In the crypto market, though most cryptocurrencies share similar underlying technologies, they are designed based on different economic models known as tokenomics. To be more specific, some cryptos feature a supply that increases over time, while some others have a fixed supply. Yet, a minority of cryptos come with a diminishing total supply that looks deflationary. Such tokens are referred to as deflationary cryptos.

We all know that some cryptos with a fixed supply, such as Bitcoin, are generally deflationary by default. Most members of the Bitcoin community reject inflation because it often represents a loss of value. For instance, a real-world currency issued by the government often controls the entire financial system of the country. If a government frequently issues a large supply of currency via the central bank while setting low interest rates and buying a huge amount of foreign bonds, the country will be prone to a credit crisis and even worse an economic depression.

Before publishing the BTC whitepaper, Satoshi Nakamoto had noticed that real-world currencies issued by the government are subject to inflation, which inspired him to develop an alternative store of value that’s similar to precious metals but is achieved digitally. Bitcoin’s flexible mining difficulty and mining reward mechanisms help it suppress inflation. Meanwhile, the unique design of Bitcoin continues to drive up its value. It should be noted that Bitcoin is deflationary not only because of its fixed supply but also because the block reward is halved about every four years.

Deflationary cryptos like Bitcoin represent not only innovative blockchain architectures and cutting-edge consensus mechanisms but also a broader experiment of moving the deflationary long-term stores of value from the real world to the crypto space.

Normally, the perk of having a deflationary cryptocurrency lies in the fact that as the total supply and the circulating supply decrease, the crypto will become more valuable, and more crypto users will pay attention to the crypto and invest in it.

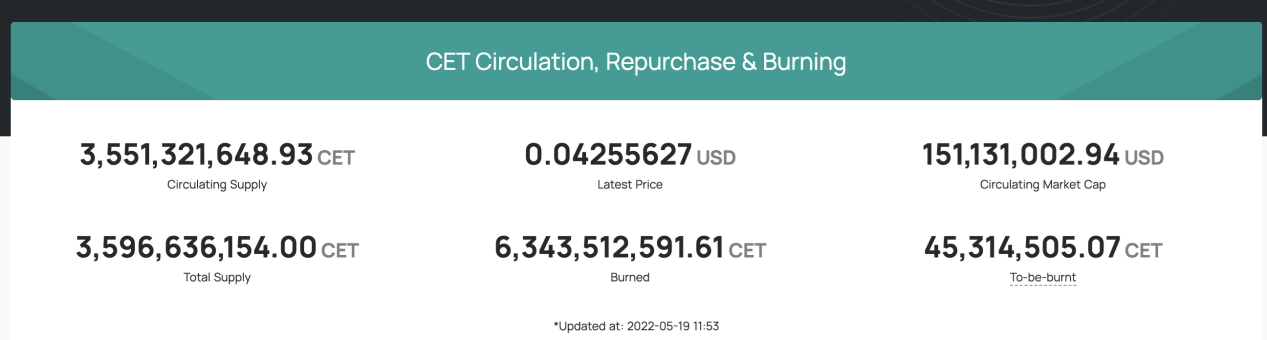

We could make a token deflationary by burning a certain percentage of the supply, repurchasing and burning some of the tokens, or repurchasing and holding the tokens. The most common method is to burn tokens manually. For instance, CET, the platform-based token of the global crypto exchange CoinEx, is a token that becomes deflationary via repurchasing and burning.

According to the value agreement of CET, CoinEx will repurchase CET every day with 50% of its trading fee income and burn all CET repurchased at the end of each calendar month until the total supply of CET reduces to 3 billion. In the next stage, the exchange will continue to spend 20% of its trading fee income upon CET repurchase and burning until the remaining CET is completely burned.

The total supply of CET is 10 billion, and through continuous efforts, CoinEx has repurchased and burned about 6.3 billion CET, and the current total supply stands at approximately 3.5 billion, according to the data on its official website as of May 19, 2022. As more tokens are repurchased and burned, the CET price had been growing throughout 2021, which attracted the attention of many crypto users. As CoinEx continues to repurchase and burn CET, the circulating supply of this deflationary token will keep dropping, and the value of CET as an ecosystem-based token will also rise over time.

Generally speaking, crypto users prefer deflationary tokens. In the long run, the value of deflationary tokens will increase as their circulating supply continues to drop, or in other words, the net worth of deflationary tokens held by their owners will be on the rise.

Credit: Source link