Quick Take

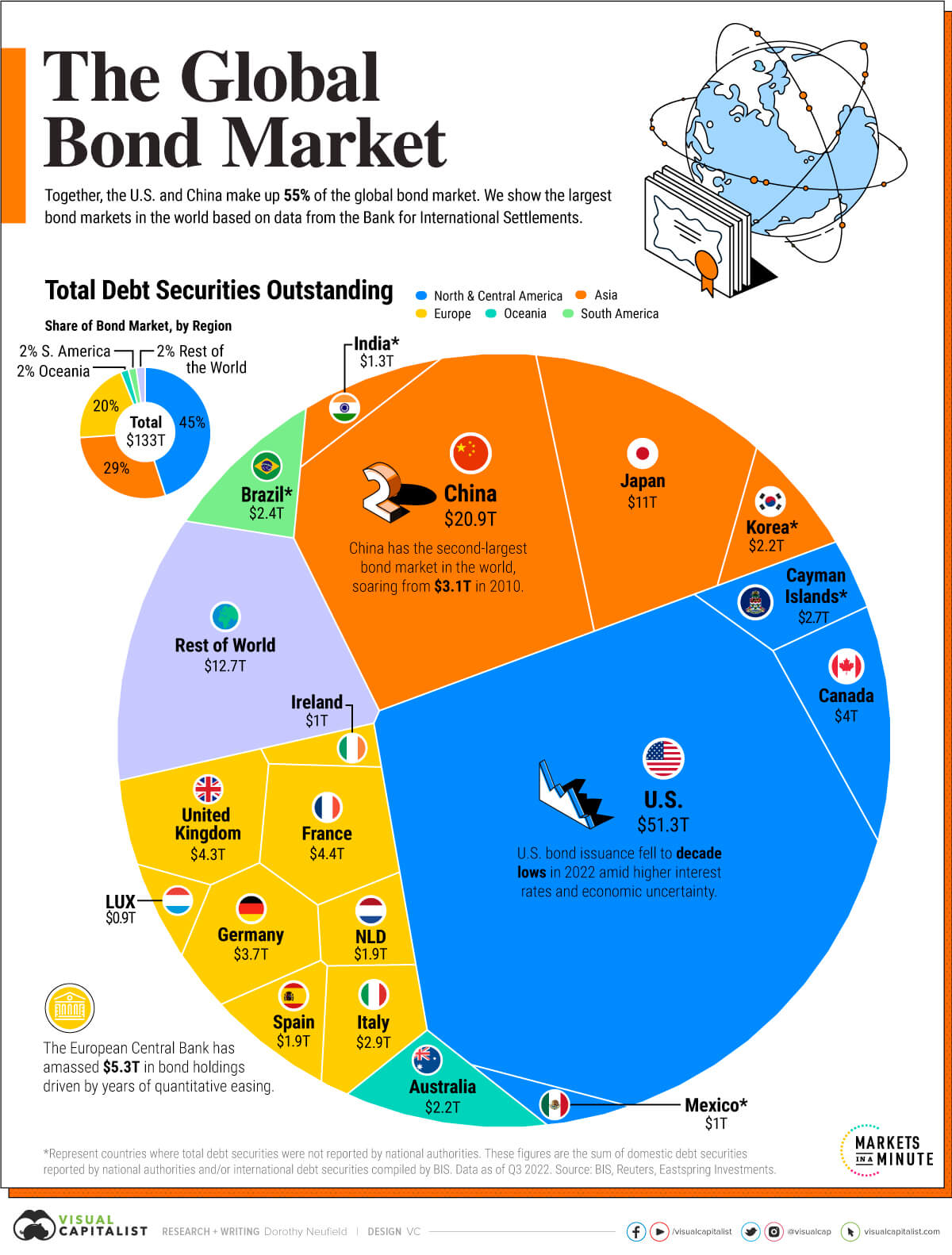

One of the most robust markets globally is the bond market, which, according to Visual Capitalist, was estimated to be worth $133 trillion in 2022. This colossal market has seen consistent growth over the last four decades, primarily driven by government debt increases due to interest rate reductions during each recession and the implementation of quantitative easing measures.

The United States leads the global bond market, holding a commanding 39% market share, equivalent to over $51 trillion. However, China is catching up and currently occupies the second spot with a 16% share in this thriving market, according to Visual Capitalist.

Japan presents an intriguing case study in this context. Visual Capitalist data indicates that Japan’s central bank owns approximately half of the country’s total debt. This significant holding prompted an in-depth analysis by the CryptoSlate research team.

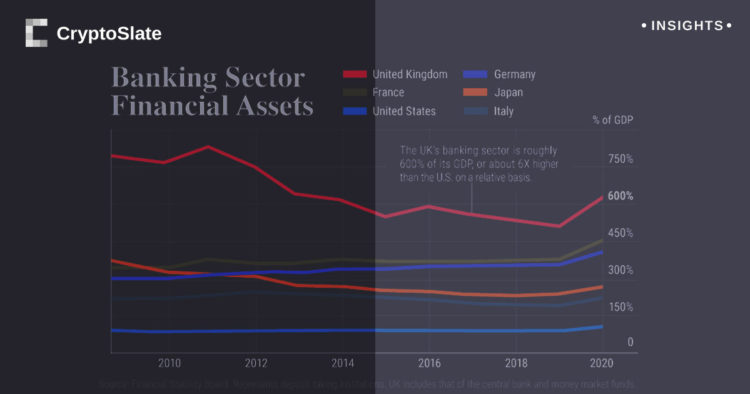

A pertinent question that arises in this scenario pertains to the buyers of this debt, particularly considering that a large portion yields negative returns. The answer lies primarily in the banking sector, as indicated in the chart provided below.

However, an emerging concern is the disproportionate size of the banking sector compared to the GDP in some countries, such as the UK, where the former is roughly six times larger, according to Visual Capitalist.

It’s critical to remember the inverse relationship between bonds and yields; when yields increase, bond values decrease. Hence, careful consideration is essential for potential investors navigating this complex market.

The idea is that investors will get tired of negative real rates in bonds and move over to assets such as Bitcoin that comfortably beat inflation over the long run.

The post Bitcoin could be the refuge as bond market faces negative returns appeared first on CryptoSlate.

Credit: Source link