Fees on Bitcoin (BTC) network have dropped more than 90% in a month, with industry insiders noting that they are low compared to what has historically been seen – but that they will now start gradually rising as a series of mining difficulty adjustments that aimed to balance out the China crackdown effects has ended.

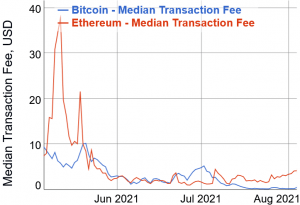

Per BitInfoCharts.com, Bitcoin median transaction fee in USD (7-day moving average) is down 93% in a month, to USD 0.33 on August 4 from USD 4.46 seen on July 4.

Recently, Stephen Barbour, owner of Upstream Data, which builds portable Bitcoin mining skids for upstream oil and gas applications, argued that mining fee revenue in BTC terms has been at “an uncharacteristic low, even compared with prior bear markets […] 2014 levels low.” He described it as “very strange” and potentially a “calm before the storm.”

Speaking to Cryptonews.com, Phillip Gradwell, Chief Economist at on-chain analytics and intelligence firm Chainalysis, also noted that the “mining fee revenue in terms of BTC, and even in USD, is low compared to what we’ve seen historically.”

According to him, this follows a decline in overall on-chain usage with the amount of bitcoin changing hands on the blockchain back to levels last seen in the fourth quarter of 2019

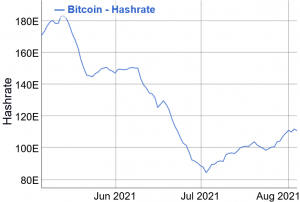

“Transaction fees have been unusually low because the network [mining] difficulty was adjusting in response to the drastic reduction in BTC hashrate that followed China’s crackdowns,” Igor Runets, CEO and Founder of major provider of colocation services for BTC mining BitRiver, added.

China has embarked on a regulatory war against the crypto industry, impacting miners heavily, and forcing both big and small miners to close shop. However, long term, this is beneficial for the Bitcoin network, analysts claim, as the hashrate will be spreading more evenly across the world, establishing further decentralization. Per a recent research, China’s share of global bitcoin hashrate started declining before the latest government crackdown.

However, Runets told Cryptonews.com that he believes that the transaction fees will now start rising gradually, saying:

“The difficulty increased after the latest difficulty adjustment that occurred over the weekend. This put an end to a series of difficulty adjustments that attempted to balance out the consequences China’s crackdowns had on the BTC hashrate.”

Bitcoin mining difficulty, or the measure of how hard it is to compete for mining rewards, went up by 6% during the latest adjustment this past weekend, breaking the second-longest drop streak in the network’s history. This is the first adjustment up since China cracked down on crypto mining in May.

Gradwell said that he always thought of fees as a lagging indicator of the overall market, saying that they increase when people want to move BTC on the blockchain, typically done when prices are already at peak levels.

“However, the point on custody is fair – it is possible that, especially with the increase in institutional investments in bitcoin in the last nine months, more bitcoin is sitting with third-party custodians. Here, it’s helpful to contrast bitcoin with Ethereum (ETH), where fees are still high (albeit down from peaks earlier this year) due to the increase in trading on non-custodial decentralized exchanges,” he told Cryptonews.com.

Looking at Ethereum fees, we see them at USD 3.5 on August 4 – up from USD 1.89 recorded on July 25 and USD 1.47 on June 29, for example. It is, however, still significantly lower than the peak seen in mid-March of USD 24.44.

____

Learn more:

– BTC Mining Migration, Challenges & Forecasts for the Post-crackdown Industry

– MEV Harms Ethereum Users And it May Be Here For Some Time

– What It’s Like To Mine Bitcoin As a Full-Time Job

– Chinese, Taiwanese Bitcoin Miners Eyeing Paraguay Move

Credit: Source link