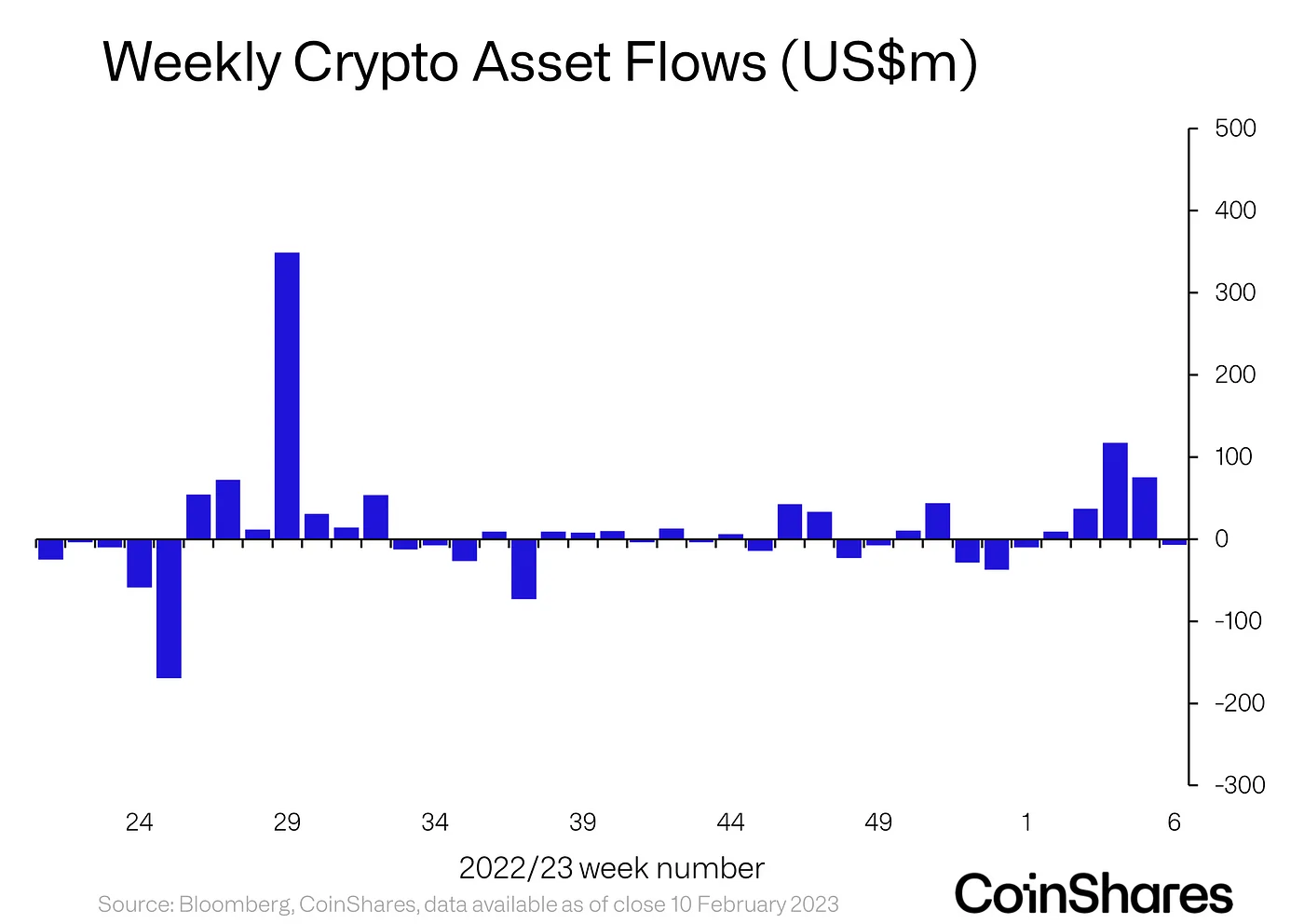

After dominating crypto inflows for most of the year so far, Bitcoin fell out of favor in the eyes of investors last week. That’s according to the latest weekly Digital Asset Fund Flows report produced by crypto analytics firm CoinShares, which tracks investment flows into and out of digital asset investment products. Bitcoin fell back under $22,000 last week for the first time since mid-January last Thursday, and ultimately dropped 5.0% last week.

