PEPE recently reached a new peak, driven by the significant hype surrounding Bitcoin Exchange-Traded Funds (ETFs). However, as the initial excitement surrounding ETFs subsided, Bitcoin (BTC) experienced a period of fluctuation.

Notably, during this time, PEPE has been gradually making lower highs. Amidst these fluctuations, it becomes essential to examine the underlying factors that have contributed to the declining trend in PEPE’s price perfomance.

Are there external market forces at play, or is it indicative of a broader shift in the cryptocurrency landscape? Additionally, how will this development impact the future trajectory of PEPE and other cryptocurrencies?

PEPE Price Performance: From Highs To Fluctuations

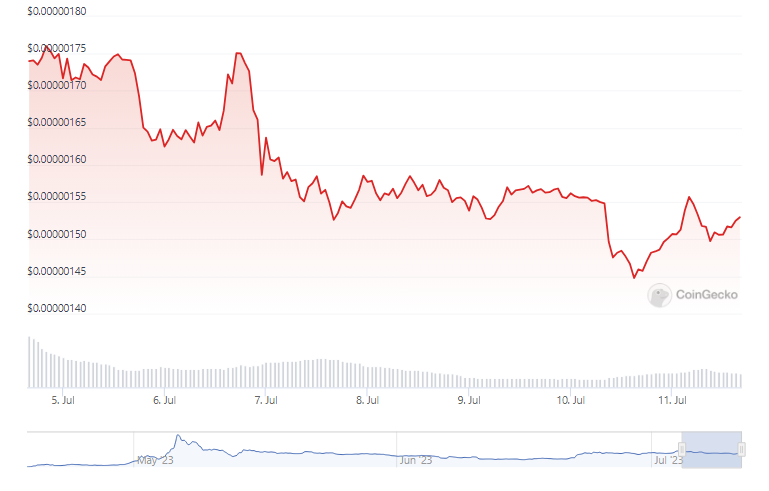

PEPE recently reached a new high of $0.00000190. However, its current price on CoinGecko stands at $0.00000152, reflecting a modest 4.3% rally in the past 24 hours. Nevertheless, over the course of the last seven days, PEPE has experienced a significant decline of 13%.

Technical indicators further emphasize the shift in PEPE’s price trajectory. A PEPE price report highlights that various indicators have flashed sell signals. Notably, the Relative Strength Index (RSI) has made lower highs, indicating a decline in buying pressure over the past few days.

Moreover, the On Balance Volume has eased, suggesting a decrease in demand, while the Average Directional Index (ADX) has dropped below 20, indicating a lack of a strong trend for PEPE.

These technical signals hint at the challenges PEPE has faced in the face of its recent fluctuations.

Altcoins’ Massive Pullbacks Amidst Bitcoin’s Extended Consolidation

Meanwhile, Bitcoin (BTC) has entered a phase of extended consolidation, with its price fluctuating above the $30,000 mark for nearly two weeks. This prolonged period of stability, coupled with intermittent fluctuations, has had a cascading effect on the broader cryptocurrency market, leading to significant pullbacks in most altcoins, including PEPE.

BTC’s status as the leading cryptocurrency makes its price movements a crucial factor influencing the market sentiment and performance of other digital assets. When Bitcoin experiences extended consolidation, investors and traders often exercise caution and become more hesitant to make significant moves.

As a result, altcoins, which rely on BTC’s stability and positive market sentiment, tend to be more susceptible to pullbacks and corrections.

The pullbacks in altcoins have been notable, with many experiencing substantial declines in value during this period of Bitcoin’s consolidation. The high correlation between Bitcoin and altcoins like PEPE exacerbates the impact of the crypto’s fluctuations on their prices.

As the alpha coin’s consolidation continues, closely monitoring its price movements and assessing the subsequent impact on altcoins and meme coins like PEPE becomes paramount for market watchers.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from PBS

Credit: Source link