Though the price of bitcoin (BTC) is up 23% in a week, institutional investors are “just watching” for now, found the blockchain analytics firm CryptoQuant.

After two months of its price hovering around $16,000-$17,000, bitcoin is seeing green fields again. It went up 2% over the past 24 hours and more than 23% over the past 7 days, currently trading at $21,188 (at 9:20 UTC). Overall, it has appreciated by 26% over the past month.

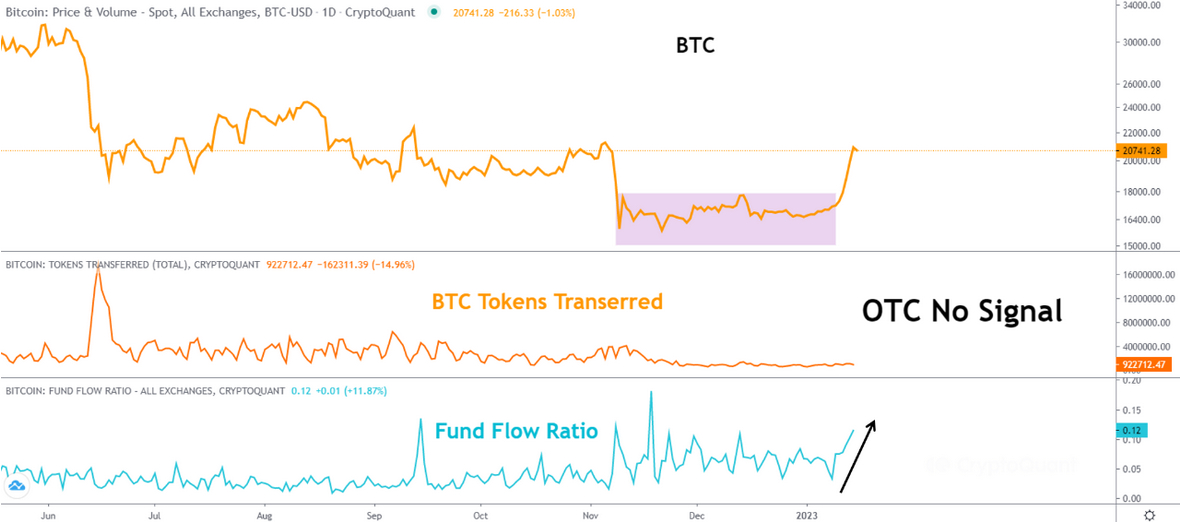

The increase can clearly be seen on the 14-day price chart below, showing an uptrend starting on January 11.

Meanwhile, it is down 51% in a year, and 69% since its all-time high seen in November 2021.

However, despite the price increase, institutional investors seem to still be on the sidelines.

According to a CryptoQuant post published on January 15,

“The current institutional investors have remained calm and just watching. OTC [over-the-counter] trading will be brisk when they expect a full-fledged uptrend turn.”

CryptoQuant analyst MAC_D noted in the post that there are three indicators to look at while crypto was rising to $21,000 – which do not show a buying trend by institutional investors.

- the Fund Volume index: the level of transaction volume is insignificant, and there is nothing unusual to note;

- the Fund Holdings index: institutions’ BTC holdings are decreasing, only prices have risen;

- Over-The-Counter transactions: no unusual transactions occurred here; it was actively traded on the exchange only, with no unusual transactions onchain; usually at the bottom, we’d see institutional investors buying quietly through OTC trading.

Given the three indicators, said the analyst, it is unlikely that the current rise means a real uptrend transition.

Rather, added the author,

“I think this is the result of buying sentiment, which was suppressed when the U.S. CPI index was recently released. Therefore, it seems better to find calm than excitement about the rise.”

The US Bureau of Labor Statistics released the Consumer Price Index (CPI) on January 12. Among other things, it said that the CPI for All Urban Consumers declined 0.1% in December 2022, after increasing 0.1 % the month before. The all items index increased 6.5% for the 12 months ending December – the smallest 12-month increase since the period ending October 2021.

____

Learn more:

– What Bitcoin Price Models Flashing Green Reveal – Is Crypto Winter Turning to Spring

– Skybridge Capital is Predicting Bitcoin Gets to $35k This Year But is That Hope Over Realism?

– Experts Predict Crypto Prices to Explode to All Time Highs if This Happens

– Why Bitcoin Hash Rate and Mining Difficulty Headed Higher is Great News for Bulls

Credit: Source link

![The 3 Best New Meme Coins to Invest in This Week Are Ready to Shake Up Your Crypto Wallet [With a Crazy 90% APY on Staking]](https://cryptocentralized.com/wp-content/uploads/2025/01/unnamed-2025-01-19T074942.725-360x180.png)

![The 3 Best New Meme Coins to Invest in This Week Are Ready to Shake Up Your Crypto Wallet [With a Crazy 90% APY on Staking]](https://cryptocentralized.com/wp-content/uploads/2025/01/unnamed-2025-01-19T074942.725-350x250.png)