On Dec. 13., a further decline of CPI to 7.1% was met by an expected rally in equities and a drop in the U.S. dollar and treasury yields. On Dec. 14., Powell increased interest rates by 50bps to a new federal funds rate target of 4.25%-4.5%.

Encouraging CPI

Headline inflation slowed from 7.7% to 7.1%, offset by a decline in core good prices by 0.5% and a 1.6% decline in energy prices.

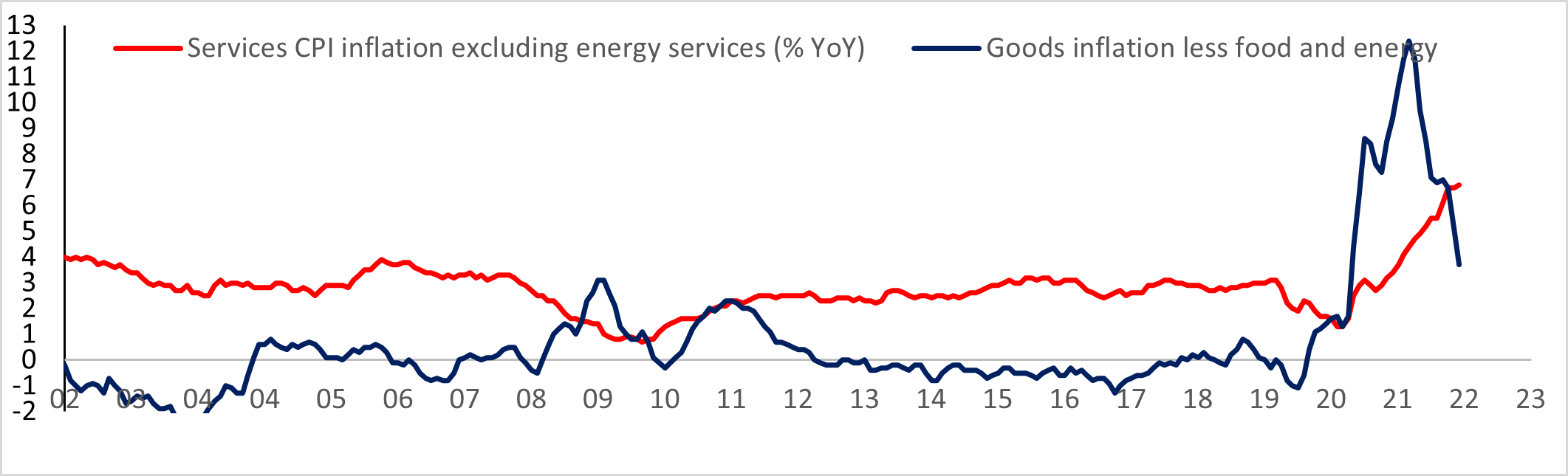

Core goods inflation continued to decrease to just under 4% from its peak in February, above 12%. However, services inflation which excludes energy rose to 6.8%. Services inflation will stay elevated as the job market is still resilient in the U.S.; however, that could change in 2023.

Powell remains hawkish

The fed raised rates by an expected 50bps to set the new fed funds target of 4.25%-4.5%, and the tone from Powell remains unchanged “ongoing” rate hikes and “we will stay the course until the job is done”. Powell expects inflation to continue declining slowly as the labor market remains tight. 55% of core CPI is still increasing rapidly even though house and goods prices are dropping rapidly.

