The price of Bitcoin has surged by 7%, prompting speculation that a new bull market may be starting. This recent increase has caught the attention of investors, who are closely watching the cryptocurrency market for any signs of a sustained upward trend.

Many factors are contributing to the current Bitcoin price movement, including increased institutional adoption, regulatory clarity, and a growing global economy.

In this article, we will delve into the details of this recent price surge and examine whether it is a sign of a new bull market or simply a short-term fluctuation.

Global Banking Crisis Sparks Concern in Financial Markets

Global financial markets persist in experiencing turmoil as Credit Suisse disclosed substantial frailties in its financial standing. Moreover, the Saudi National Bank declared its unwillingness to provide additional capital to stabilize the beleaguered Swiss institution.

In an attempt to alleviate mounting concerns over Credit Suisse’s liquidity, the Swiss National Bank intervened late Wednesday, granting Credit Suisse access to borrow up to $54 billion.

Amidst the ongoing banking crisis, investors have commended the unwavering performance of the cryptocurrency market. This resilience, coupled with bitcoin’s minimal correlation to stocks in recent months, has altered perceptions of bitcoin as a viable alternative asset.

As the week saw a considerable surge in cryptocurrency values, the BTC/USD price escalated in response to investors assessing vulnerabilities in the US and European financial structures.

Uncertainty Over Fed Rate Hikes Sparks Volatility in Bitcoin Market

Investors harbor apprehensions that the Federal Reserve may reduce the 50 basis point rate hike to strengthen its defenses against unrelenting inflation within the United States.

US data unveiled on Wednesday exhibited a decline in producer inflation and a slump in retail sales figures, which heightened anticipation that the Federal Reserve might implement a modest increase in interest rates during its meeting.

Furthermore, emerging concerns of a global financial meltdown have contributed to the discourse of waning inflation, thus reducing the probability of the Fed elevating interest rates by 50 basis points.

Reuters also disclosed that, during its meeting on March 22, the FOMC may opt for a mere 25 basis point rise in the federal funds rate.

In early March, US consumer sentiment experienced a downturn as the University of Michigan’s (UoM) Consumer Confidence Index fell to 63.4 from 67 in February. This outcome was more unfavorable than the anticipated market prediction of 67.

As a result, the Dollar Index dipped to 104.06 and might persist in its descent due to the growing uncertainty surrounding the Fed’s interest rate verdict. This weakening of the US dollar proved advantageous for the BTC/USD pairing.

Bitcoin Price

The current live price of Bitcoin stands at $26,604, accompanied by a 24-hour trading volume of $42.8 billion. Over the past 24 hours, Bitcoin has experienced a 7% increase in value. Presently, Bitcoin holds the #1 position on CoinMarketCap, boasting a live market capitalization of $513 billion.

Bitcoin could face an immediate hurdle at the $26,650 level, limiting its upward momentum. Breaking this resistance level may trigger more buying opportunities, potentially pushing the price up to $27,700.

On the downside, Bitcoin’s immediate support is at $25,100, and breaking this level could lead to more selling pressure, pushing the price down to $24,750. Traders may consider opening a buying trade if BTC manages to hold above $25,150.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

Discover the top 15 cryptocurrencies to keep an eye on in 2023 with Industry Talk’s curated list, compiled by the experts at Cryptonews. Whether you’re a seasoned crypto investor or new to the market, this list offers insights into promising altcoins that could make waves in the industry.

Be sure to check back regularly for updates on new ICO projects and altcoins.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

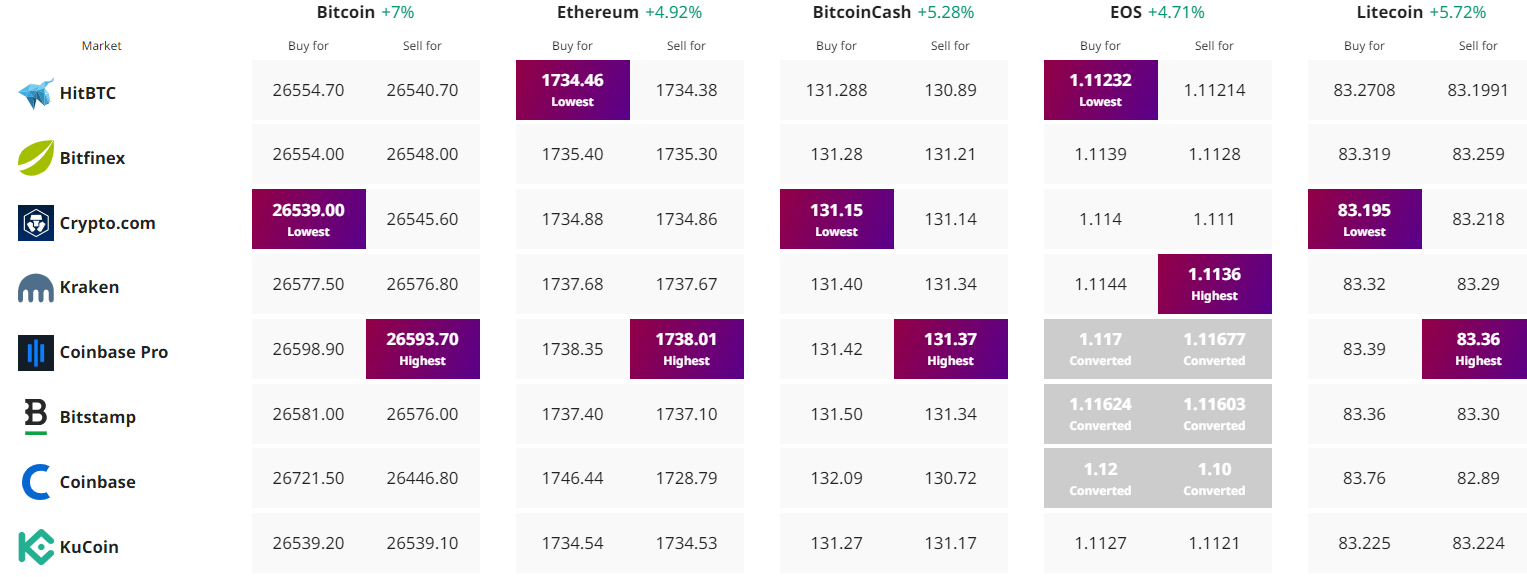

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link