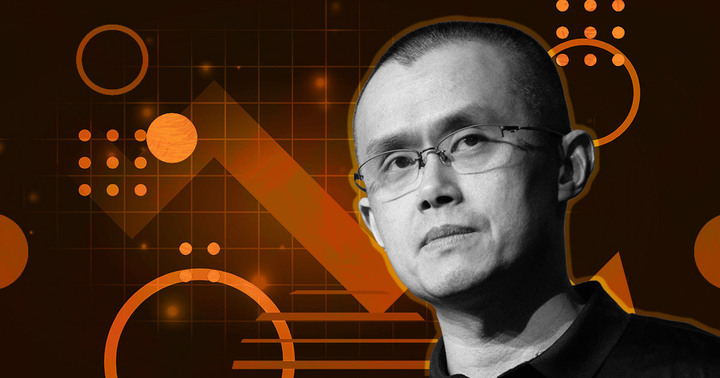

Binance CEO Changpeng ‘CZ’ Zhao said bad projects should be allowed to fail and Binance has no intention of offering “bailouts” to such projects.

In the blog post titled “A Note on Bailouts and Crypto Leverage,” CZ said that Binance has to help “industry players survive and hopefully thrive” even if the company does not gain anything from such help.

CZ categorizes bailouts

He continued that there are different types of bailouts. He believes some projects or companies are bad, which is visible in their poor design, management, and operations.

Such projects do not deserve to be saved regardless of the number of users they might have. According to CZ:

Bailouts here don’t make sense. Don’t perpetuate bad companies. Let them fail. Let other better projects take their place.

The second category comprises projects with fixable problems. These projects made mistakes, like spending too much or saving too little.

CZ said companies with these good qualities and fixable problems should be bailed out and “made to fix the problems that led them to this situation in the first place.”

In the third category, projects with great potential but have struggled to survive because of limited budgets should be classified as great investment assets. CZ added that the Binance deals team has been in talks with these kinds of projects lately.

Talks about bailouts on the up

CZ shared his view just a few days after SEC commissioner Hester Peirce said she doesn’t support bailouts for crypto companies. According to Peirce, the market crash is a chance for bad projects to collapse.

Meanwhile, FTX and Alameda Research CEO Sam Bankman-Fried recently said his companies might step in to prevent contagion in the industry.

Alameda Research has issued a loan of $200 million USDC and a revolving line of credit of 15,000 BTC to the crypto brokerage firm Voyager Digital.

Additionally, FTX has also offered a $250 million loan facility to BlockFi.

Credit: Source link