On Sunday, Bitcoin and Ethereum both saw a modest rise in value, with BTC surpassing $20,000 and ETH reaching the $1,400 mark. However, the decline of the US dollar, which resulted from February’s labor statistics showing slower wage growth, may be responsible for this ongoing modest increase in crypto value.

Additionally, the adoption of Ordinal, a Layer 2 solution, is expanding the use cases of the Bitcoin network beyond just BTC transactions. While there have been differing opinions on using Ordinal in the Bitcoin community, its rising popularity and potential impact on the Bitcoin network could change the game for BTC miners.

Ordinal’s ability to enable fast and inexpensive transactions could lead to increased adoption of Bitcoin and potentially reduce the load on the network. This could ultimately result in greater efficiency and profitability for BTC miners. This has been identified as one of the key factors that could help BTC regain its strength and increase in price.

Weaker US Dollar Boosts Crypto Market

The global cryptocurrency market has seen significant losses over the past week, with both Bitcoin and Ethereum losing almost 11% of their value. However, the price decline began to slow down as the US dollar weakened, and Bitcoin started to recover some of its losses.

Interestingly, the weaker US dollar has been a critical driver behind the recent surge in the cryptocurrency market. Nevertheless, the labor data released for February indicated slower wage growth, suggesting a decrease in inflationary pressures. This could prompt the Federal Reserve to keep its interest rate hikes modest, thus reducing the appeal of the US dollar.

While the US economy gained jobs rapidly in February, the slower wage growth and increased unemployment rates have dampened expectations for a 50-basis-point rate hike when Federal Reserve officials meet in two weeks.

However, given the ongoing regulatory concerns and recent market volatility, it remains uncertain how the cryptocurrency market and the US dollar will perform in the coming weeks.

Silicon Valley Bank’s Liquidity Crisis Sparks Fears of Contagion in Financial Markets

Silicon Valley Bank (SVB), a major financial institution that caters to venture capital firms, has been hit hard by a liquidity crisis. The bank’s troubles have raised fears of contagion in financial markets and sparked concerns over the potential impact on the broader economy.

It is worth noting that the bank, headquartered in Santa Clara, California, provides a range of financial services to venture capital firms and their portfolio companies. SVB is known for its expertise in the technology sector and has played a vital role in the growth of the venture capital industry in Silicon Valley.

However, recent reports have highlighted the bank’s financial struggles, with insiders reporting a “serious liquidity problem” at the institution. The reports suggest that the bank has been struggling to maintain its funding levels, leading to concerns that it may be unable to meet its obligations.

It should be noted that the news of SVB’s liquidity crisis has sent shockwaves through the cryptocurrency market, with prices of major digital assets falling. The crypto market, which has been on a bull run for the past month, has been hit hard by the news, with Bitcoin and Ethereum losing significant value.

The focus will be on how SVB and other financial institutions respond to the crisis and whether the fallout can be contained. However, the crypto market, like other financial markets, will be closely watching developments in the coming weeks as investors look for signs of stability and a return to normalcy.

SEC Rejects VanEck’s Proposal for Bitcoin Trust: Impact on BTC

It’s worth noting that the Securities and Exchange Commission (SEC) has once again rejected VanEck’s proposal to create a spot Bitcoin trust that would allow investors to trade Bitcoin on regulated exchanges. This decision marks nearly 20 similar rejections over the past six years, as the SEC has hesitated to approve any such applications.

SEC rejected VanEck's proposal to list a #Bitcoin ETF for the third time. pic.twitter.com/cnCLVt3TnS

— CryptoCurrency News (@CryptoBoomNews) March 11, 2023

The SEC cited concerns over market manipulation, liquidity, and valuation in denying VanEck’s proposal. However, the commission also noted that there is still a lack of transparency and regulation in the cryptocurrency market, making it difficult to ensure that investors’ interests are protected.

The rejection of VanEck’s proposal is likely to have a negative impact on Bitcoin’s price in the short term, as it reduces the options for investors to invest in the cryptocurrency through regulated channels. It also highlights the regulatory challenges that cryptocurrencies continue to face in the US.

