Decentralized Finance, or DeFi, was created with a view to create a market of open finance, with minimal involvement of centralized financial intermediaries. The idea was to enable faster transactions, more transparency, and zero paperwork.

The DeFi industry has been in the buzz ever since its start. More and more DeFi coins are entering the market of digital assets, and they are being seen as a profitable investment option by many.

How to understand which is the best option? It is important to keep track of the best performing DeFi assets, their use cases and future potential to arrive at the best investment choice.

We have elaborated below on some of the top DeFi coins to help you understand this.

The Top 10 DeFi Coins in Last 24 Hours

1. Uniswap

Uniswap is an Ethereum-based automated crypto exchange that has its own governance token, UNI. It is based on Ethereum’s blockchain.

The platform is different from other popular exchanges because it is fully decentralized – that is, it isn’t owned and run by a single organization – and uses an “automated liquidity protocol”, which is a very new type of trading mechanism.

Uniswap is also open source, which means that anyone may copy the code and use it to build their own decentralized exchange. Users can even list tokens on the exchange for free. Because Uniswap is a decentralized exchange (DEX), users keep complete control over their funds.

This is in contrast to a centralized exchange, which requires traders to relinquish control of their private keys in order for orders to be logged on an internal database rather than executed on a blockchain, which is more time consuming and costly.

Today’s Uniswap price is $5.45, with a $154 million 24-hour trading volume. In the previous 24 hours, Uniswap has gained 11.58 percent. The current market capitalization is at $3.9 billion. There are 718 million UNI coins in circulation, with a maximum supply of 1 billion UNI coins.

Buy Uniswap on eToro

Your capital is at risk.

2. Chainlink

Chainlink (LINK) is a cryptocurrency and technology platform that allows non-blockchain businesses to connect to blockchain platforms securely. It is a middleware platform that connects smart contracts on the blockchain to external data.

The LINK currency of Chainlink is used to pay network operators and to secure smart contract agreements on the network.

Chainlink uses blockchain technology to help businesses connect with any of the major blockchain networks, such as Ethereum, Solana, and Terra.

The Ethereum platform, which uses the proof of work operating mechanism, hosts the Chainlink blockchain. Chainlink is an open source blockchain project, which means that anyone can look at and contribute to the code.

Chainlink is currently trading at $7.20, with a 24-hour trading volume of $353 million. In the previous 24 hours, Chainlink has gained 8.23%. The company’s current market capitalization is $3.3 billion. There are 467 million LINK coins in circulation, with a total quantity of 1 billion LINK coins.

Buy Chainlink on eToro

Your capital is at risk.

3. AAVE

Aave is a decentralised lending system that allows individuals to lend or borrow cryptocurrency without having to go via a third party.

Users deposit digital assets into “liquidity pools,” which the protocol can use to lend out monies. They gain interest when they lend and pay interest when they borrow.

Aave was created on top of the Ethereum network, and all of the tokens on the network are ERC-20 tokens. Aave has subsequently extended to include Avalanche, Fantom, and Harmony, among others.

Today’s Aave price is $108.44, with a $200 million 24-hour trading volume. The current market capitalization is $1.5 billion. There are 13.8 million AAVE coins in circulation, with a maximum supply of 16 million AAVE coins.

Buy Aave on eToro

Your capital is at risk.

4. Maker

Maker (MKR) is the decentralized lending platform Maker’s main utility and governance token.

Maker is a decentralized autonomous organisation (DAO) based on Ethereum that allows anybody to lend and borrow cryptocurrency without the need for a credit check. To do this, the network combines powerful smart contracts with a uniquely pegged stablecoin.

MKR is a decentralised ERC-20 coin that symbolises a Maker Project investment.

Maker was also the world’s first DAO. Maker is now regarded as an important member of the DeFi community.

Today’s Maker price is $1,308.82, with a $134 million 24-hour trading volume. The current market capitalization is $1.2 billion. There are 977,631 MKR coins in circulation, with a maximum supply of 1 million MKR coins.

Buy Maker on eToro

Your capital is at risk.

5. Convex Finance

Convex Finance is a platform created by an anonymous group of developers that allows Curve Finance’s liquidity providers to receive increased rewards without locking their CRV tokens. There are no withdrawal fees and just minor performance fees on the platform.

Staking and providing liquidity are two important ways for the protocol to create more benefits.

CVX is the native cryptocurrency of the Convex platform. CVX can be used to earn cvxCRV, which gives a piece of Curve LP’s CRV earnings as well as a percentage of the fees, by staking it on Convex Finance.

More value will be awarded to cvxCRV holders as the Convex platform’s revenue grows.

Buy Convex Finance on Binance

Your capital is at risk.

6. Curve

Curve is a decentralised exchange liquidity pool based on Ethereum that aims to make stablecoin trading as efficient as possible. Launched in January 2020, Curve offers trading stablecoins with low slippage, a low fee algorithm created exclusively for stablecoins, and the ability to earn fees.

Compound, PAX, Y, BUSD, sUSD, ren, and sBTC are the seven Curve pools that currently enable swaps for a wide range of stablecoins and assets. ERC20 tokens are unique to each Curve pool.

