Glassnode data analyzed by CryptoSlate shows that Marathon, Hut8, and Riot built the top three largest Bitcoin (BTC) pools, while Bit Digital recorded a 134% growth in reserves in nine months.

BTC miners in 2022

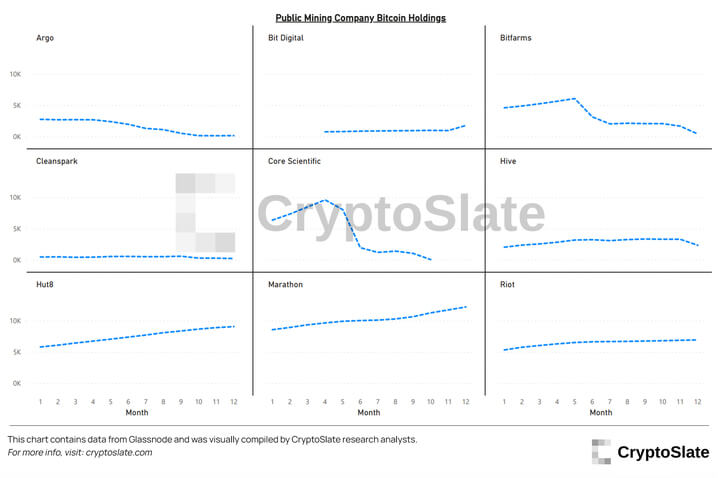

BTC miners entered the year 2022 with resources acquired through cheap debt in 2021. The majority of them invested these resources into growing their ASICS, which kept increasing their BTC holdings until May.

However, the bear market started in May introduced immense pressure and led to distribution across miners. The Russian-Ukraine war increased energy costs, the BTC price fell, and the hash rate increased, which heated the competition for block space.

