The best Ethereum 2.0 staking services and how to pick one according to your needs. We dive into pros and cons of Ethereum staking pools, independent ETH2 node providers, and much more.

With over 5 million ETH already staked with Ethereum 2.0, the public is now faced with a plethora of services that let both institutional and individual clients take part in the proof of stake. Whilst the demand for staking services is set to only continue in its growth, we decided to take a step back and see what the best Ethereum 2.0 staking service providers really are.

Do they get to keep all the commission, returning only a fragment of original ETH2 annual percentage yield (APY)? How straightforward is it to get started with ETH2 staking?

If you find yourself asking these questions, then you are in the right place as we compare the Ethereum 2.0 staking providers in search of the best solution on the market. First though, let’s dive into the basics behind ETH 2.0 staking, the state of the market and finally, the best way to stake including:

- Ethereum staking pools

- Independent Ethereum staking

- DIY ETH 2.0 staking on personal servers

Ethereum 2.0 staking 101

Anyone can participate in Ethereum 2.0 staking, contributing towards the decentralisation of the network, whilst receiving ETH as a reward in return. The proof of stake version of Ethereum runs on the beacon chain, which by design, mimics the original Ethereum proof of work network. Next, are the validator nodes that connect to the beacon chain and do transaction attestations. Think of validator nodes as if they are the generation-old miners, ones that require a fraction of the energy and do not crash if run on cloud servers like AWS.

Each validator node requires users to lock 32ETH. This is done to secure the network from any public wrongdoings, because a single missed transaction or false attestation may lead to slashing (being forcefully removed from the network) and a fee. There can be up to 50% taken from the staked amount and it is a genius solution that extortiates any dark-minded activity within the blockchain.

As Vitalik Buterin has recently put it: You need to own at least 51% of validator nodes to govern the transactions and that is at least 2,5 million ETH you first need to own, and then risk, for a chance to win over the network.

Ethereum 2.0 and the market outlook

In today’s world, blockchain is no longer a space that attracts only the tech purists. Instead, it is a behemoth of an industry that by mid-2021 amounts to $1.4 trillion. Then, there is DeFi, and its $60 billion worth of fiat and cryptocurrency, locked in various staking projects. Finally, come the myriads of projects that operate on existing blockchains like Ethereum, and offer services that by now even the off-blockchain corporate world is dependent on.

Strong Foundation = Value Floor

Since Ethereum is already a household name when it comes to blockchain networks, it is a no-brainer that the price of ETH continuously displays an uptrend performance. Expectedly, the public started to flock to the ETH2 staking, locking ETH in favour of network participation and the annual yield that the staking generates. The corporate world has also joined in and even private companies now dedicate the employees’ pension fund money towards staking. But what are the best Ethereum 2.0 staking providers? How exactly do you find one that fits you best?

#1 Non-custodial Ethereum 2.0 staking

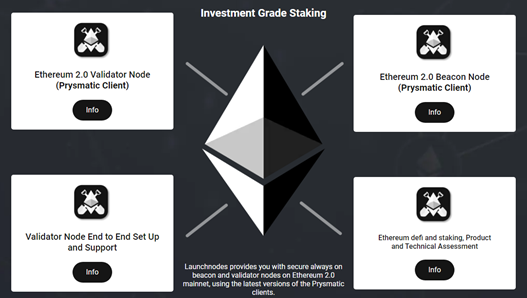

Meet the lesser-known, but the most advantageous way to stake ETH 2.0. It only makes sense to think that independent Ethereum staking generates the highest yield since it eliminates intermediaries out of the equation. By doing your own staking, you run a validator node and get all the rewards. Sounds complicated? Not necessarily. The only company on the market that offers such services on a turnkey basis, whilst also being non-custodial is Launchnodes, and it combines Ethereum 2.0 staking with cloud computing on AWS.

We work with both enterprise and individual clients and ensure they run the safest infrastructure and get zero-fee Ethereum 2.0 staking APY. The beacon and validator nodes we set up, run on AWS. It is cost-effective, truly independent and easy to set up with our concierge service.

