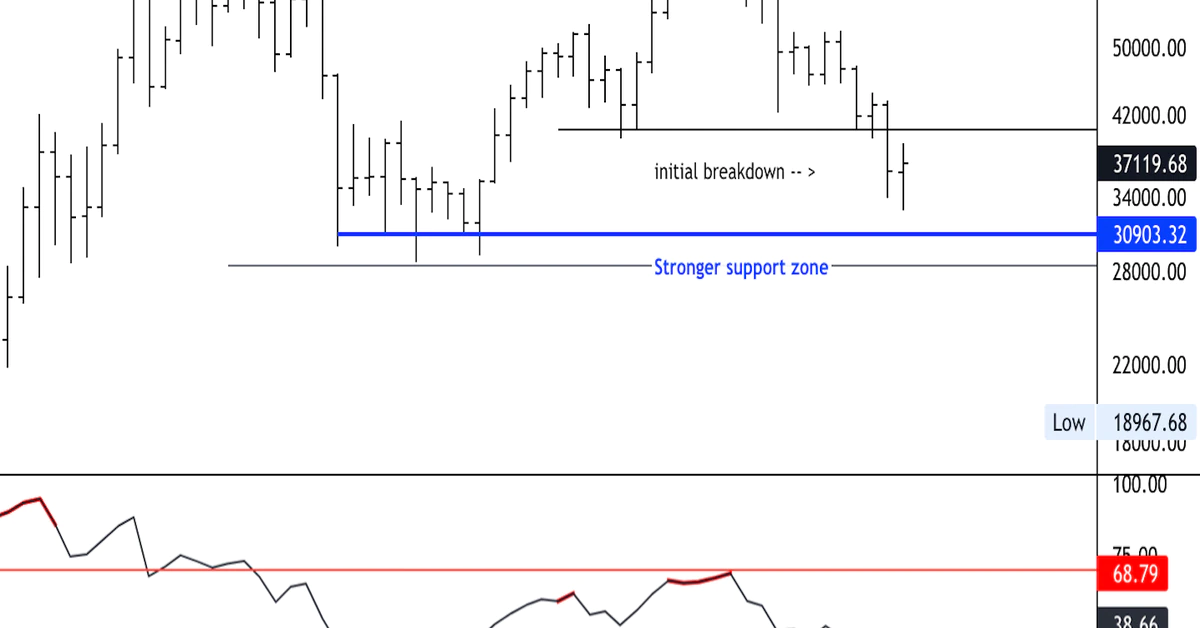

Still, longer-term indicators are neutral/bearish, which could limit upside at the $40,000-$43,000 resistance zone.

For now, the relative strength index (RSI) on the weekly chart is approaching oversold levels, similar to what occurred in March 2020, which preceded a price rally. This time, however, the monthly chart indicates strong selling pressure that could maintain BTC’s intermediate-term downtrend.

On the daily chart, the RSI has risen from oversold levels since Jan. 22, which could attract short-term buyers.

For confirmation, traders could monitor the Nasdaq 100 Index of stocks, which has short-term support at $14,000. An oversold bounce in traditional markets could be a near-term positive for crypto prices as correlations rise.

Credit: Source link