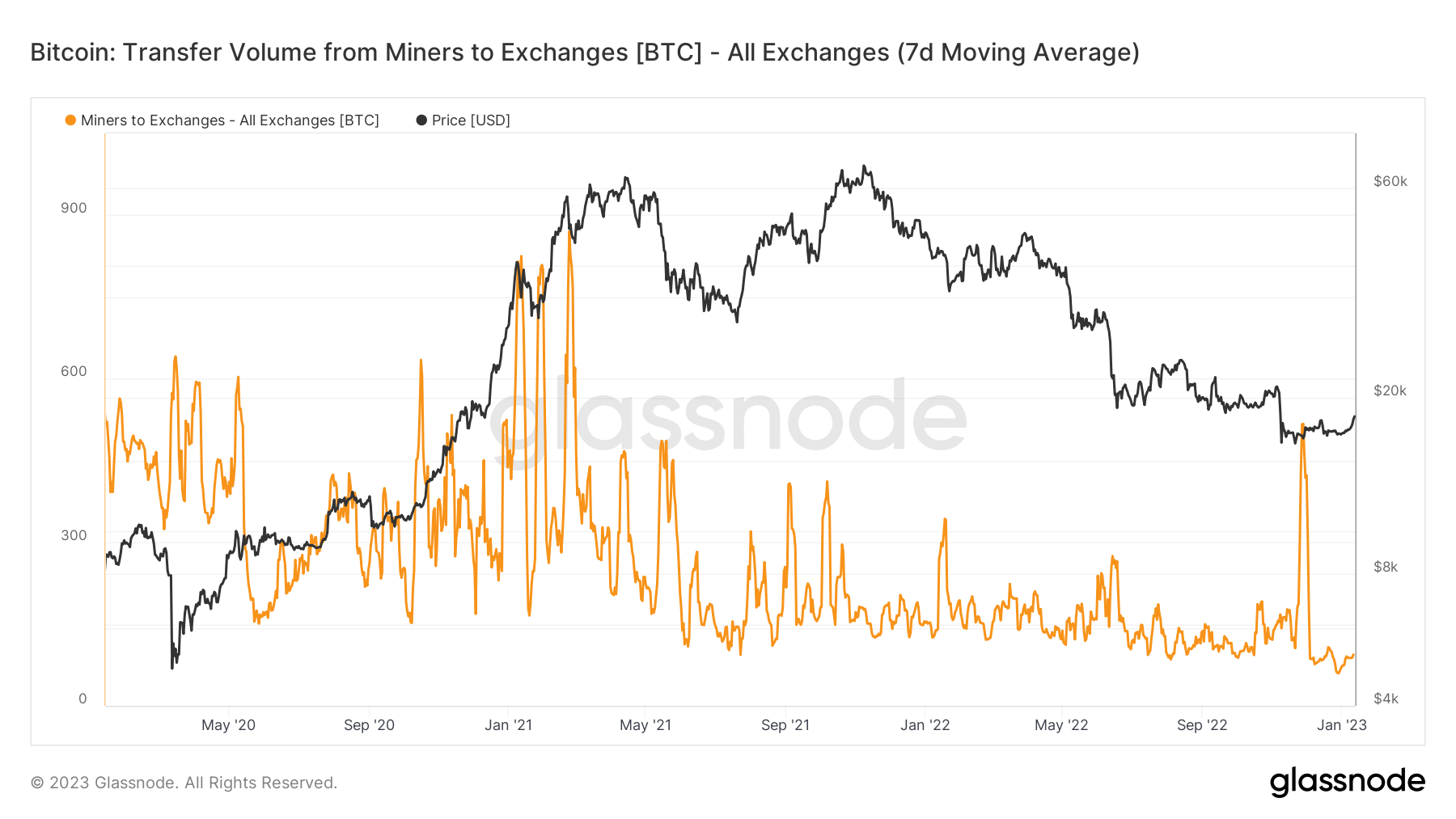

Distribution emerged as the main theme for BTC miners in the second half of 2022. However, the BTC volume in exchanges didn’t grow. Throughout the whole year, less than 60,000 BTC got sent to exchanges.

