Renowned crypto analyst EGRAG Crypto has unveiled a fresh XRP price prediction, introducing the community to a less-known indicator, the “Average Sentiment Oscillator” or ASO. Commenting on its significance, EGRAG explained on Twitter today: “Exciting ASO Update Alert! Check out the post from September 9th to witness the impressive ascent and curve of the bullish trend! The momentum is ablaze, with an unstoppable surge toward that coveted bullish cross! #XRPArmy, HOLD STEADY! The imminent ASO bullish cross is the spark that will ignite the upcoming XRP bull run!”

Here’s When The Next XRP Bull Run Could Start

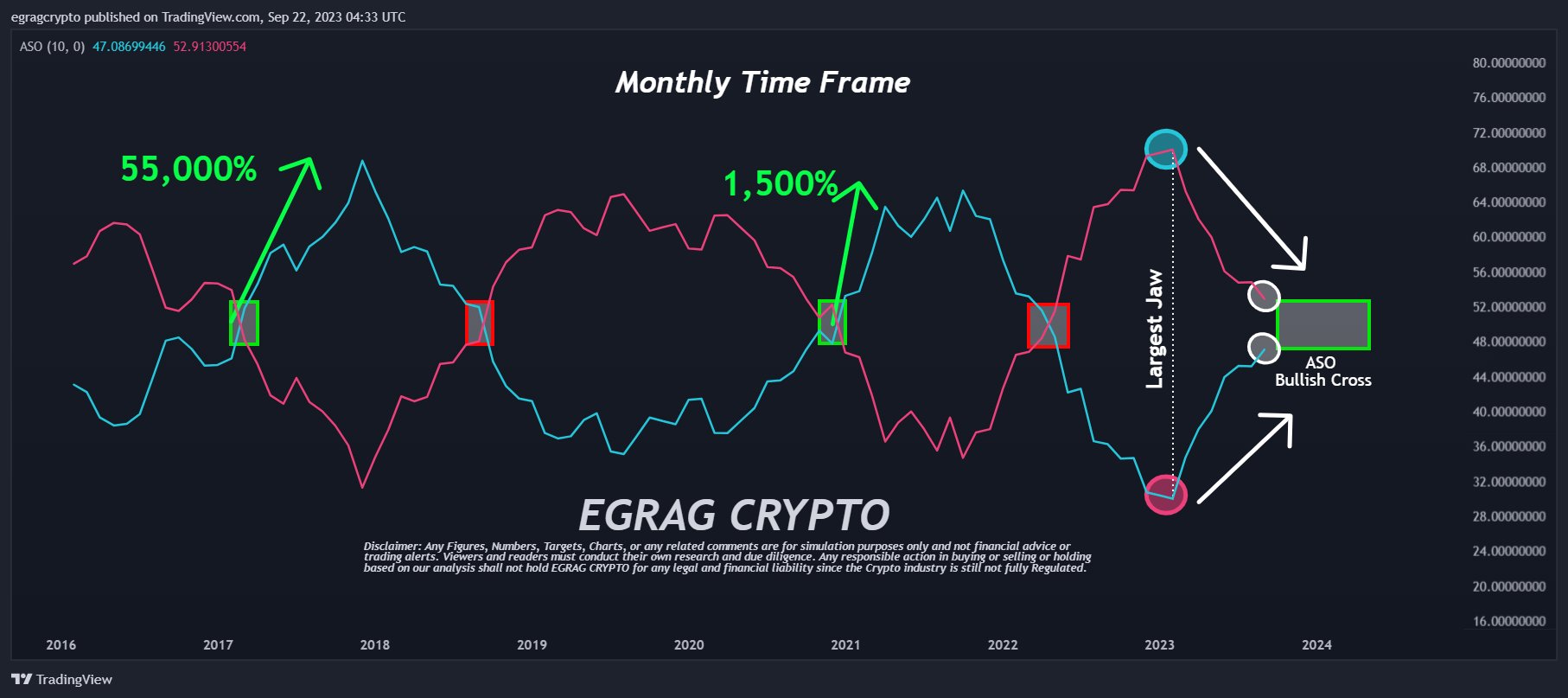

From the chart presented by EGRAG, the convergence of the blue line (representing bulls) and the red line (representing bears) is evident. By demarcating a yellow box on this chart, EGRAG anticipates the bullish crossover to manifest between the conclusion of 2023 and the commencement of the second half of 2024.

Historical data reveals that XRP has already undergone this bullish crossover on two prior occasions. The first, in 2017, witnessed a meteoric 55,000% rise in XRP’s price. The subsequent occurrence, spanning late 2020 to April 2021, saw XRP appreciate by a commendable 1500%. EGRAG underscores the magnitude of the current situation by noting the presence of “the largest jaw” ever, leading to speculation that the ensuing XRP rally could dwarf previous ones.

EGRAG’s September update brought substantial insights, underscoring the notable shift in the ASO and the build-up of undeniable momentum towards the bullish cross. In his words, “there’s an undeniable momentum building towards that coveted bullish cross.”

First, EGRAG had outlined the oscillator’s remarkable potential in March, describing it as the harbinger of a monumental bullish setup, showcasing the depth of market volatility and the contrasting strength/weakness of an asset. He emphasized, “The Mother of all #Bullish Set-Ups is upon us,” pointing to the impressive setups building in both the 3 Weeks Time Frame (TF) and Monthly TF.

A Deep Dive Into ASO

The ASO serves as a momentum oscillator, providing averaged percentages of bull/bear sentiment. This tool is recommended for accurately gauging the sentiment during a specific candle period, aiding in trend filtering or determining entry/exit points.

Conceptualized by Benjamin Joshua Nash and adapted from the MT4 version, the ASO employs two algorithms. While the first algorithm evaluates the bullish/bearish nature of individual bars based on OHLC prices before averaging them, the second assesses the sentiment percentage by considering a group of bars as a single entity.

The ASO displays Bulls % with a blue line and Bears % with a red line. The dominance of sentiment is represented by the elevated line. A crossover at the 50% centreline indicates a power shift between bulls and bears, offering potential entry or exit points. This is particularly efficacious when the average volume is significant.

Further insights can be derived by observing the strength of trends or swings. For instance, a blue peak surpassing its preceding red one. Any divergence, like a second bullish peak registering reduced strength on the oscillator but ascending in the price chart, is clearly visible.

By setting thresholds at the 70% and 30% marks, the oscillator can function similarly to Stochastic or RSI for trading overbought/oversold levels. As with many indicators, a shorter period provides advanced signals while a longer period reduces the likelihood of false alerts.

At press time, XRP traded at $0.5097.

Featured image from ShutterStock, chart from TradingView.com

Credit: Source link