— Jaydeep Korde, CEO at Launchnodes.

The truth of the matter is, whatever staking pool you finally end up on, it is most likely already using such a service and therefore, it makes little sense not to stake Ethereum 2.0 directly. Furthermore, independent staking is the only suitable option for institutional clients that intend to run more than one node. Think investment and pension funds, banks, individuals, private and public companies, they are all starting to stake ETH2 independently. This is where tailored infrastructure comes into play, perfecting the network latency settings and other technical parameters.

Pros:

- Collect 100% of Ethereum APY

- Zero dependencies on third-parties

- Do not transfer your ETH to any third-parties

- Ethereum 2.0 staking infrastructure designed with the Enterprise

- Cloud-based staking ensures zero downtime and is cost-effective to run

- Stake 32ETH multiples thereof, or less

- Requires zero technical knowledge

Cons:

- The only way to stake less than 32ETH is by pooling in with friends

Taking into account that you need 32ETH to run a validator node, it may seem that this is where independent staking struggles to capture the wider audience. To go around this, the team at Launchnodes has introduced a new product called Staking Club. It allows you to group together with friends through AWS, but unlike with conventional pools, retain all the benefits of non-custodial Ethereum 2.0 staking.

#2 Ethereum 2.0 staking pools

Staking pools offer easy access to ETH2 staking. The setup behind each staking pool is all about getting as many people as possible to partially contribute less than 32ETH (the required amount of ETH to run a validator node). Once the pool is complete, the operating company launches the staking pool, takes out its commission and splits the rewards between pool participants, according to respective staked amounts. Binance is the only company that doesn’t take the staking commission if you go through the intricate process of exchanging your ETH to BETH, which is their in-house cryptocurrency. And still, you are dependent on the exchange’s very likely future commission adjustments. This means that the rates are subject to change as more clients get drawn to its Ethereum staking pool service.

Pros:

- Easy to get started (depending on the service provider)

- Stake less than 32ETH

Cons:

- High commissions (25%+)

- Dependency on the service provider

- No infrastructure clarity for whale stakers and investment-grade enterprise clients

#3 Staking Ethereum 2.0 on your PC

If Ethereum staking can be done on a cloud server, then it can also be done on your personal PC. It is another way to grab 100% of the ETH2 rewards, but there are risks involved. First, one will have to make sure that the server is always on, not to miss an attestation passed on by a beacon node. The same issue can also materialize in case of a power cut, slow internet connection or even a simple software freeze. So, there is a lot to take into account.

Another criteria to keep in mind when setting up a validator node and beacon node on your PC is that it requires substantial technical knowledge for the node to run smoothly. Next, you will have to choose the ETH2 client. At the moment available clients are Prysm, Teku, Lighthouse and Nimbus. In the conversation with Rajesh Sinha, Co-founder at Launchnodes and an ex quant, he outlined the following:

‘We made a decision to run the nodes on the latest version of the Prysmatic Client as it has shown nothing but high performance and consistency during our evaluation process.’

There is a lot to take in when staking Ethereum 2.0 on a personal PC or server. Still, if you believe that the above-mentioned risks can be resolved, head over to the ETH2 launchpad to start.

Pros:

- Collect 100% of ETH2 rewards

- Govern your staking architecture

Cons:

- Risky, may lead to being slashed and high non-performance fees

- Highly technical set up process

- Requires continuous upkeep

Best Ethereum 2.0 staking services at glance

Ethereum staking is imminent in its growth and it shows no signs of stopping, judging by how well the public switched to staking from mining or simply holding on to ETH. Moreso, it captured the attention not only of individual investors but also the corporate world. Private companies, large investment funds, pension funds and even banks will soon be all staking ETH as part of their growth plan. And this sets Ethereum 2.0 for an upward trend that is here to stay.

Summarizing the best way to stake Ethereum 2.0, it becomes apparent that independent, non-custodial staking takes the lead. It eliminates all the intermediaries and if done via the right provider, removes any possible risks attached to other Ethereum staking options.

Credit: Source link