The price of bitcoin (BTC) reached as high as USD 55,500 in the market today, after it broke through an important resistance level in the chart at around USD 52,700 for the first time since May. The rise also brought the market capitalization of the number one cryptocurrency above the psychologically significant USD 1trn mark.

At 14:37 UTC, BTC traded at 54,239, slightly down from its high above USD 55,000 reached earlier today. The price is up 9% over the past 24 hours, making it one of today’s best performers in the crypto market.

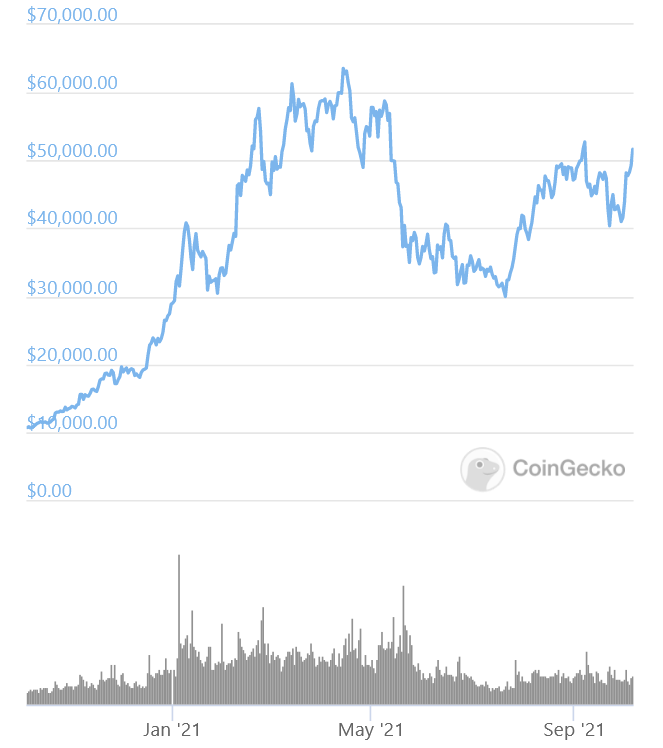

BTC price chart:

The sharp price rise in the bitcoin price also led to a marked increase in bitcoin short positions being liquidated, data from Bybt.com showed. Over the past 4 hours, bitcoin shorts worth almost USD 151m were liquidated across all major exchanges, marking a sharp rise from the USD 4.3m in shorts that were liquidated in the prior 4 hours.

However, according to the CEO of CryptoQuant, Ki Young Ju, today’s price spike may have more to do with increased buying pressure than simply a cascade of liquidations. The CEO said that his data shows that someone bought USD 1.6bn worth of BTC via market orders in just five minutes earlier today.

According to Anto Paroian, Chief Operating Officer at crypto hedge fund ARK36, this latest uptrend seems different from the one four weeks ago when BTC was also trading around this price range.

“Then, breaching the USD 50,000 barrier generated a lot of hype but ultimately there wasn’t enough strength in the markets to sustain a further rally. Now, after consolidating for a long time in the USD 40,000 range, bitcoin seems much better prepared for another big move upwards. If that happens, bitcoin will likely go on to test its all-time-high [of around USD 65,000] and there’s a high probability it will break it,” Paroian said in an emailed comment, adding that “a small pullback to around USD 48,000 is equally likely.”

Meanwhile, Martha Reyes, Head of Research at digital asset prime brokerage and exchange BEQUANT, noted that we have a bit of a liquidity crunch “but in a good sense.”

“Coins have been leaving the exchanges over the last month and long term holders are now at ATHs, and much less likely to have paper hands. This is colliding with strong institutional interest (probably due to better signalling from regulators) as you can tell from CME activity, where futures spreads are recovering nicely and open interest is up,” she said.

“I believe we are done with the four-year halving cycle – and on to the next price era,” Dan Morehead, CEO and Founder of Pantera Capital, wrote in the latest Pantera Blockchain Letter, sent today.

According to him, as the market becomes broader, more valuable, and more institutional the amplitude of prices swings will moderate.

“While we’ve had two down 83% bear markets already, I believe those are a thing of our primordial past. Future bear markets will be shallower. The previous two have been -61% and -54%,” the CEO wrote, adding that the flipside of this is that we probably won’t see any more of the 100x-in-a-year rallies either.

Also, today, Soros Fund Management, owned by billionaire investor George Soros, confirmed at a Bloomberg summit that the fund has invested in BTC.

“From our perspective again, we own some coins, not a lot, and the coins themselves are less interesting than the use use cases of DeFi and things like that,” Dawn Fitzpatrick, CEO and Chief Investment Officer, said.

The surge in the bitcoin price was also followed by a more modest rise for other major cryptoassets, with for instance ethereum (ETH) rising 3% over the past 24 hours, and cardano (ADA) trimming its losses from earlier today to end up down a mere 1% over the past 24 hours.

____

Reactions:

_____

Learn more:

– ‘Extreme Volatility’ Expected as Bitcoin Investors Learn to Value It

– Bitcoin Price to Face Another Test as Central Banks Eye Rate Hikes

– Bitcoin Lightning Network Is Growing Faster Than You Think

– Investments In Bitcoin Rotate From Ethereum Again as BTC Flirts With USD 50K

– Not Ideal, but ‘Better Than Nothing’ – Market Awaits ‘Paper Bitcoin’ ETF

– Bitcoin May Surpass USD 66K in 2021 and USD 400K by 2030 – ‘Panel of Experts’

____

(Updated at 17:02 UTC with additional comments.)

Credit: Source link