- Bitcoin topped $40,000 for the first time since June, but it has since recoiled to trade around $37,000.

- While Amazon accepting cryptos may have been the big announcement, there were other more significant price pushers.

Bitcoin has hit the $40,000 mark for the first time in July. The top crypto topped at $40,499, pushing on with momentum it picked over the weekend. It has since then retraced and is trading just below $37,000 at press time.

Since it dipped below $30,000 on Tuesday, Bitcoin has been gaining consistently over the past week. Towards the end of the week, the sell-off that had suppressed BTC’s price seems to have cooled down and by Sunday, it was trading above $34,000. Yesterday, it finally gathered enough momentum to shoot past $40,000.

Amazon was one of the big factors behind the price gain, analysts believe. The e-commerce giant announced that it would be bringing onboard a digital currency expert, sparking rumors that the company was bracing itself to accept Bitcoin payments. A source inside the company even confirmed as much to CityAM.

However, in a statement yesterday, the company denied the rumors, stating, “Notwithstanding our interest in the space, the speculation that has ensued around our specific plans for cryptocurrencies is not true.”

It wasn’t just Amazon that sparked Bitcoin rally

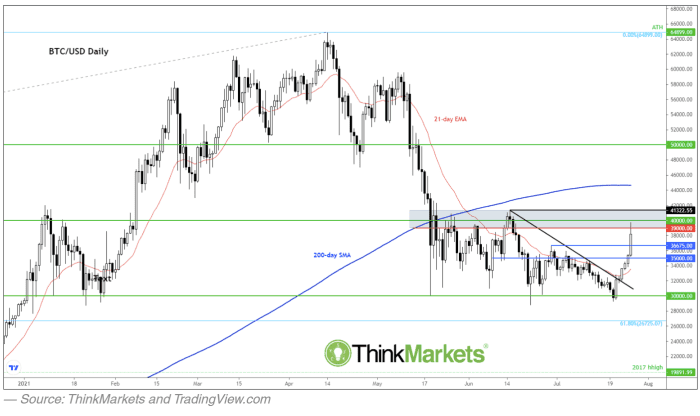

There were other factors as well behind the price pump, analysts note. Fawad Razaqzada, an analyst at ThinkMarkets, believes Bitcoin also reacted to a technical breakout which pushed more people to accumulate. In a note on Monday, the analyst explained:

Prices had been coiling for several weeks and when they finally broke above the bearish trend line a few days ago, we have been seeing a few back-to-back ‘green’ or in my case white candles.

Fawad was referencing the chart below and the candlestick analysis in which green candles indicate positive momentum and red candles point towards the opposite direction. According to him, green candles at the end of the day, which indicated the closing price was higher than the opening price, gave investors hope that the recovery had started.

“It is clear that some speculators relying on price action must have decided it was the right time to get back on board,” he added. However, he believes that we must make a clean break above the $40,000 mark (which is the shaded area on the chart) “to tilt the bias completely back to full-on bullish.”

Analysts at Fundstrat believe that the rally was because of squeeze play. In particular, they pointed to short-covering, a practice in which traders who bet that BTC would drop further liquidate their positions by having to buy more Bitcoin.

“According to data from Skew, nearly $800 million in BTC short positions were liquidated on Sunday evening,” they wrote. A look at Bybt.com’s data supports their analysis, showing $771 million in BTC positions were liquidated in the 12 hours ending at 12 a.m. Eastern on Monday. Of these liquidations, $721 million came from short covering.

Vijay Ayyar, the head of Asia Pacific at Luno exchange reiterated this view, stating:

Shorts were piling up as we were moving down, assuming we were looking at a minimum of $25,000, which was expected across the board. But then there was heavy accumulation in the $29,000 to $30,000 region which caught a lot of those shorts unaware and hence led to the spring upwards.

Credit: Source link