Arbitrum (ARB), the token that powers the Decentralized Autonomous Organization (DAO) that runs the Arbitrum blockchain protocol, has pulled back from its recent highs to the north of the $1.70 level and was last trading in the $1.62s, down around 4% on Monday as per TradingView data.

However, according to CoinGecko, Arbitrum is still up around 32% in the last seven days, making it the best-performing cryptocurrency in the top 50 by market capitalization, with price predictions still mostly upbeat.

Last Thursday and Friday, Arbitrum burst higher, rallying from around $1.20 to above $1.70 in under two days.

The rally was triggered by an upside break of a downtrend linking a series of highs going back to March.

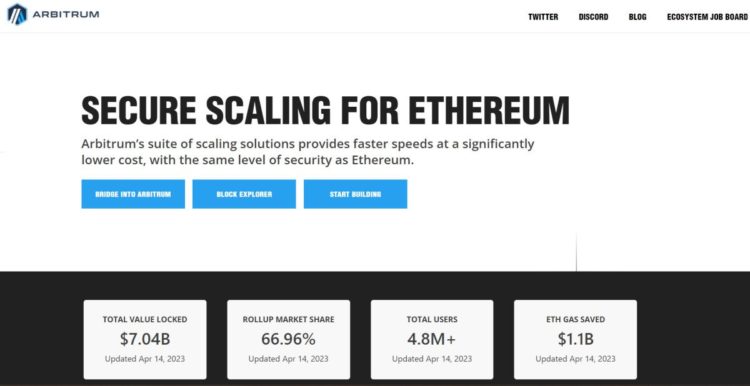

The Arbitrum blockchain is a layer-2 scaling solution built on top of the Ethereum network, aiming to lower transaction fees and increase throughput.

Arbitrum officially transitioned to become a DAO with the airdrop of its ARB token on the 23rd of March.

Read More: Arbitrum’s 700 Million ARB Return Proposal Fails, Deemed a “Power Play” by Whale – Here’s What Happened

Where is Arbitrum’s (ARB) Next Price Target?

The fact that Arbitrum has found solid support at its March highs in the $1.60 area suggests that the bull run that began midway through last week has legs.

But a lack of price data going back beyond mid-March makes it difficult to pin-point ARB’s next series of targets to the upside.

Indeed, if ARB does continue pushing higher, it will be in a state of price discovery and trading conditions will likely be highly volatile.

One way to think about price targets would be to target prices that correspond to certain market capitalizations.

For example, at the current price of just above $1.60, ARB has a market cap of just over $2 billion.

Given its current supply of 1.275 billion tokens, to hit a market cap of $3 billion, ARB would need to hit a price of $2.35.

As a result, $2.35 might be a level that some bulls are targeting.

Another method bulls might use to create upside price targets might be 1) consider psychologically important round numbers and 2) to consider key Fibonacci levels.

Regarding the former, many bulls will likely be targeting a test of $2.0 per token, then $2.5 and $3.0 and so on.

Round numbers have a long history of importance in crypto – for example, Bitcoin bulls have long been waiting for Bitcoin to hit $100,000 (which it may well do later this bull market cycle).

Long-term ARB bulls might thus target a $10 in the coming years.

Regarding key Fibonacci levels, a Fibonacci retracement from the recent lows to the recent highs can be extended to the upside to give a 161.8% and 261.8% retracement levels at $2.13 and $2.78.

Some bulls may allocate these levels as price targets.

Buy Arbitrum Here

Arbitrum (ARB) Alternatives to Consider

While Arbitrum certainly has a positive outlook for the weeks and months ahead given that the token is currently in a bullish trend, crypto investors should always be looking to diversify their holdings.

And one coin has been generating a lot of hype within the crypto community, as well as at Cryptonews.com, where analysts have ranked it as one of the best presales to invest in for 2023.

This exciting new crypto project is called Deelance – the web3 start-up is building an NFT-powered metaverse that will facilitate remote working, whilst also doubling up as a recruitment platform.

Analysts think that Deelance’s native crypto token DLANCE could perform very well in the coming years as it rides the dual waves of 1) the ongoing transition to remote working and 2) greater adoption of crypto and metaverse technology.

And the start-up’s DLANCE tokens have been flying off the shelves in the presale. In just a few weeks since the presale’s launch, DLANCE has already raised over $240,000.

Investors need to move fast as the token price will soon rise from its current $0.025 level to $0.029.

DLANCE will list on exchanges later this year at $0.53, meaning investors who get in now can be sat on paper gains of north of 100%.

Visit DeeLance Here

Credit: Source link