Bitcoin Price Prediction – July 24

There has been a line of movements showing that the BTC/USD trade pushes close to the level of $35,000. The crypto maintains a percentage rate of about 0.77 to trade around the point of $34,198.

BTC/USD Market

Key Levels:

Resistance levels: $37,500, $42,500, $47,500

Support levels: $30,000, $27,500, $25,000

It is displayed on the BTC/USD daily chart that the crypto trade pushes close to the important value at $35,000 after a couple of several sessions, witnessing some downturns. The current northward pushes begun during July 21st trading time from around the critical support line drawn at $30,000 level. The smaller SMA trend-line has breached slightly northward to indicate that the crypto is on the rise. The 50-day SMA is over the14-day SMA. The Stochastic Oscillators have moved northbound into the overbought region in an attempt to close the lines in it. That indicates that the pressure to the upside is on a gradual reduction pace.

Would there be a long-kept upside motion as the BTCC/USD trade pushes close to $35,000?

As the BTC/USD trade pushes close to the key-line at $35,000, several smaller-ups have to take up the trading situation in the near time. In the wake of that crypto-economic projection, variant trading candlesticks will characterize the market in the form of a consolidation moving outlook. By that assumption playing out, traders may have to wait for another line of price actions to determine the next distinct direction of the crypto trade.

On the downside, the trading area at $35,000 needed to be used by the BTC/USD bears to rebuild their impact in the crypto market. A pull-up that will eventually lose momentum to a reversal move in that regard will most likely clear the way that a sell order may fourthly resurface. In the meantime, bears should stay out of the trade for a while. But, they could be on the lookout for a visible lapse in the uptrend pressure to make a sell order.

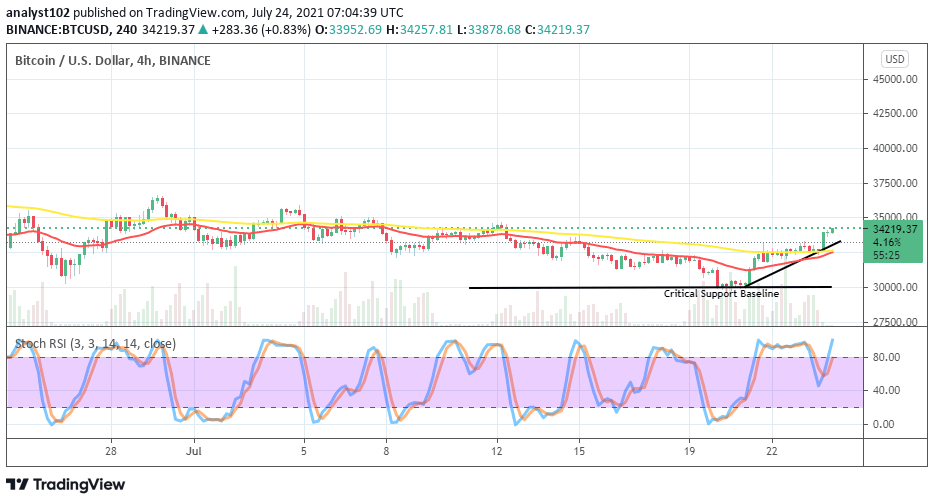

BTC/USD 4-hour Chart

Variant 4-hour candlesticks bottomed on the critical support baseline during July 20t h trading time to mark a strong start for the crypto market. On the following day, the crypto witnessed a rebound, making the crypto trade pushes close to the level of $35,000. Even though the trend is relatively inclined, it could be the long-awaited restart of the bullish run. All the indicators point slightly point to the north. The bullish trend-line drew tightly over the 50-day SMA as the 140-day SMA close underneath them. The Stochastic Oscillators are in the overbought region, swerving the lines to the northbound from a lower range near the range of 40. That suggests that a force to the upside is ongoing. Therefore, shorting positions needed to be put on hold until a while when there may be a bearish candlestick to signal re-entry of a sell order of the crypto market.

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provide

Credit: Source link