Yesterday, Bitcoin (BTC) spiked over 6% following Federal Reserve Chairman Jerome Powell’s announcement that they are adjusting its policy and hinting at a potential 25bps rate cut at the next meeting on September 18. This unexpected news has fueled Bitcoin’s recent volatility, with prices swinging unpredictably in the past weeks.

Related Reading

Crucial on-chain data from CryptoQuant is providing a glimmer of optimism. According to the data, traders are positioning for further price appreciation.

As the market digests the Fed’s new stance, all eyes are on Bitcoin to see if this could mark the beginning of a new bullish phase.

Bitcoin Data Showing Market Optimism

Bitcoin is trading above $63,000 and gaining momentum as it prepares to break past the critical $65,000 mark.

On-chain data from CryptoQuant reveals growing market optimism, highlighting a significant trend that could drive prices higher. Specifically, Bitcoin exchange reserves on centralized exchanges have plummeted to an all-time low. Since the end of July, the supply of BTC on exchanges has decreased from over 2.75 million to approximately 2.67 million, representing a 3% drop in just 30 days.

This decline indicates that less BTC is available for trading on exchanges, which could create a supply shock, a situation where demand outstrips supply, leading to a potential price surge. As Bitcoin’s availability on exchanges diminishes, the likelihood of a price increase grows.

With Bitcoin starting to gain strength, the market is closely monitoring this trend, potentially pushing Bitcoin into new bullish territory.

BTC Price Action: $65,000 Next?

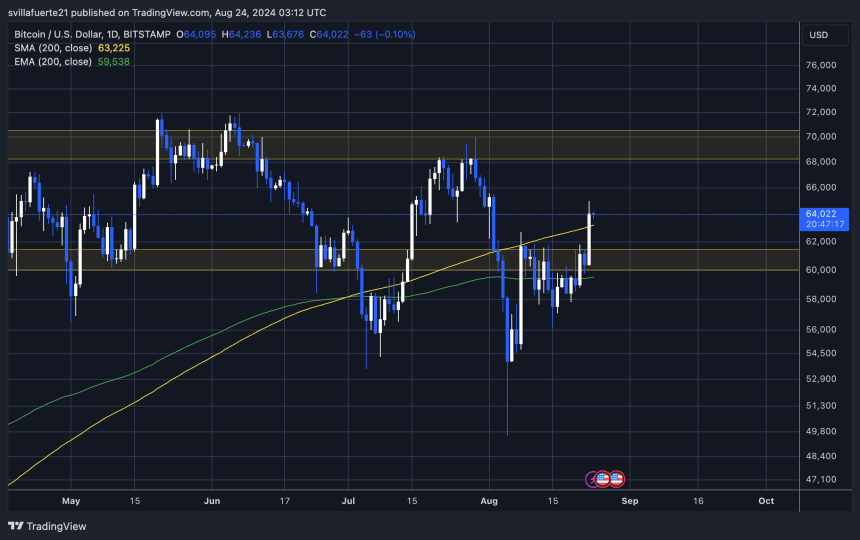

After two weeks of volatility and consolidation, Bitcoin is currently trading at $64,100 at the time of writing, holding above the crucial daily 200 Moving Average (MA).

This level is essential for bulls to maintain the uptrend in a higher time frame. For the price to break past the $65,000 mark, it must confirm its bullish structure by holding above the $57,500 level. Ideally, staying above the daily 200 Exponential Moving Average (EMA), which sits at $59,538, is preferable.

These levels are vital for establishing continued upward momentum. Holding above them would signal strength in the market, reinforcing confidence among traders and investors. The data of declining Bitcoin exchange reserves and the central bank’s policy announcement have been met with optimism. Investors are increasingly expecting a Bitcoin rally in the coming months, fueled by these bullish indicators.

Cover image from Dall-E, chart from TradingView.

Credit: Source link