The recent surge in Bitcoin and Ethereum prices has caught the attention of many investors and traders, with both cryptocurrencies experiencing significant gains in value over the past few months.

However, the upcoming interest rate decision by the US Federal Reserve (FOMC) has sparked uncertainty and speculation about how it will impact the crypto market.

Bitcoin (BTC), the world’s largest cryptocurrency, managed to regain its traction on Wednesday morning, reaching fresh 9-month highs above $28K as traders patiently awaited the outcome of the US Federal Open Market Committee (FOMC) meeting, which might result in a 25 basis point interest rate hike.

Meanwhile, the second largest cryptocurrency, Ethereum, has seen substantial increases, rising 3.50% in the previous 24 hours.

Several famous cryptocurrencies, including Dogecoin (DOGE) and Litecoin (LTC), also managed to land in the greens. At the time of writing, the global crypto market value was $1.18 trillion, representing a 2.20 percent 24-hour rise.

Bitcoin Rebounds Up to 40% Amid Collapse of Global Financial Institutions

Bitcoin has surged by more than 40%, mainly due to the collapse of major banks. This has caused investors to lose faith in the financial system and turn to Bitcoin as a more reliable alternative.

Bitcoin has reached a new high of $28,000, the highest level since June 2022. As a result, people have started to view Bitcoin as more trustworthy than banks.

As a result, Bitcoin’s popularity is surging as more people buy it while it is still relatively inexpensive, and institutions strive to keep up with the growing demand.

It is worth emphasizing that Bitcoin is a decentralized digital currency that is not controlled by central banks or financial institutions, which has earned it a reputation as a safe-haven asset during economic downturns.

The rapid uptick in Bitcoin’s value due to several significant bank failures underscores the growing importance of decentralized digital currencies in today’s financial landscape.

As more organizations and individuals seek out Bitcoin as a viable alternative to established financial systems, its popularity is expected to continue to grow in the coming months.

Fear and Greed Index Indicates Bitcoin Investors Remain Confident

It is worth mentioning that the fear and greed index is a means for investors to gauge their feelings about Bitcoin and the cryptocurrency sector. However, the values vary from 1 to 100, with 1 indicating that investors are highly fearful and 100 indicating that they are quite confident.

According to recent analyses, Bitcoin’s fear and greed score is currently at 68, the highest it has been this year. This shows that investors are quite optimistic about Bitcoin’s future and expect its value to climb further.

FOMC Meeting and Federal Reserve Interest Rates Could Impact Bitcoin Price

Traders are closely monitoring the upcoming Federal Open Market Committee (FOMC) meeting, which is scheduled for later in the day. The decision on US interest rates by the Federal Reserve could have an impact on the price of bitcoin, and therefore, market participants are eagerly anticipating the outcome of the meeting.

It’s important to note that in 2022, the Federal Reserve raised interest rates multiple times in order to combat rising inflation. However, in December of that year, they reduced the rate hike to 0.50%, and then to 0.25% in February 2023.

Following this, Fed Chairman Jerome Powell suggested that due to the strong performance of the economy, interest rates may need to be raised beyond what was initially projected.

As a result, cryptocurrency prices dropped, with Bitcoin falling below $22,000.

The current global financial crisis may impact the Federal Reserve’s decision to raise interest rates as planned, and they might even consider cutting them. If interest rates are decreased, it could result in the value of Bitcoin increasing.

Bitcoin Price

The current price of Bitcoin is $28,300, with a 24-hour trading volume of $35.1 billion. Over the past 24 hours, Bitcoin has experienced a 1.50% increase in value.

As of Wednesday, the BTC/USD pair is consolidating near the $28,000 threshold after surpassing the resistance level of $27,750. If this bullish trend continues, Bitcoin’s value could potentially climb toward $29,250 or $30,700.

If Bitcoin breaks through the support levels of $26,700 or $25,200, the next level of support will be at $23,150.

However, despite the potential for downturns, the overall trend for Bitcoin remains bullish due to the formation of bullish engulfing candles. Let’s keep an eye on the US FOMC meeting to determine further trends in the market.

Buy BTC Now

Ethereum Price

The current price of Ethereum is $1,800, with a 24-hour trading volume of $10.7 billion. Ethereum has gained nearly 4% in the last few hours. Ethereum is currently struggling to break through the $1,800 resistance level and is holding steady near the $1,700 support zone.

If the ETH/USD pair manages to break through the $1,800 level, it is expected to face resistance at the $1,900 threshold.

The ETH/USD pair is expected to find support levels at either $1,700 or $1,620.

Buy ETH Now

Cryptocurrencies to Watch in 2023

Check out Cryptonews’ Industry Talk team’s curated list of the top 15 altcoins to watch in 2023. The list is regularly updated with new ICO projects and altcoins, so be sure to check back often for the latest updates.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

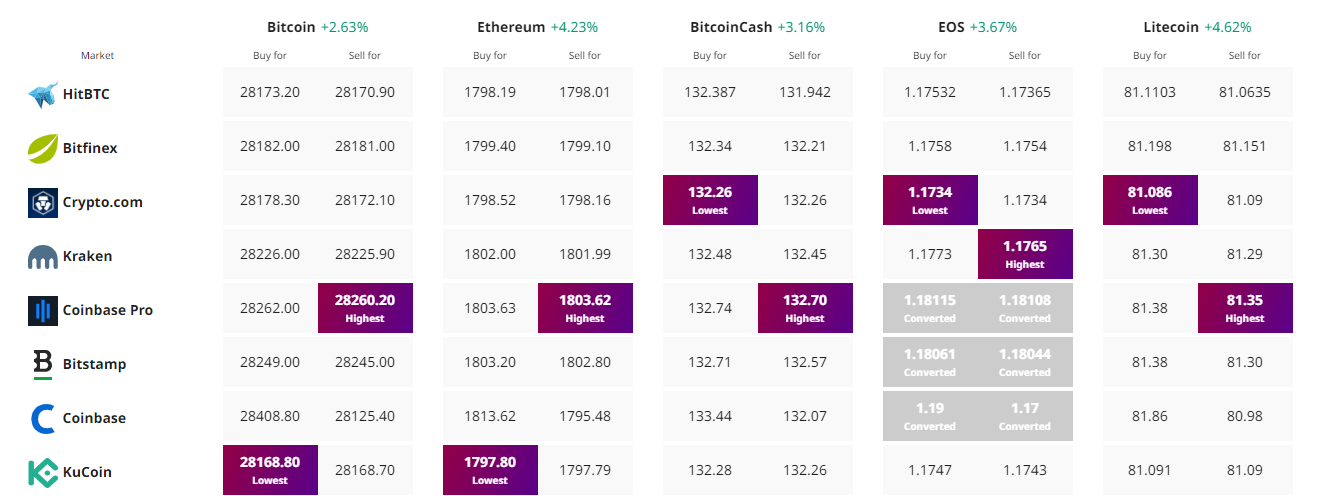

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link