The live Curve DAO Token price today is $1.32 with a 24-hour trading volume of $122 million. Curve DAO Token is up 7.92% in the last 24 hours. The current market cap is at $607 million. It has a circulating supply of 458 million CRV coins and a maximum supply of 3.3 billion CRV coins.

Buy Curve on eToro

Your capital is at risk.

7. Amp

Amp is a new digital collateral token that promises to provide instant, verifiable guarantees for any type of value transfer.

Flexa, a blockchain network dedicated to make payments as fast and secure as possible, is backing Amp. On trades that fail or take too long, Amp is used in place of other crypto assets.

The current Amp price is $0.012108, with a $7.68 million 24-hour trading volume. The current market capitalization is $511 million dollars. There are 42 billion AMP coins in circulation, with a maximum supply of 92 billion AMP coins.

Buy Amp on Coinbase

Your capital is at risk.

8. Compound

Compound is a decentralised network that enables digital asset lending and borrowing. Cryptocurrency holders can earn income by lending their assets to the company’s liquidity pool. It makes use of the pool to lend money to others who are looking for money.

COMP, the company’s native token, may be used to lend cryptos to lending pools. It also permits holders of voting rights to use their privileges to make changes to the protocol.

COMP can be purchased for $60.79 per coin. It has a $433 million market cap and a daily trading volume of $69.8 million. 7.1 million coins are now in circulation. The coin’s maximum supply is ten million.

Buy Compound on eToro

Your capital is at risk.

9. Kyber Network

Kyber Network is a decentralised, blockchain-based platform for aggregating liquidity and facilitating token exchanges without the use of a middleman.

Decentralized applications (dApps), crypto wallets, and decentralised finance (DeFi) platforms can all use Kyber Network. KyberDAO, a decentralised autonomous organisation, is in charge of the protocol, which is managed by holders of the protocol’s native Kyber Network Crystals (KNC) currency (DAO).

The current Kyber Network Crystal v2 price is $2.17, with a $142 million 24-hour trading volume. The current market capitalization is $385 million. There are 177 million KNC coins in circulation, and the maximum supply is unknown.

Buy Kyber Network on eToro

Your capital is at risk.

10. 1inch

1inch (1INCH) is an Ethereum token that drives 1inch, a decentralised exchange that attempts to provide “the best prices by identifying the most efficient switching routes among all prominent DEXes.”

1inch and other decentralised exchanges (also known as DEXes) allow users to trade tokens without the necessity of a middleman. To find the cheapest pricing for users, 1inch combines token values from decentralised exchanges.

1INCH is a cryptocurrency based on the Ethereum network.

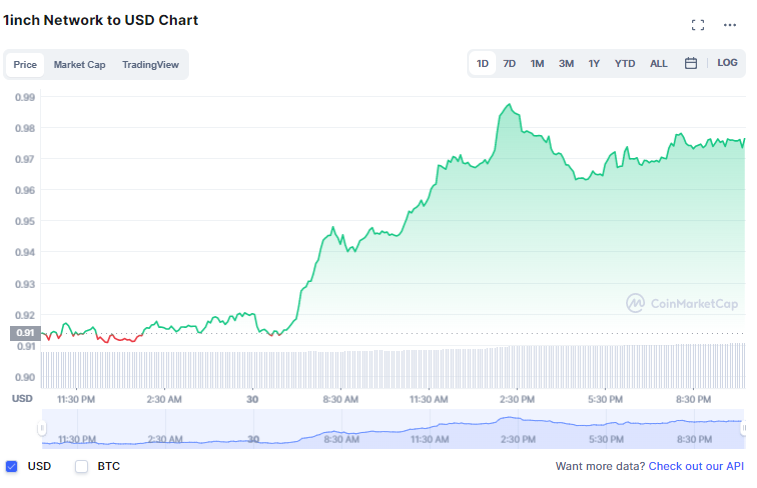

With a 24-hour trading volume of $45 million, the current 1inch Network price is $0.976362. In the last 24 hours, 1inch Network has increased by 6.82 percent. The current market capitalization is $405 million. There are 415 million 1INCH coins in circulation, and the maximum supply is unknown.

Buy 1inch on eToro

Your capital is at risk.

What is the Best Place to Buy DeFi Coins?

If you are looking to buy DeFi coins with good investment potential, then eToro is the best platform. The popular crypto exchange is highly regulated and safe, besides coming with an affordable fee structure. All you need to begin your trading journey is $10 as deposit.

eToro also offers a copy portfolio feature that allows traders to imitate trade choices of successful investors on the platform. You can also use the smart DeFi portfolio to track your investments and latest developments in real-time.

eToro’s smart DeFi portfolio enables instant expansion into leading DeFi assets like Uniswap, Chainlink, AAVE, MKR, and more.

Visit eToro Now

Your capital is at risk.

Read more:

DeFi Coin – Our Recommended DeFi Project for 2022

- Listed on Pancakeswap, Bitmart (DEFC/USDT)

- Automatic Liquidity Pools for Crypto Swaps

- Launched a Decentralized Exchange – DeFiSwap.io

- Rewards for Holders, Staking, Yield Farming Pool

- Token Burn

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Credit: Source link