Luis Martim Aureliano is an independent financial crypto analyst, consultant.

____

With cryptocurrencies surpassing the USD 2trn market capitalization milestone, the upward price momentum has drawn a fair share of cheerleaders and detractors into the conversation surrounding Bitcoin (BTC)’s future. While the debate rages on, the expansion of the Bitcoin monetary ecosystem to support greater derivatives trading has sparked many interesting developments, especially for traders.

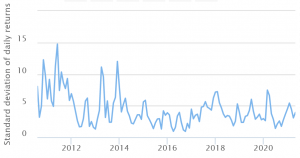

For one, given that Bitcoin exhibits the largest and most developed futures contract ecosystem, the king of crypto is undeniably benefiting from lower volatility over time, which continues to fall as evidenced by the chart below.

Although candlestick price charts may tell another tale, given how unprecedented the price swings are compared to nearly every other asset class, the introduction of Bitcoin futures has also encouraged more participation from retail and institutional investors alike.

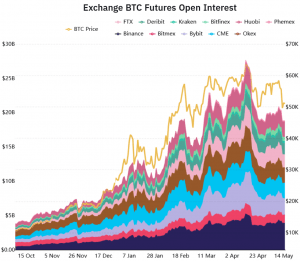

A quick look at the rise in futures open interest (how many futures contracts are outstanding) in the chart below demonstrates the overall growth in demand for futures. A closer inspection shows that the expansion in open interest does lag prices (yellow line) historically with a few exceptions (most recently in mid-April). This can be interpreted to mean that BTC price action in the spot market might be a key driver of growing interest in the futures market.

Still, that doesn’t mean that Bitcoin futures have no role in indicating the future of BTC spot prices. There is still a significant spread (difference or delta) between Bitcoin futures prices and spot prices, which have opened up a uniquely profitable trading opportunity with very limited risk. This is especially attractive for traders who want to avoid being held prisoner to sharp daily price swings.

The most unexposed BTC trading opportunity

Before the days of a booming futures market, the main arbitrage opportunity in the crypto space was between exchanges. For those unfamiliar with arbitrage, this is basically the idea of buying something cheap and simultaneously selling it for more, capturing the difference in prices while maintaining a neutral position in the market.

One historical example in Bitcoin was when traders would buy coins at a cheaper price on one exchange, move them to another exchange to be sold for a higher price, and then repeat the process. However, the time it took to move coins between exchanges and BTC price volatility made this risky trade.

Fortunately, since exchange fees now make this form of arbitrage difficult, if not impossible to implement, a relatively risk-free opportunity has arisen. Traders can exploit the significant difference between spot and futures prices in a trade, which persists to this day, with more minimal risk.

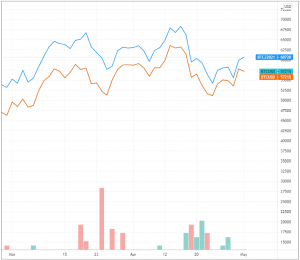

At the time of writing, a quick look at CME futures data for Bitcoin showed that the December 2021 contract (which expires in that month) was trading substantially higher than spot prices (see chart below comparing BTC futures to BTCUSD spot prices on Coinbase). As of the close of trading on May 3rd, 2021, the difference between the spot and futures price was approximately USD 3,500. This difference represents an almost risk-free opportunity.

Effectively, that means that traders could, for example, buy Bitcoin in the spot market at USD 57,215 and sell December 2021 Bitcoin futures for USD 60,720, capturing the USD 3,505 difference. This equates to around a 6% return over 9-months. Traders would have to hold onto this trade for 9-months (until the futures contract expires at the end of December), but other futures contracts which expire sooner can also be purchased to drive returns even higher.

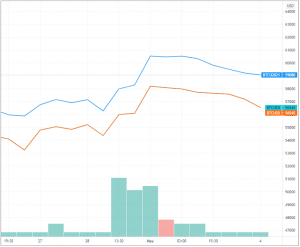

For instance, the September futures contract displayed below also highlights a notable difference between recent prices and September’s price, which can be exploited.

What this means is that every time a futures contract is more expensive than spot prices, traders can buy BTC in the spot market and sell BTC in the futures market to capture this difference, while remaining completely unexposed to bitcoin volatility. Ultimately, given the structure of futures contracts relative to spot prices, generating a 15%-20% return over 2021 would not be implausible.

This makes the above-mentioned trading opportunity very promising, namely due to the lower level of risk. Just don’t lose your private keys to your BTC wallet holdings.

____

Disclaimer: This article is not a financial advice and you should always do your own research before investing.

____

Learn more:

– Obsessed Amateur Crypto Traders Are ‘Disproportionately Liquidated’

– 5 Leverage Trading Platforms (for Experienced Margin Traders) in 2021

– The UK and US Clamping Down On Crypto Trading – It’s Not Yet A Big Deal

– 7 Ways to Short Crypto

Credit: Source link

![Best Crypto To Buy Now [New 2025 List]](https://cryptocentralized.com/wp-content/uploads/2025/02/unnamed-38-350x250.jpg)