The biggest news in the cryptoverse for Sept. 6 includes liquidations crossing $100 million as Bitcoin falls below the $19k support, CryptoVinco accusing Saylor of sending 200K BTC to Coinbase, and Ethereum’s Bellatrix fork going live.

CryptoSlate Top Stories

Crypto whale alleged to be Saylor sent over 200K BTC to exchanges in July; community in doubt

Twitter user CryptoVinco convincingly alleged that Bitcoin maximalist Michael Saylor is the whale behind the movement of over 200,000 BTC to Coinbase back in July. He claimed that Michael Saylor was planning to sell all the transferred tokens.

One of the biggest #Bitcoin whales with over 200K+ $BTC sent ALL of their coins to exchanges.

I’m 99% certain this is Michael Saylor’s Bitcoin address, and they’re planning to sell everything.

When he soon sells, expect a bloodbath to the likes we’ve never seen ever before. pic.twitter.com/vx643TPAyg

— CryptoVinco (@CryptoVinco) September 5, 2022

Notwithstanding, the crypto community did not fully buy into his claims on the grounds that the said wallet address holds more BTC than Saylor’s MicroStrategy.

Bitcoin loses $19k as $100M is liquidated in less than 4 hours

The sharp decline in BTC price below $19,000 on Sept. 6 saw over $100 million in Bitcoin liquidation within four hours, according to Coinglass data.

The ripple effect on the market was that about 100,000 traders reportedly lost over $407 million in the total daily liquidations.

Circle CEO says Binance decision to stop USDC support is good as it increases utility

Circe CEO Jeremy Allaire threw his weight in support of Binance’s move to convert users’ USDC holdings to BUSD. He said the decision was consistent with the converged dollar book model obtainable in leading exchanges like FTX and Coinbase.

Wintermute’s Gaevoy added that using a converged will make the market more liquid and easier for users to deposit and withdraw USDC from the platform.

Bellatrix upgrade goes live, sets stage for Ethereum’s Merge

Bellatrix, the first step towards the Merge was successfully activated today. The upgrade was triggered on the consensus layer by 73% of Ethereum nodes.

With a successful execution of the Bellatrix upgrade, the community is preparing for the Paris upgrade, which will mark the end of proof-of-work mining on Ethereum and usher in the Merge.

Ethereum prints year-to-date high vs Bitcoin after Bellatrix hard fork ahead of The Merge

News of the successful execution of the Bellatrix upgrade helped Ethereum gain up to 6% as its price hit $1,680.

Since the start of September, Ethereum has gained 15.6% when snapped against Bitcoin. Looking into the ETH-BTC charts, it revealed that Ethereum traded at a high of 0.84 BTC since falling low to 0.49 BTC in June.

Charles Hoskinson calls Ethereum Classic’ dead project with no purpose’

Cardano Co-founder Charles Hoskinson was accused of trying to milk Ethereum Classic after he proposed a 20% miner tax.

In response to the allegation, Hoskinson said that Ethereum Classic is “a dead project with no purpose.” He, however, advised users who were keen on using proof-of-work networks to turn to the Ergo blockchain, which most Ethereum miners said they would adopt after the Merge.

Sports NFT market doubles to $2.6B in 2022

A Market Decipher report shows that the gradual shift from physical to digital collectibles has contributed to seeing the Sports NFT market double from $1.3 billion to $2.6 billion in 2022.

Annual growth projections in the study reveal that the Sports NFT market will likely reach $41.6 billion by 2032.

Research Highlight

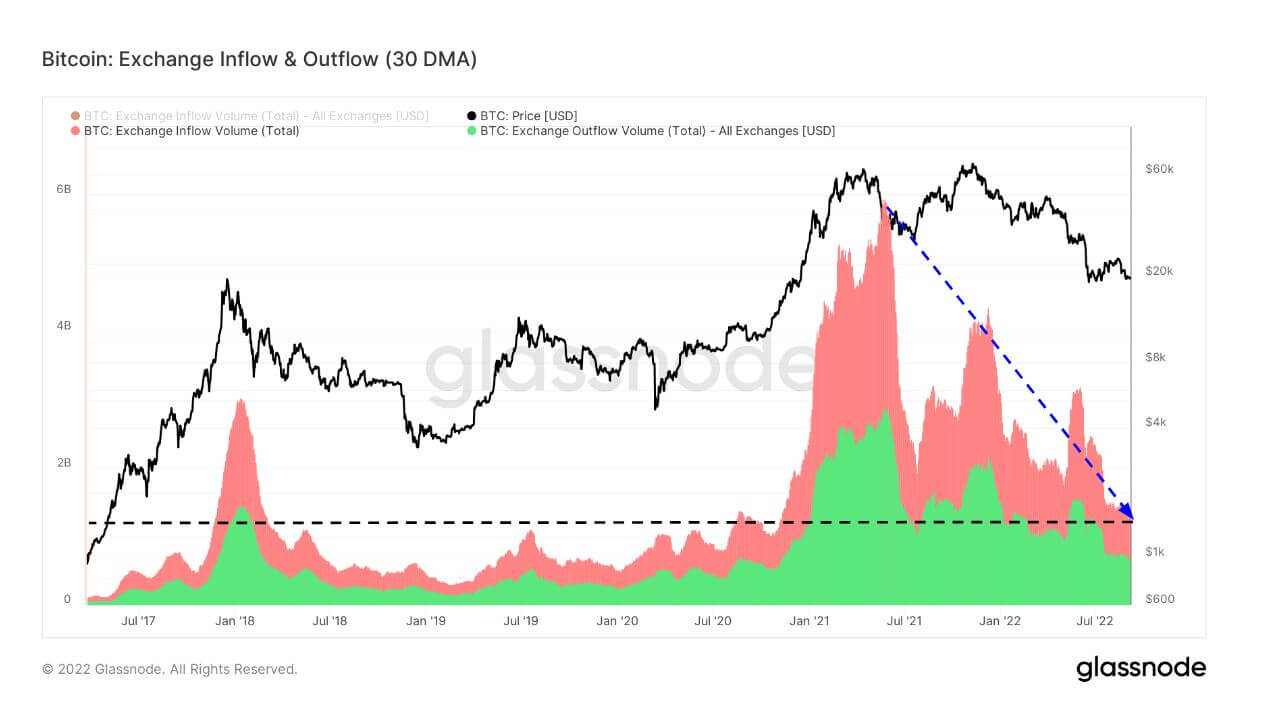

Bitcoin exchange inflows sink to multi-year lows

Bitcoin’s exchange flow metrics analyzed by CryptoSlate reveal that there is an overall decline in both inflows and outflows, though inflows are rising higher, indicating that more investors are cashing out.

CryptoSlate also considered the exchange heatmaps, which track total transfer volumes deposited and withdrawn from exchanges.

The exchange inflow heatmap shows high inflow volume during the bull market peak of December 2020, March 2021, and November 2021. Similarly, the exchange outflows peaked in the same period.

The analysis reveals that during bull market peaks, short-term holders bought Bitcoin while long-term holders were cashing out.

News from around the Cryptoverse

Singapore’s largest bank DBS to offer crypto services to 300,000 investors

DBS CEO Piyush Gupta said the leading bank is working to extend its cryptocurrency services to over 300,000 investors across Asia, according to the Financial Times.

Only accredited institutional investors will be allowed to access the crypto offering as Singapore’s current regulatory measures restrict retail investors.

Crypto Market

Bitcoin was down -04.49% on the day, trading at $18,891, while Ethereum was trading at $1,573, reflecting a decrease of -1.8%

Biggest Gainers (24h)

Biggest Losers (24h)

Credit: Source link