- Bitcoin Cash’s (BCH) price jumped more than 108 percent in the last week following the launch of the EDX Market exchange.

- The BCH network enjoys a high throughput that has helped onboard more than 22 million holders seamlessly.

The fourth largest proof-of-work (PoW) blockchain network, Bitcoin Cash (BCH), has outperformed most of the top digital assets following the recent boost from institutional investors. Notably, the Bitcoin Cash (BCH) network recorded a daily traded volume of about $1 billion on Tuesday, up approximately 65 percent in the past 24 hours. Interestingly, the six-year-old Bitcoin Cash (BCH) network recently surpassed more than 22 million holders and over 369 million on-chain transactions, according to the latest on-chain data from Tokenview.

With a similar token supply as Bitcoin, the BCH market outlook remains extremely bullish from all perspectives. Moreover, the BCH network offers users fast finality and affordable transaction fees despite a rise in on-chain activity.

Bitcoin Cash Market Outlook

As a PoW-secured chain, the Bitcoin Cash (BCH) network remains under the close radar of most investors seeking to mine and speculate on digital assets. As of Tuesday, Bitcoin Cash reported a total hash rate of about 3.9 (EH/S) and a mining difficulty of about 369.96 (G). With a fully diluted valuation (FDV) of about $4.6 billion, the BCH network assures traders of immense liquidity despite the bear market devastations.

As a result, the BCH price has risen approximately 108 percent in the past seven days to trade around $220 on Tuesday. Nevertheless, the BCH value is more than 94 percent down from its ATH, around $3,785, which was achieved during the 2021 bull market.

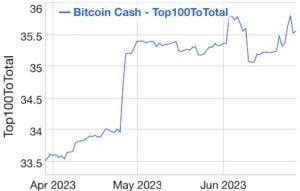

The recent gains in the Bitcoin Cash network are directly attributable to the meteoric rise in whale activity. Moreover, the top 100 richest BCH addresses have increased their appetite in the recent past according to on-chain data.

The move is not surprising as Bitcoin Cash was named among the crypto assets supported by a newly launched centralized exchange dubbed EDX Markets, which is backed by veteran institutional investors including Charles Schwab, Citadel Securities, Fidelity Digital AssetsSM, Paradigm, Sequoia Capital, and Virtu Financial, among many others. Led by CEO Jamil Nazarali, EDX Markets noted that it will offer trading for BCH, Ethereum, Bitcoin, and Litecoin to a myriad of crypto enthusiasts.

While the move was viewed as a direct competition to Coinbase Global and Binance in the American crypto market, experts argue the overall effect is the mainstream adoption of digital assets.

The Bitcoin Cash social dominance is expected to rise further in the coming months, particularly as more institutional investors onboard the industry. According to market intelligence platform Santiment, the Bitcoin Cash social dominance hits its highest level since 2020 fueled by the recent adoption through EDX Market.

Price Action

Having been in existence since August 2017, Bitcoin Cash has experienced several major crypto bull and bear markets. The recent BCH pump has completely wiped out the bears that rocked the market last year. As a result, BCH’s price is likely to continue rallying toward $300 in the coming weeks.

No spam, no lies, only insights. You can unsubscribe at any time.

Crypto News Flash does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products, or other materials on this page. Readers should do their own research before taking any actions related to cryptocurrencies. Crypto News Flash is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned.

Credit: Source link