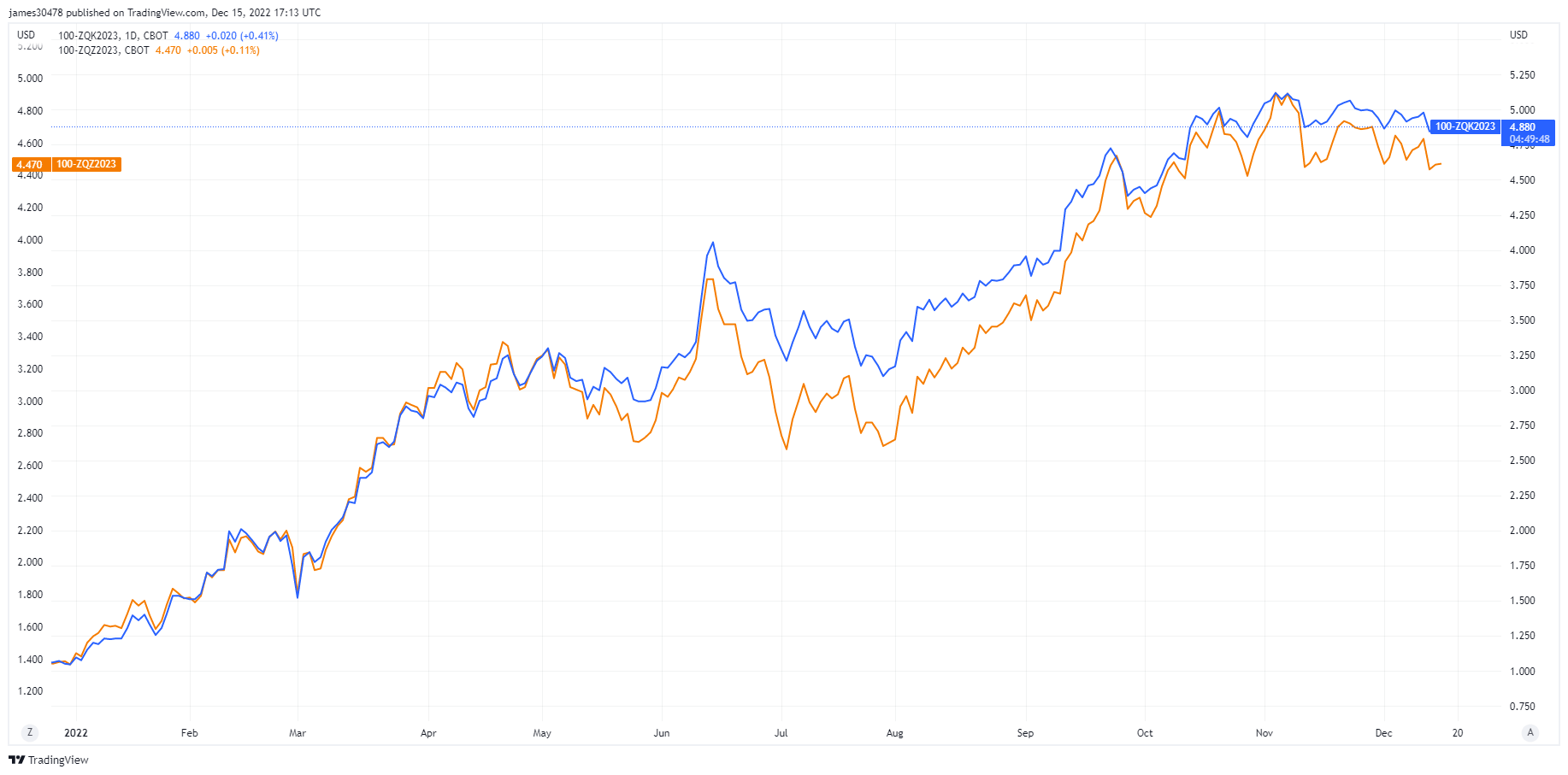

The market continues to fight the fed and disagree on futures feds funds rates. The market is projecting a peak in the fed funds rate of 4.8% in May 2023, with a decline to 4.5% by December 2023.

