Este artículo también está disponible en español.

On-chain data shows that Dogecoin (DOGE) is among the altcoins that have observed significant losses for 6-month traders, which may help the coin’s price rebound.

Dogecoin MVRV Suggests DOGE May Be Offering A Buy Window

In a new post on X, the on-chain analytics firm Santiment has discussed how assets like Dogecoin and XRP (XRP) have been looking like regarding trader returns on various timeframes.

The indicator of relevance here is the popular “Market Value to Realized Value” (MVRV), which keeps track of the ratio between the value that the investors of an asset as a whole are holding (that is, the market cap) and the value that they put into the asset (the realized cap).

Related Reading

When the metric has a value greater than 1, the investors are currently in a state of net unrealized profit. On the other hand, it being under the cutoff implies the dominance of loss in the market.

Historically, whenever the investors of a cryptocurrency have been in a state of high profits, tops have become more probable to occur for its price, as the likelihood of a mass selloff with the motive of profit-taking becomes significant in such conditions.

Similarly, bottoms in the asset’s price have tended to take place when most of the investors have been in losses and sellers have reached a state of exhaustion.

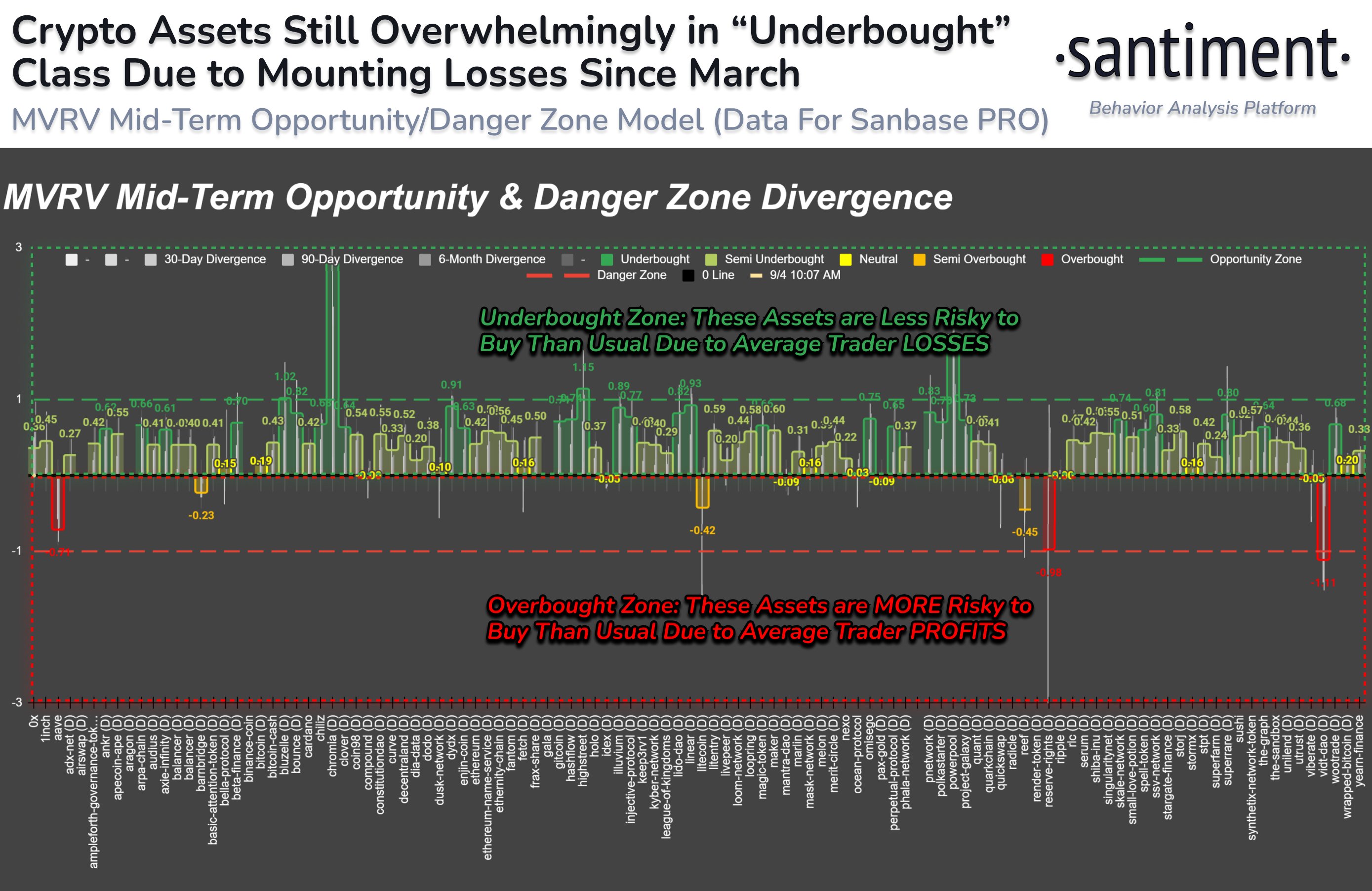

Based on these facts, Santiment has developed an “Opportunity & Danger Zone Model,” which finds out how the mid-term versions of the MVRV have diverged from the norm for the different coins in the sector. Below is the chart for the model shared by the analytics firm.

The “mid-term” versions of the MVRV specifically target the investors who bought inside 30-day, 90-day, and 6-month timeframes. When the divergences of these metrics are positive for an asset, it means said coin may be undervalued right now. Similarly, a negative divergence suggests potential overvalued status.

From the graph, it’s visible that most of the altcoins are currently in the bullish region, with some of them even seeing their divergence surpassing the 1 level, corresponding to a region that Santiment classifies as the “Opportunity Zone.”

According to the analytics firm, Dogecoin, Toncoin (TON), and Ethereum (ETH) have seen the lowest 6-month MVRV values recently, with traders who bought them in the last six months sitting at 32%, 23%, and 22% losses, respectively. Interestingly, unlike these assets, XRP’s 6-month traders are in profits instead.

Related Reading

“As a trader, if you enjoy making profits, you WANT to be in assets where other traders are in pain and seeing losses,” notes Santiment. Based on this, Dogecoin may offer the best window among the top coins, while XRP may be the worst option.

DOGE Price

At the time of writing, Dogecoin is trading around $0.0975, down more than 3% over the past week.

Featured image from Dall-E, Santiment.net, chart from TradingView.com

Credit: Source link