In 2021 it is even easier to make and receive payments from anywhere and to retain your privacy. That’s because online remittance providers are now accessible to even the unbanked. The decentralized landscape has created an environment that is friendly and offers seamless services for buying, selling, and trading cryptos and some of the leading providers even offer users rewards for transactions they make.

This article looks at some of the best solutions for those users that want the freedom to send money, with minimum fees and to claim rewards along the way.

1. Mobie

Mobie seeks to step up the crypto payment industry by offering cross-border payments that are an easy and secure way of spending your crypto immediately for your everyday purchases. It offers you cash and rewards for every transaction and referral you make. No need for debit or credit cards or even bank details, promoting a true sense of privacy and anonymity. Mobie has an entire ecosystem that facilitates mobile phone payments for both fiat and crypto payments.

Mobie limits transaction fees and can exchange your cryptos to fiat currencies. You can exchange your fiat and digital currency between one another straight away, with literally no fees. It allows you to pay for anything with your crypto holdings. Mobie has teamed up with over 225,000 physical and online Point-of-Sale (POS) systems at leading retailers across the world to bring a fresh face to mobile crypto payments.

Mobie allows you to safely store your crypto holdings and can link all of your accounts into one single payment gateway. Their exchange allows users to send, spend, transact their cryptocurrencies or local currencies instantaneously. The Mobie ecosystem is powered by the MobieCoin that sits at the heart of this protocol. You can stake your Mobie tokens (wMBX) for regular payouts.

Join the Mobie waitlist to participate in the early access to their beta.

2. Crypto.com

Crypto.com is growing fast. With over 10 million users and counting it enables its users to buy and sell over 100 cryptos with 20+ fiat currencies using bank transfers or your credit and debit card. Crypto.com which was founded in 2016, currently has 900 employees. It offers a decentralized exchange, a hub for margin trading of leading cryptocurrencies, the ability to trade derivatives online, and you can earn up to 8.5% on your crypto holdings or up to 14% APY for your stablecoin holdings.

Crypto Pay allows you to send money to friends free of charge, and to pay any merchant online with its crypto checkout feature. Also the more you spend the bigger the rewards you get, up to 10% CRP for food and beverage purchases, 5% on gaming, fashion, taxis, and entertainment, and 2.5% for hotels and leisure bookings. You can even borrow money using your crypto holdings as collateral.

3. Spend.com

Spend.com has lofty plans for world domination, at least in terms of offering a global payment service for any household. Spend offers a wallet, which enables users to buy, spend, track payments and store their crypto holdings. It has a credit card that is accepted in over 40+ million locations globally. It also allows users to take out loans and then instantly use those funds via their Spend.com Visa cards. They charge no monthly fees, purchase fees, or ATM withdrawal fees for their Visa cards. The card allows you to spend your crypto holdings for fiat payments and to buy and sell crypto for fiat currencies. They currently support 24 leading cryptocurrencies.

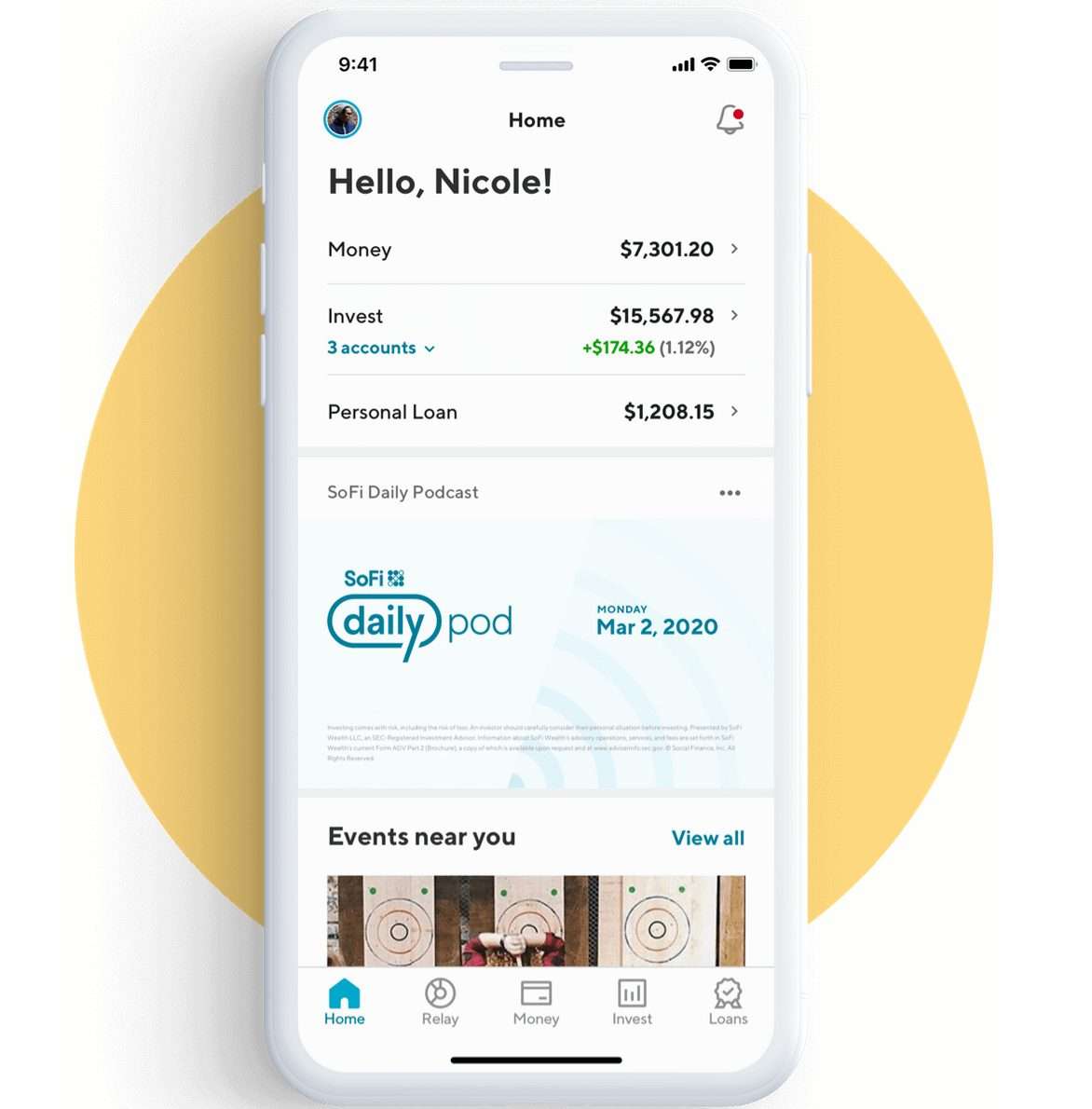

4. SoFI

SoFI is a payment facilitator with a difference. They focus on lifestyle. This includes refinancing for student loans, medical and dental loans, personal and home loans and they offer IPO investing, with the ability to invest in upcoming IPOs as well as a platform for trading stocks, ETFs, and cryptos as well as automated investing through their own robot. This company, a true jack of all trades, seems to have thought of everything. They also offer specialized insurance for home, car, and estate planning. Like Spend.com, they also offer a credit card that allows users to earn cashback rewards of 2%. They might sound like a bank, but they are not. SoFi was founded in 2011, they currently have over 1500 staff and have dedicated customer support based in the US.

Credit: Source link