Year-end reserves

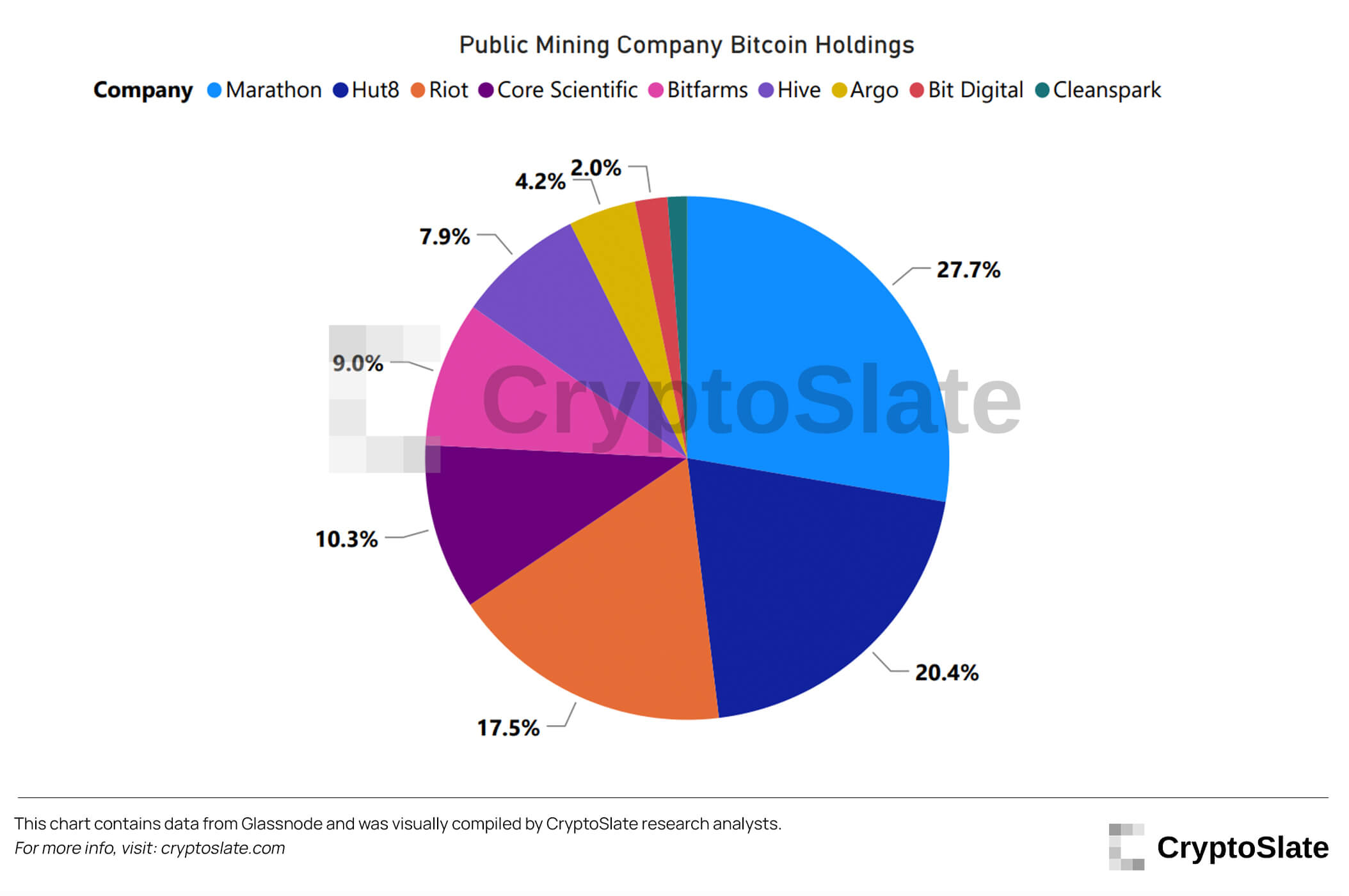

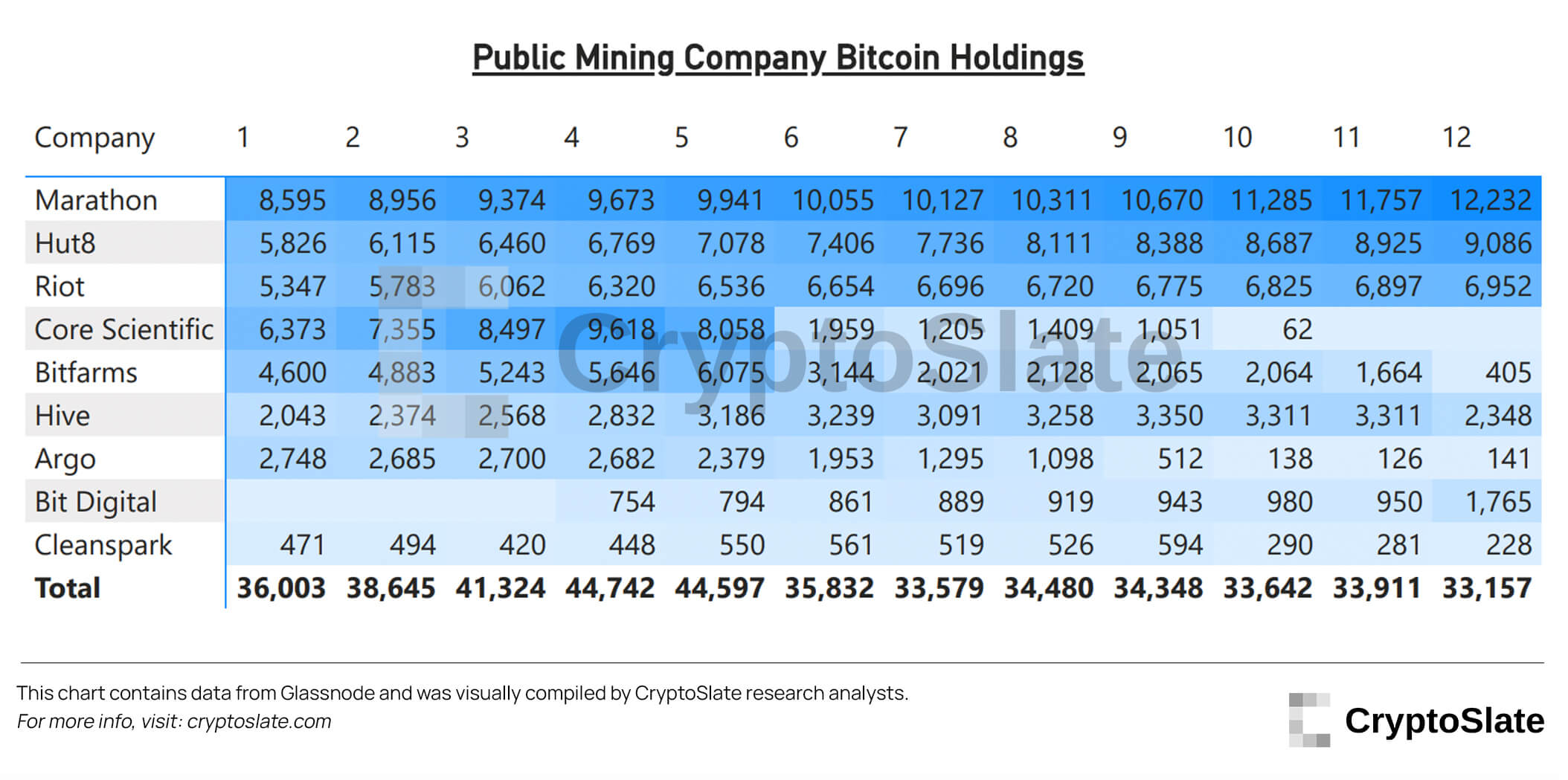

Marathon, Hut8, and Riot became the top three companies with the largest total BTC holdings, with 12,232 BTC, 9,086 BTC, and 6,952 BTC, respectively.

Marathon’s holdings account for 27.7% of the combined BTC pool of the top nine mining companies, while Hut8 and Riot account for 20.4% and 17.5%, respectively.

Top 9 Companies

CryptoSlate analyzed the top nine BTC mining companies in detail. Marathon, Hut8, HIVE, Riot, and Bit Digital ended the year by growing their holdings.

However, Bit Digital recorded the most impressive growth in mining capabilities throughout the year. Bit Digital started its operations in April and mined 754 BTC in the first month. For the rest of the year, the company recorded a 134% growth in reserves and reached 1,765 in December.

Marathon started the year with 8,595 BTC, recorded a 42% increase, and saw 12,232 BTC in December. The 5,826 BTC Hut8 had in January increased to 9,086 by December, reflecting an almost 56% increase. Finally, HIVE’s January reserves were at 2,043 BTC, which grew by 14.9% throughout the year and reached 2,348 BTC in December.

Bitfarms entered the year with 4,600 BTC and recorded a 91% decrease by falling to 405 BTC in December. Similarly, Argo held 2,748 BTC in January, which fell to 141 BTC in December, marking a 94.8% decrease. CleanSpark’s BTC reserves fell by 51%, falling from January’s 471 to December’s 228. Finally, Core Scientific couldn’t survive the winter. The company entered the year with 6,373 BTC and went bankrupt in December.

First two weeks of 2023

The year 2023 started with the least amount of selling pressure of the past three years. The chart below represents the flow of BTC from miner wallets to exchanges.

According to the data, only 88 BTC got sent to exchanges in the last two weeks.

Credit: Source link