As per a report by PWC, one of the biggest consulting firms, a third of all hedge funds are now invested in crypto. With most only dipping their toes, while some allotting half the weightage to the asset class.

The 4th Annual Global Crypto Hedge Fund Report 2022 said that as of this year, about 38% of hedge funds have crypto assets in their portfolio, and almost a 2x increase when compared to last year. Where only 21% of these funds were exposed to crypto.

The report was created in collaboration with the Alternative Investment Management Association and Elwood Asset Management.

Visit eToro to Buy Crypto Now

Your capital is at risk.

How Deep are Hedge Funds into Crypto

Over time, a lot of crypto-focused funds have come into existence, amidst the volatility in the market, and most of these funds have been able to deliver impressive returns to investors.

As crypto is increasingly gaining acceptance, “traditional” hedge funds have grown to make themself involved with this asset class. Currently, 38% of these funds are invested in crypto. This number is quite significant, as it has almost doubled from 21% when compared to last year.

There are about 300 specialist crypto funds globally, and the rate at which this number is growing has been significant for the last couple of years. As of 2021, the total value of assets under management of these crypto funds is $4.1 Billion, as per the report that came out this year.

Of the 38% of traditional hedge funds involving themselves in crypto, 58% have no more than 1% of their portfolio dedicated to crypto. While, on the other hand, about 20% of these funds have 5% to 50% of their portfolio equipped with crypto. And two-thirds of the funds currently invested are planning to improve their stake by the end of the year.

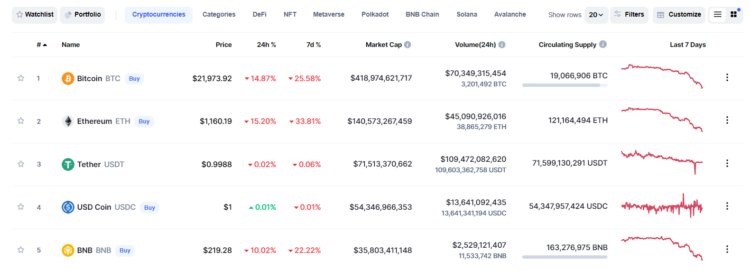

In spite of the volatility in the crypto market, crypto hedge funds have been able to deliver promising returns. The median return for crypto funds was 63.4% in 2021, and 127.55% a year before that. A lot of crypto funds traded a limited number of assets, including Bitcoin, Ethereum, Solana, Terra, Avalanche and Polkadot.

Buy Cryptocurrencies via eToro Now

Your capital is at risk.

Would Hedge Funds Invest More Into Crypto?

Regulatory issues have been cited as the key reason why hedge funds have been reluctant on investing heftily into crypto. Even the funds currently invested are intimidated by this factor, the others simply choose to pass the option for later.

The crypto industry is under-regulated, which goes against the likings of most institutional investors, and unless more regulation is introduced in the space, these investors will continue to be hesitant. As mentioned in the report, digital assets need improvement in the area of audit and accounting, risk management and compliance, and fund administration to improve their chances of being adopted.

Amidst all of this, the number of people not invested in crypto has come down to 62% from 79% last year. A considerable chunk of these are planning to invest by the end of this year. While, on the other hand, more than 40% of investors said they won’t consider investing in crypto at least for the next 3 years.

PWC Report Discussed Above

Regulatory uncertainty is considered to be the biggest obstacle by 83% of these investors, and the only way to increase investments will be through improved governance. Investors are actively waiting for the market to become more mature.

Commenting on the same, Olwyn Alexander said “Increasing appetite and demand from investors has spurred interest in crypto as an asset class, spanning retail to institutional. In addition to the numerous hedge funds investing in crypto, many larger “traditional” asset managers have been exploring the crypto space, working on pilots, and are now starting to launch products.

This will help to accelerate the institutionalisation of the crypto markets and, as they mature, regulation and infrastructure will continue to improve. Given recent market developments, we are hearing greater demand for transparency and trust from investors.”

Invest in Bitcoin at Low Fee Now

Your capital is at risk.

Are Cryptos Risky to Invest In?

Although crypto investments have been increasing progressively, and an increasing number of hedge funds are starting to include crypto in their portfolio, a recent comment on the issue says otherwise.

Mike Novogratz, the founder and chief executive of Galaxy Digital Holdings, has said that as a consequence of the current market conditions, two-thirds of the hedge funds that have invested in crypto are likely to fail.

He suggests the volume will go down, causing hedge funds to restructure their approach, saying, “There are literally 1,900 crypto hedge funds. My guess is two-thirds will go out of business.”

Visit FCA Regulated eToro Now

Your capital is at risk.

He’s suggested the removal of stimulus from the Federal Reserve to be the cause of the market crash that has occurred for the better part of this year. Bitcoin, for example, has dropped more than 50% since its last recorded high.

Read More:

Lucky Block – Our Recommended Crypto of 2022

- New Crypto Games Platform

- Featured in Forbes, Nasdaq.com, Yahoo Finance

- LBLOCK Token Up 1000%+ From Presale

- Listed on Pancakeswap, LBank

- Free Tickets to Jackpot Prize Draws for Holders

- Passive Income Rewards – Play to Earn Utility

- 10,000 NFTs Minted in 2022 – Now on NFTLaunchpad.com

- $1 Million NFT Jackpot in May 2022

- Worldwide Decentralized Competitions

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Credit: Source link