Bitcoin bulls are licking their lips as they look at various widely followed metrics of on-chain activity. The world’s first cryptocurrency and largest by market capitalization is already up over 40% this year, but that rally could extend in the months ahead if positive on-chain trends continue, assuming macro headwinds as the US Federal Reserve continues to tighten monetary policy don’t get too severe.

On-chain Metrics Trending in a Bullish Direction – A Look Under the Hood

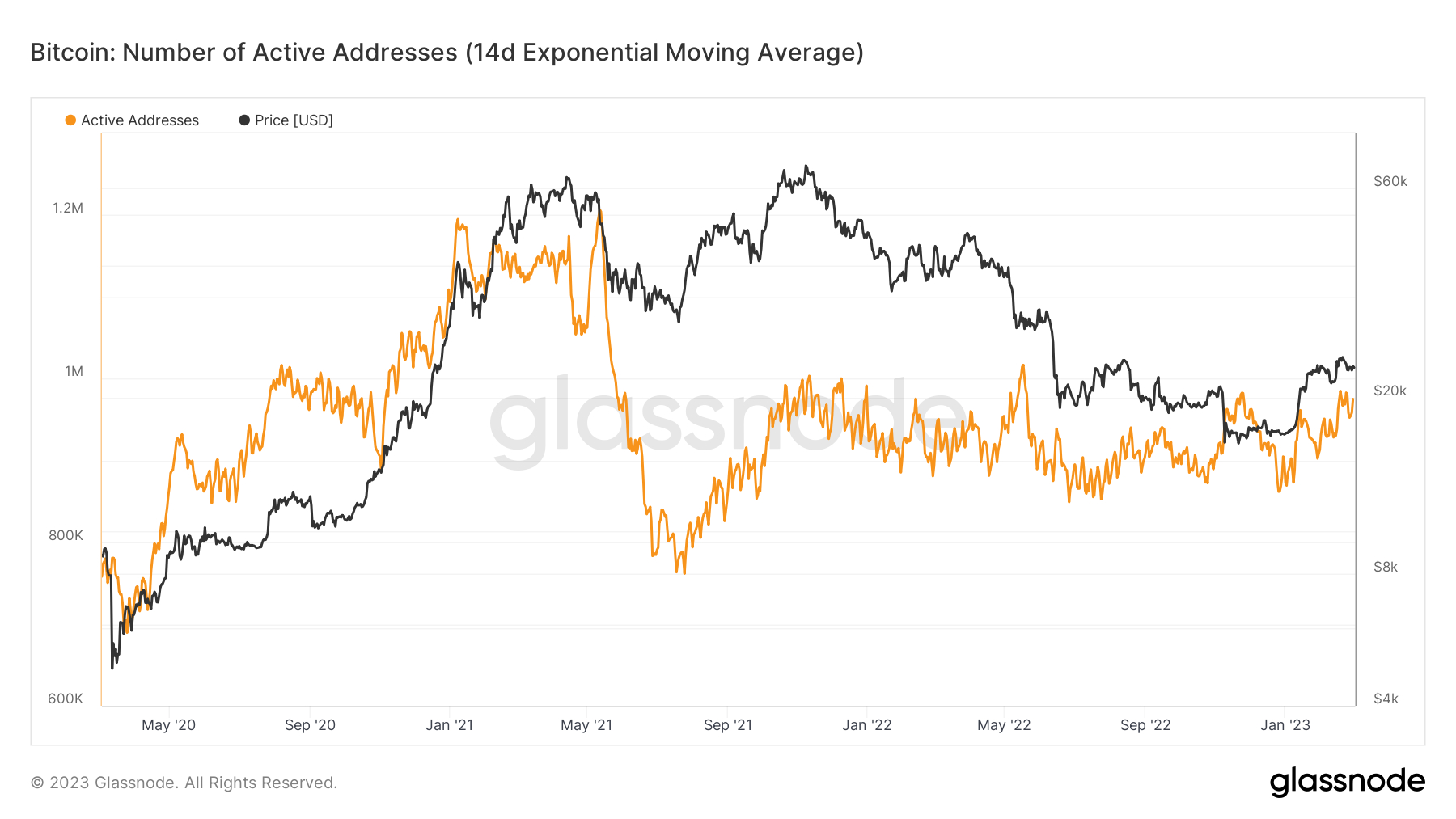

According to data presented by crypto analytics firm Glassnode, the 14-day Exponential Moving Average (EMA) of the number of active addresses interacting with the Bitcoin network was at around 975,000 on Wednesday, having trended higher consistently since ending last year well under 900,000. If this metric can continue to rise and push above 982,000, active addresses would be at their highest since last May. The number of active addresses on the network can be seen as a rough proxy for BTC demand.

