Arbitrum, a token that was recently airdropped remains one of the best-performing cryptos in the industry, possibly next to Bitcoin (BTC) and Ethereum (ETH) which have been on an aggressive bullish push since the banking crisis started in the US.

ARB, the token powering the now popular Ethereum blockchain layer-2 scaling solution, Arbitrum is easily the day traders’ darling. CoinMarketCap reveals an 84% increase in the 24-hour trading volume to $1.6 Billion.

Arbitrum price is trading at $1.33, growing by 10% in the same 24-hour period. ARB has also been one of the most volatile cryptos in the market following its launch on March 23 when it rallied almost reaching $10.00 before dumping to $1.1. If interest in ARB continues, we could see another spike to $10.00.

What Is Arbitrum and Why Is It a Big Deal?

Arbitrum is a layer-2 scaling solution designed for the Ethereum blockchain. It seeks to improve the scalability of the second-largest cryptocurrency network in the world subsequently reducing gas fees.

The scaling protocol utilizes an optimistic roll-up system to process transactions off-chain, which are later committed to the primary blockchain—Ethereum. This method avoids the congested Ethereum network, reducing the load to allow users to send transactions much faster and at lower fees.

Smart Money Accumulating ARB

The ARB airdrop, as expected culminated in a sell-the-news narrative, with token holders cashing out in large numbers. However, the token’s fundamentals have not faltered amid an influx of funds from institutions and other large-volume buyers – smart money.

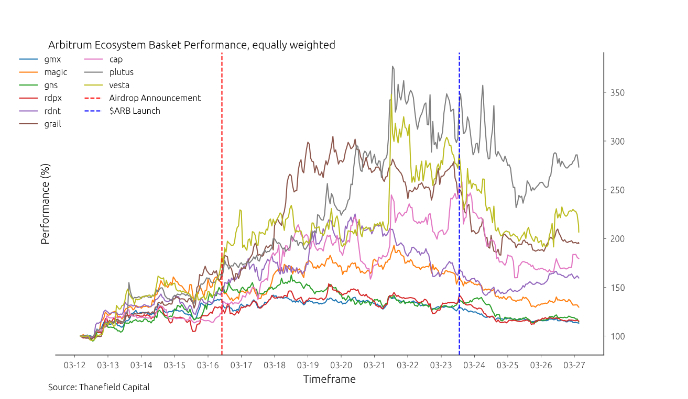

Following the announcement of the airdrop on March 16, tokens within the Arbitrum ecosystem exploded including Magic (MAGIC), GMX (GMX) Radiant Network (RDNT), and Gains Network (GNS).

Experts believe the pump experienced by these tokens was a result of a catalyst effect by the ARB airdrop.

An Ape’s Prologue explained further that “on the day the airdrop happened, which marked the launch of the $ARB token, the prices of ecosystem tokens began to decline,” suggesting a classic ‘sell-the-news’ event.

Can Arbitrum Price Reach $10?

Arbitrum is emerging as a protocol to be reckoned with for its role as a layer-2 solutions provider for the Ethereum blockchain. Other tokens within the Arbitrum ecosystem like GMX and RDNT are “two of the fastest-growing protocols in terms of fundamentals and price appreciation,” Dustin Teander, an analyst at Messari said.

In other words, ARB has launched into an ecosystem with strong fundamentals, which are likely to cool off the token’s downside in the coming weeks. Moreover, accumulation among investors, taking advantage of the dump after the airdrop could provide the necessary momentum for ARB to rally again.

The lack of enough price data makes it difficult to forecast ARB’s outlook in the short term and long term. However, from the one-hour timeframe chart, we can see a strong bullish contender that has already bounced from the new primary support at $1.1 to trade at $1.33 on Thursday.

There was an attempt to flip resistance at $1.40 earlier in the day but selling pressure overwhelmed the bulls. Now, relatively weak support has emerged at $1.30, strengthened by the descending upper trendline and highlighted by the upper yellow band.

If ARB overshoots this support, the 50-day EMA would come in handy, in addition to another substantial buyer congestion at $1.20. If push comes to shove ARB would retest the primary support at $1.1 before making an ultimate recovery attempt to $10.

Arbitrum Alternatives to Buy Today

Investors may want to explore some of the high-potential crypto presales in the market for 2023 as ARB tries to find support before another rally occurs.

In the list below, we’ve reviewed the top 15 cryptocurrencies for 2023, as analyzed by the Cryptonews Industry Talk team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Related Articles:

Credit: Source link

![Top NFTs for Sale with High Potential in This Bull Run [2025 List]](https://cryptocentralized.com/wp-content/uploads/2024/11/unnamed-2024-11-25T113320.523-360x180.jpg)

![Top NFTs for Sale with High Potential in This Bull Run [2025 List]](https://cryptocentralized.com/wp-content/uploads/2024/11/unnamed-2024-11-25T113320.523-350x250.jpg)