Bitcoin Cash Price Prediction – June 13

The Bitcoin Cash price struggles to stay above $580 as bears call for $560 as the coin could settle in consolidation around $560.

BCH/USD Market

Key Levels:

Resistance levels: $800, $850, $900

Support levels: $350, $300, $250

At the time of writing, BCH/USD is pushing for consolidation around $565 but the trend has a bearish inclination, which may likely test the support at $500 as it moves below the 9-day and 21-day moving averages. More so, the technical indicator has remained bearish as the Relative Strength Index (14) continues to dig deeper in the negative region as the signal line reflects the influence the sellers have over the price.

Bitcoin Cash Price Prediction: Can BCH Price Go Further Lower?

According to the daily channel, the best the bulls can do is defending the support at $550 and focus on pulling towards $580. In the past few weeks, the Bitcoin Cash lost balance alongside other cryptos and the sharp drop affected the buyers from an attempted recovery above $800. However, BCH/USD is making an effort to jump above $565 and it is also looking forward to reclaiming the ground past $580.

Moreover, the coin is already at the negative side and therefore a reflex bullish action is expected to correct the declines with a possible jump above $600. Meanwhile, if there is an increase in buying pressure, the price may break above the 9-day and 21-day moving averages to reach the $700 resistance. While trading at that level, the bullish continuation could push the coin to the resistance levels of $800, $850, and $900.

In other words, a minimum swing may likely push the market to a $500 level of support. Exceedingly, this level could take the bears to the support levels of $350, $300, and $250 by crossing the lower boundary of the channel.

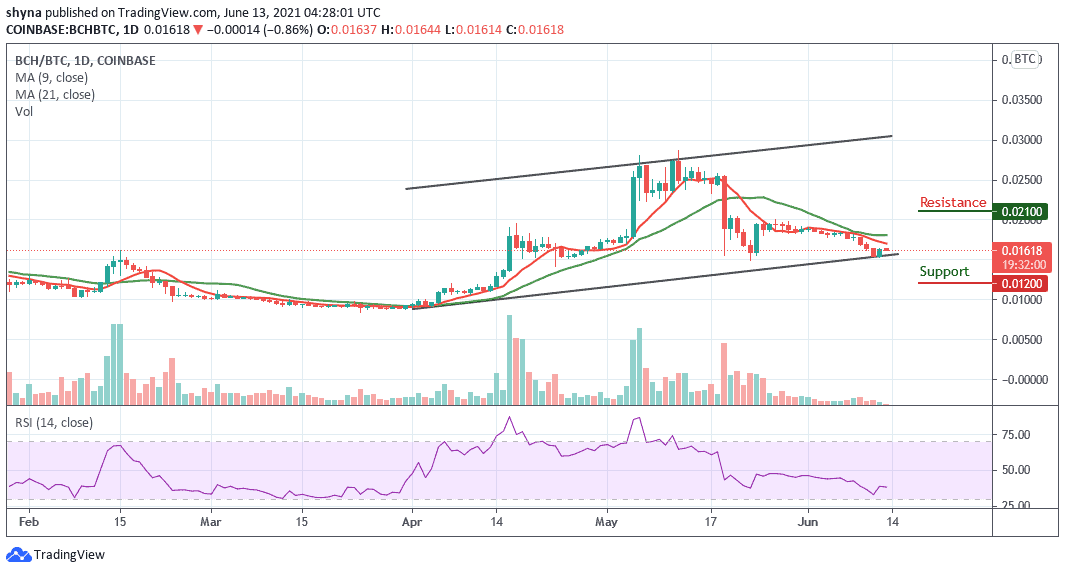

Against Bitcoin, the bears are still showing more commitment to BCH trading. Meanwhile, as the market price follows the recent negative sign, the trend may continue to follow the downtrend in as much as the buyers failed to push the price above the 9-day and 21-day moving averages.

However, as the signal line of Relative Strength Index (14) is seen within the negative side as the signal line moves below 40-level, Crossing above 40-level may likely cause the coin to begin an upward trend in order to touch the resistance level of 2100 SAT and above but a retest could lower the Bitcoin Cash price to the support level of 1200 SAT and below.

Looking to buy or trade Bitcoin Cash (BCH) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider

Credit: Source link