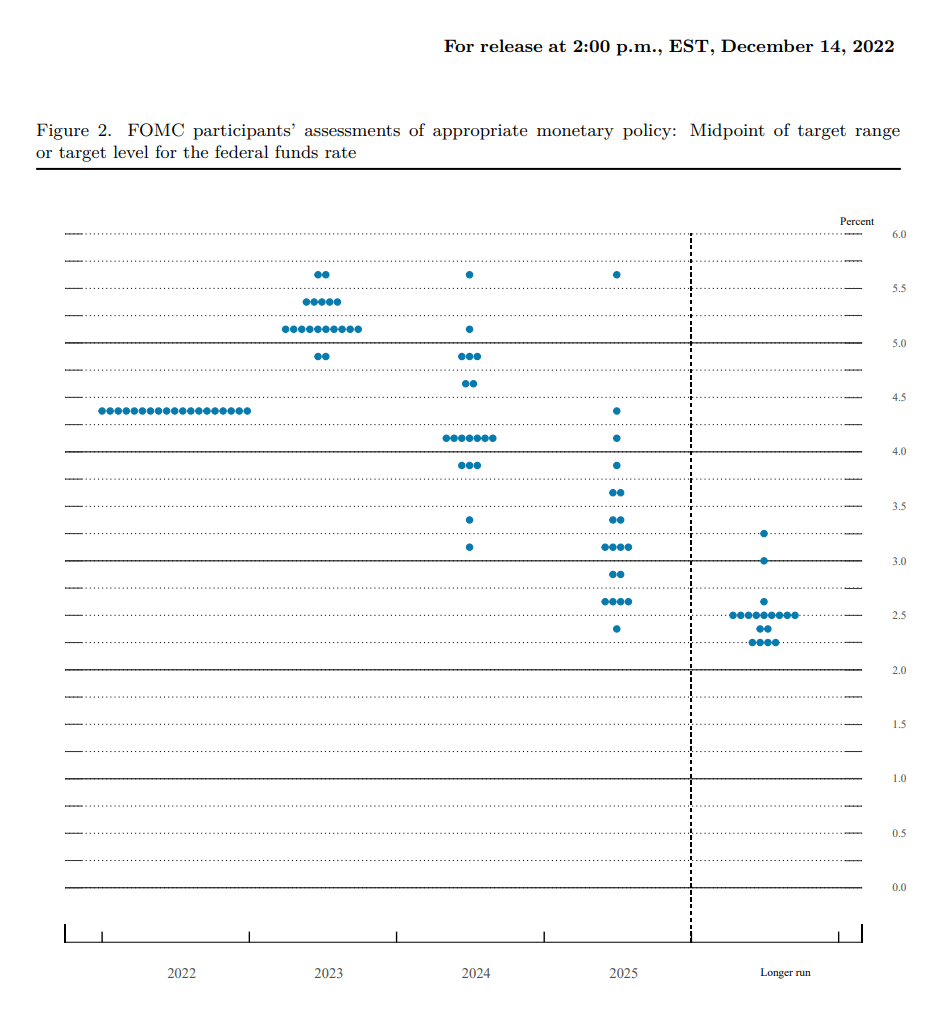

According to the DOT plot, which shows the projections for the federal funds rate, each dot represents the view of a Fed policymaker. The fed has a higher projected funds rate than the market at the end of 2023, revised from 4.6% to 5.1%; seven fed officials project a rate above 5.1% and ten above 5%.

Other notable rate hikes

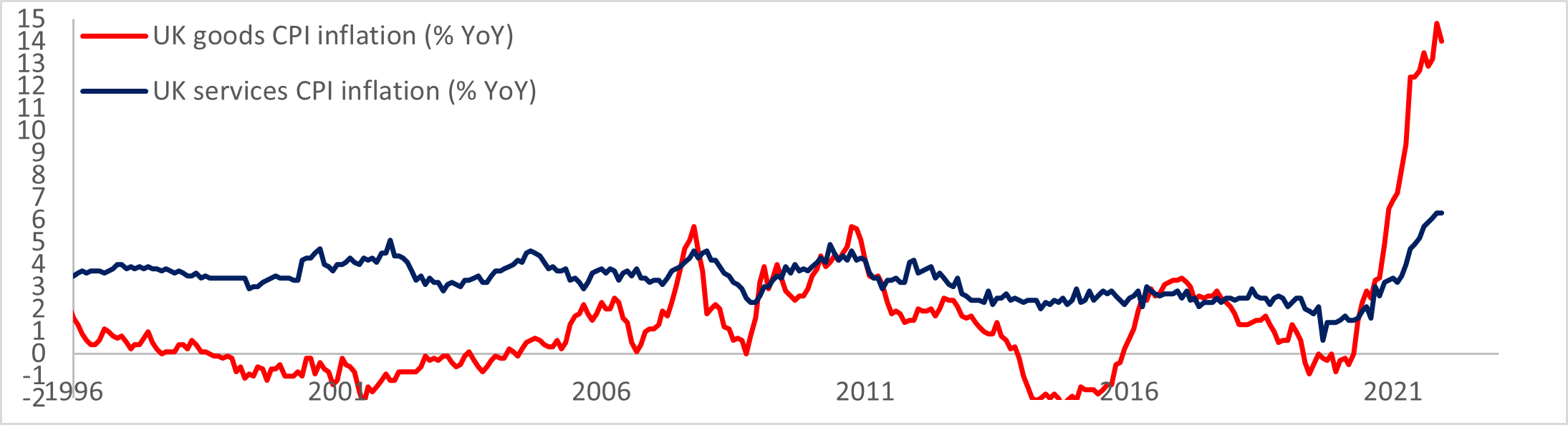

The Bank of England delivered a 50bps rate hike on Dec.15 to raise the bank rate to 3.5%. This was the ninth consecutive interest rate hike from the BOE. In addition, inflation may have peaked in the U.K. as inflation expectations beat market estimates as inflation dropped from 11.1% to 10.7%, with the core rate falling to 6.3% from 6.5%.

