BCH Trades Positions Underneath – July 5

BCH/USD market activity trades positions underneath the value of $600. The crypto’s actual trading worth stands around at $514 as of writing at a percentage rate of about -2.57.

Trades Positions Underneath: BCH Market

Key Levels:

Resistance levels: $600, $800, $1,000

Support levels: $400, $300, $200

The BCH/USD daily chart showcases that the crypto market trades positions underneath the line of $600. The 50day SMA indicator is over the 14-day SMA trend-line. And, the bearish trend-line drew downward across them to place a resistance mark where it meets the smaller SMA at a lower point. A line of variant smaller candlesticks is close underneath the smaller trend-line. The Stochastic Oscillators are in the overbought region, seemingly attempting to continue moving in a consolidation mood. That portends that the market will most likely see more variant smaller candlesticks in the next session.

Will the BCH/USD market succumb further to a downward force as it trades positions underneath $600?

Being as it is, the BCH/USD bulls’ catalyst appears un-weighty to portend smooth upside run of the market as it now trades positions under $600 level. The critical support baseline at $400 will play a vital role in determining if the crypto economy will still need to dump southward further, purposely let there be an upward swing that bulls in the market could rely upon several times.

On the downside, It still appears that the crypto value may continually trade positions for more days’ sessions in a range-bound outlook around the points of $600 and $400. Therefore, if that assumption were valid, bears needed to be on the lookout for price reversal that could emanate from that upper value before considering placing a sell order. Meanwhile, the deeper the market goes down, the better chance to buy more to keep or hold.

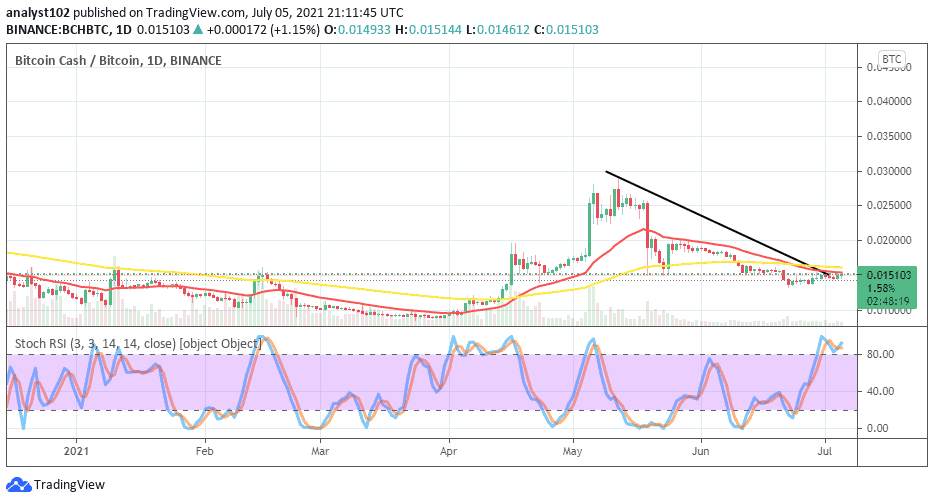

BCH/BTC Price Analysis

In comparison, Bitcoin Cash appears struggling to trend against the market’s weight of Bitcoin. There is a small space between the SMAs as the 50-day SMA indicator is closely over the 14-day SMA trend-line. The bearish trend-line drew downward, touching the smaller SMA indicator. The Stochastic Oscillators are in the overbought region, seemingly attempt consolidating in it to potentially signify a pause in both the trending weight of the two different trading instruments.

Looking to buy or trade Bitcoin Cash (BCH) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider.

Credit: Source link