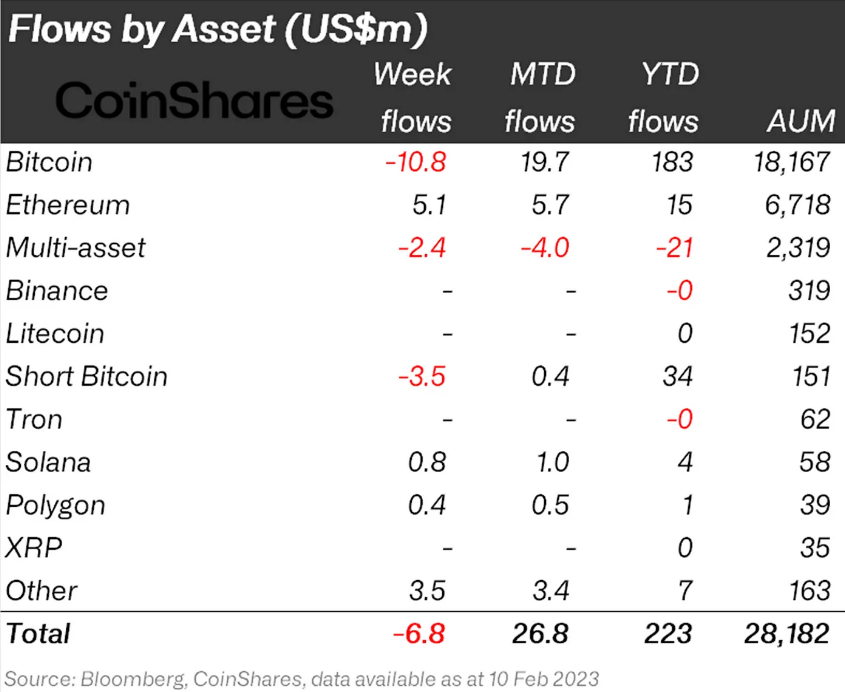

According to CoinShares, Bitcoin investment products saw a net outflow last week of $10.9 million, while altcoin investment products saw a net inflow of $3.9 million. It is worth noting that short-Bitcoin products saw an outflow of $3.5 million, with some investors seemingly taking advantage of the recent pullback to take profits or cut losses on short positions in wake of 2023’s rally.

Ethereum finally started seeing some love. The world’s second-largest cryptocurrency by market capitalization and dominant Decentralized Finance/Application blockchain infrastructure provider saw inflows of $5.1 million, taking its year-to-date inflow to $15 million. That still lags Bitcoin by a long way, which has seen related investment products receive inflows of $183 million.

Net Crypto Outflows Triggered By Fear of Fed Tightening

CoinShares put the net outflow of $7 million in digital asset investment products down to investors getting “spooked by the prospect of additional rate hikes by the US Federal Reserve” in wake of “a week of macro data that significantly beat expectations to the upside”. The week before last, US jobs and ISM services PMI survey data for January both surprised massively to the upside, signaling that the US economy still remains fairly hot and boosting confidence at the Fed that they can press ahead with rate hikes without triggering a recession.

Investors Face Another Testing Week of Macro Risks

This week could easily follow in the footsteps of last, with further outflows from digital asset investment products highly likely if macro headwinds persist. Crypto traders will be nervously monitoring Tuesday’s US Consumer Price Index (CPI) report. Worryingly for the crypto bulls, economists are forecasting an uptick in MoM inflationary pressures that, if confirmed, might worry Fed policymakers and increase their resolve to take and hold interest rates above 5.0% for some time.

This may reinforce the recent uptrend seen in the US dollar against most of its major G10 peers and in US bond yields, which could weigh heavily on crypto. An uptick in US inflation could push Bitcoin lower towards the $20,500 support area (the 18th of January low and 50DMA). A break below here would open the door to a test of the 200DMA and Realized Price in the upper $19,000s.

Crypto traders will also be monitoring US Retail Sales data out on Thursday which will inform expectations as to how likely the US is to fall into a recession sometime later this year. Market participants will also be keeping an eye on remarks from a smattering of Fed policymakers who will be speaking throughout the week.

Credit: Source link