In addition, the ECB increased interest rates from 1.5% to 2% and announced a plan to shrink its balance sheet.

Asset review: week commencing Dec. 12

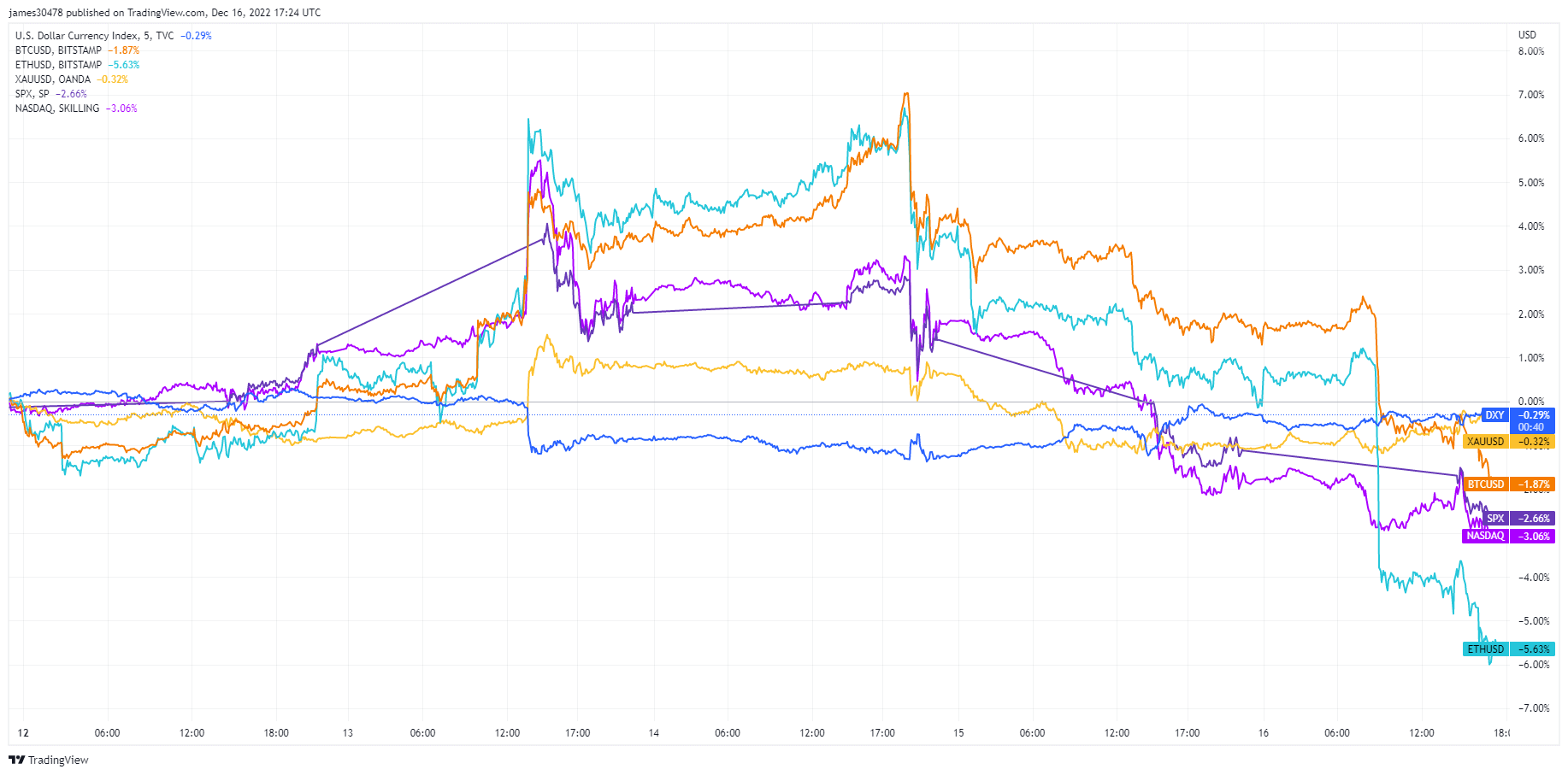

From Dec. 12 to Dec. 15, BTC had been the best-performing asset compared to its peers, however, BTC and ETH made new for the week on Dec. 16.

- BTC: -1.85%

- ETH: -5.60%

- Gold: -0.33%

- DXY: -0.39%

- SPX: -2.0%

- Nasdaq: -2.76%

Credit: Source link