As the weekend approaches, cryptocurrency enthusiasts are keeping a close eye on Bitcoin (BTC) and Ethereum (ETH), wondering if these leading digital assets will manage to break free from their recent tight trading ranges.

Both BTC and ETH have experienced limited volatility, leaving investors and traders eager to see if these cryptocurrencies can shake off the shackles and embark on a decisive price move.

In this update, we’ll delve into the latest price predictions for Bitcoin and Ethereum, exploring the factors that could potentially trigger a breakout in either direction.

Cryptocurrency Fundamental’s Outlook

Bitcoin, the world’s biggest cryptocurrency, has been trading on the bullish track and has seen significant growth this year, rising more than 70% since the start of 2022. BTC is currently trading above $28,250 levels after reaching a nine-month high of $29,000 levels.

Meanwhile, Ethereum, the second most popular cryptocurrency, has also seen significant gains, climbing above the $1,800 mark. The global cryptocurrency market capitalization is $1.18 trillion, with a 24-hour gain of 2.43%.

However, the reason for its upward trend could be attributed to a variety of factors, including the upcoming Bitcoin halving event in 2024, which will benefit Bitcoin prices by reducing supply and creating long-term positive factors.

Furthermore, the upticks in Bitcoin prices were also linked to large investors, known as “Bitcoin Whales,” who have been accumulating BTC and have wallets containing 1,000-10,000 BTC, suggesting a potential price rebound for Bitcoin.

It is worth noting that Bitcoin has outperformed several cryptocurrencies with its unexpected rises and provided fantastic returns to those who bought it at a discount. According to experts ‘ predictions, Bitcoin may surpass its all-time high of $69,000 and approach $100,000.

Bloomberg Strategist Predicts Strong Bitcoin Performance in 2024 Due to Halving and Fundamental Developments

According to Bloomberg Intelligence senior macro analyst Mike McGlone, Bitcoin will perform well in 2024. This is due to several factors, including the upcoming four-year halving event, which has typically been seen as a positive event for Bitcoin markets.

McGlone also notices that Bitcoin is showing indications of becoming a global digital reserve commodity and possibly a store of value, particularly during periods of high stock market volatility.

McGlone believes that Bitcoin will continue to climb and may ultimately reach $100,000. Bitcoin’s rise may continue in the future years, with large investors accumulating BTC and popular companies and groups increasingly adopting cryptocurrency.

Short-term Traders & Whales Fuel BTC Price Rally

On the flip side, Bitcoin’s upward rally can also be linked to the activities of short-term traders and whales. Short-term holders took advantage of the opportunity to cash out their investments, and some holders exited their positions at their true value.

However, the short-term holder SOPR for bitcoin holders had crossed the value of one, indicating a potential new support level. Whales spent their bitcoin holdings, with spending activity increasing since March.

There has been an increase in the number of bitcoin addresses with more than 10 BTC, indicating more large investors are accumulating bitcoin.

However, the accumulation is likely a hedge against inflation or a long-term investment strategy. These factors have contributed to the current BTC price rally, and a potential new support level may be emerging.

Upbeat Crypto Market – Eyes on Core PCE Price Index

The global cryptocurrency markets had seen significant gains on Friday, as evidenced by the sharp rise in Bitcoin prices. Meanwhile, the broad-based US currency has weakened due to labor market worries.

Moving forward, Investors are keeping their eyes on a reading of the Federal Reserve’s preferred inflation gauge, which is expected to be released later in the day.

During the first quarter of 2023, many cryptocurrencies traded higher due to fears of a possible financial crisis affecting the dollar’s value, leading to speculation that the Federal Reserve may decrease its hawkish attitude.

The dollar has dropped 1% over the past three months, and some experts think the Federal Reserve may be easing its pace in raising interest rates.

However, if inflation continues to decline, the Fed’s preferred inflation measure, personal consumption expenditures, is expected to impact the dollar’s value and boost demand for cryptocurrencies.

Bitcoin Price

The BTC/USD pair trades the most choppy, maintaining a narrow range of $28,000 to $29,000. It currently displays a neutral trend based on technical analysis. Nevertheless, it may encounter resistance upon reaching the $28,950 level.

In the event of a bearish trend, support levels around $27,500 and $26,500 are expected to offer significant reinforcement. Alternatively, If Bitcoin successfully breaches the resistance level at $28,950, its value could potentially soar to $29,250 or even $30,500.

Buy BTC Now

Ethereum Price

At present, Ethereum is trading within a tight range of $1,700 to $1,850, and it is facing difficulty in breaking past the resistance level of $1,850, as it consistently hovers near the $1,700 support zone.

If the ETH/USD pair manages to exceed the $1,800 level, it is anticipated to encounter resistance at the $1,900 mark.

Buy ETH Now

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself informed about the latest ICO projects and altcoins by frequently referring to the handpicked selection of the 15 most promising cryptocurrencies to monitor in 2023, which has been suggested by the specialists at Industry Talk and Cryptonews.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

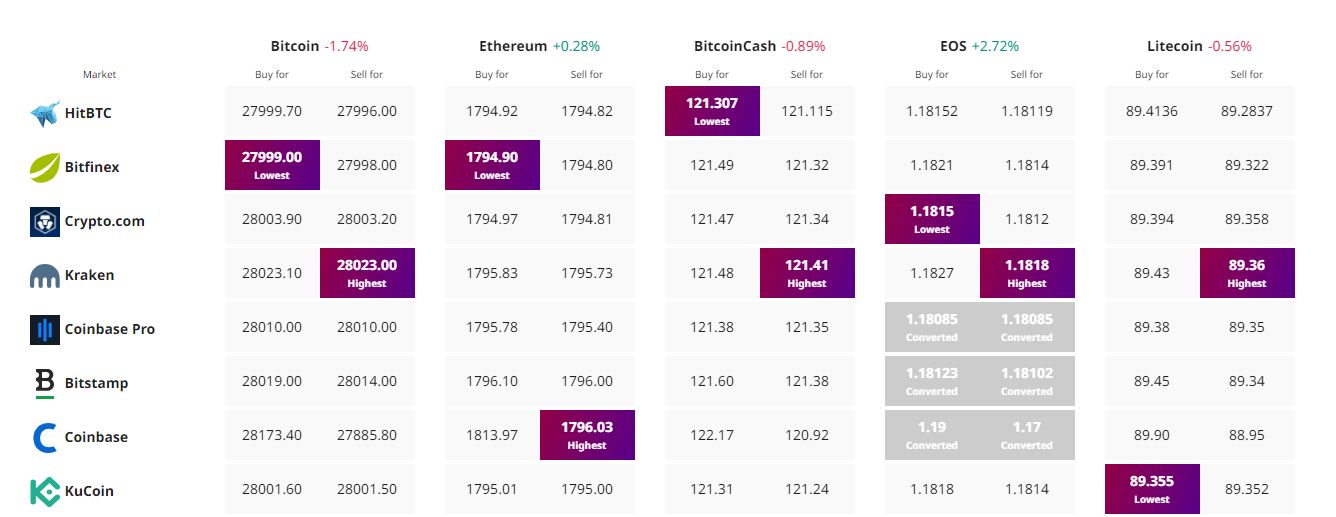

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link