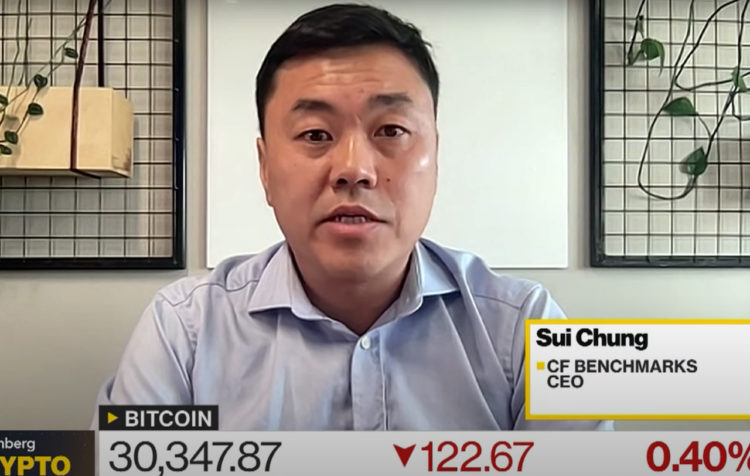

Sui Chung, CEO of the crypto index provider CF Benchmarks, says he is “very optimistic” about the US Securities and Exchange Commission (SEC) approving a spot Bitcoin exchange-traded fund (ETF).

“We are very optimistic that approval will be granted by the SEC because the SEC has consistently stated that it wants to see certain safeguards in place,” Chung said in an interview with Bloomberg TV on Monday

He went on to explain that the key safeguard the SEC has asked for is “information-sharing between the listing exchange of an ETF and crypto exchanges.”

“That bar has been very clear, and we believe that bar has been met by the provisions that collectively we have all put in place,” the CF Benchmarks CEO added.

Bitcoin is only commodity traded on “organized” spot markets

Asked how the surveillance of a spot Bitcoin ETF would differ from the surveillance of any other commodity-backed ETF products, Chung pointed out that spot commodities are typically not traded on “organized marketplaces.”

“Spot oil, spot gold is negotiated over the telephone, via email, via chat, etcetera, not on an organized marketplace,” he said.

As a result of this, commodity-backed ETFs traditionally have information-sharing agreements with derivatives exchanges instead of with spot marketplaces, “because that’s the organized marketplace where transactions happen,” he said.

But despite this traditionally being the way things have worked, Chung noted that crypto is different because the spot crypto is traded on organized marketplaces.

“We haven’t quite been here before, there’s no exact parallel,” the CEO explained.

Watch the full interview with Sui Chung on Bloomberg TV below:

Credit: Source link