Bitcoin Price

Today, the live Bitcoin price is $21,515, with a 24-hour trading volume of $22.8 billion. Over the past 24 hours, Bitcoin has gained 5.00%. It currently holds the top spot on CoinMarketCap, with a live market cap of $415 billion.

Bitcoin has bounced off the support level of $19,850. If it had broken below this level, it could have triggered selling pressure and led to a further decline towards the $16,400 level.

On the other hand, the first hurdle for Bitcoin is at the $21,700 resistance level. If Bitcoin breaks above this level, it could trigger buying pressure and potentially push its price towards the $23,175 level.

If the bullish momentum continues, there is a chance that Bitcoin could even reach the $25,150 mark.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

Take a look at Industry Talk’s carefully selected roster of the top 15 altcoins to keep an eye on in 2023, curated by Cryptonews. The list is regularly updated with fresh ICO projects and altcoins, so be sure to check back frequently for the latest developments.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

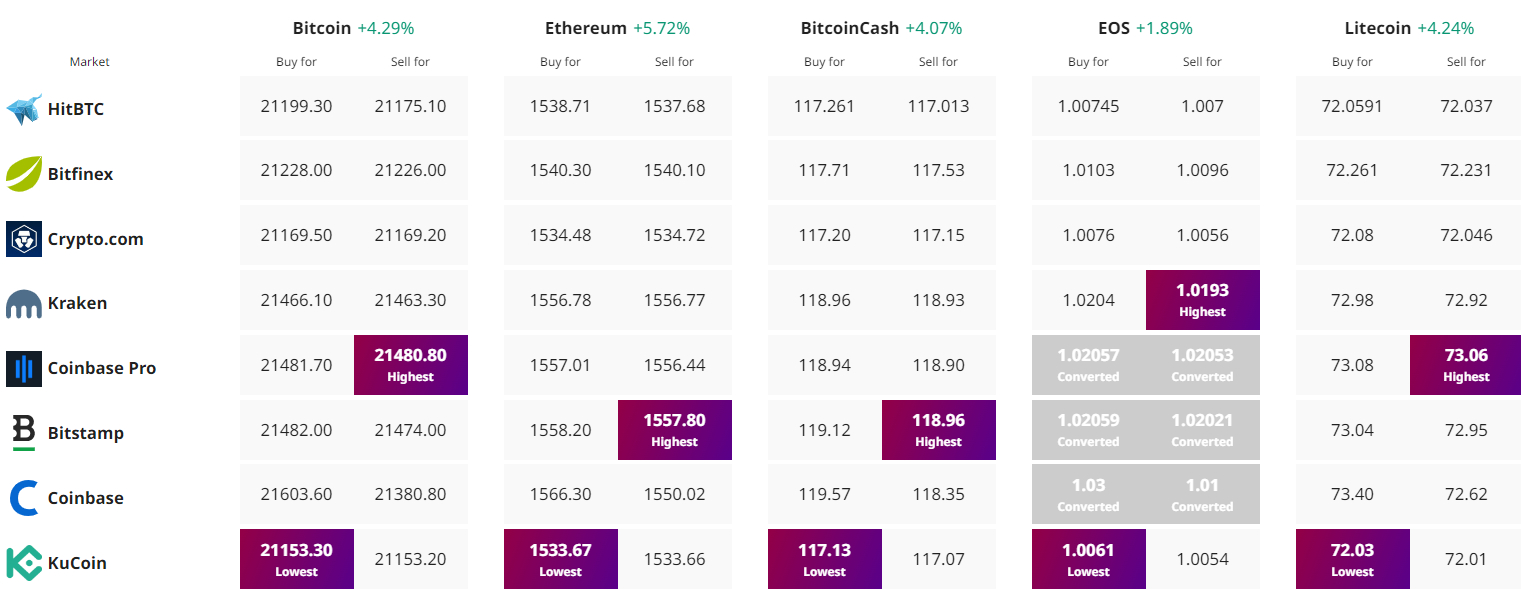

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link