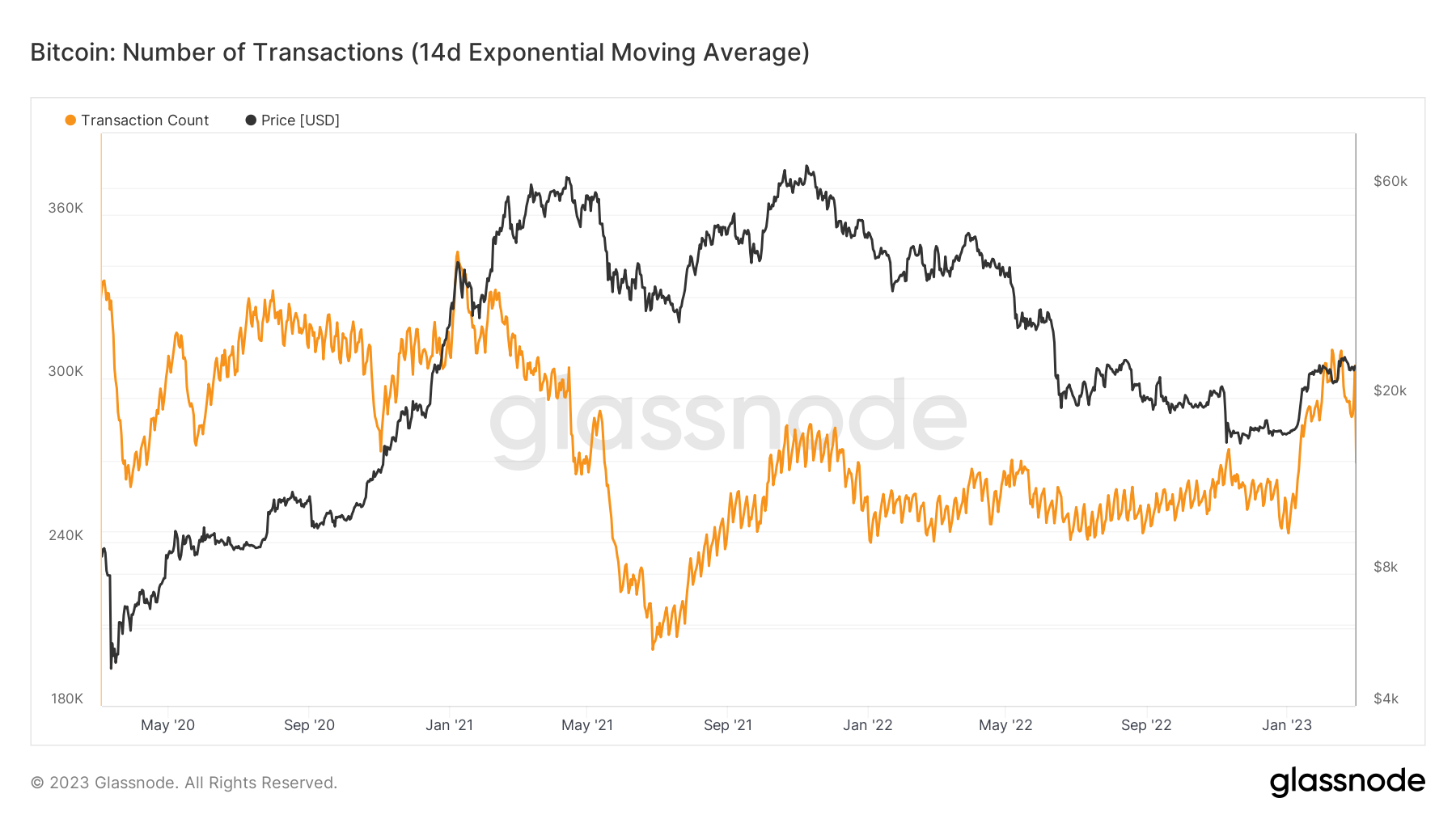

Elsewhere, the 14-day EMA of the number of transactions taking place on the network recently came close to its highest levels since early 2021 when it nearly hit 305,000 on Wednesday. That’s an approximate 50,000 rise since the end of 2022. Rising transaction numbers can also be used a rough proxy for a rise in BTC demand.

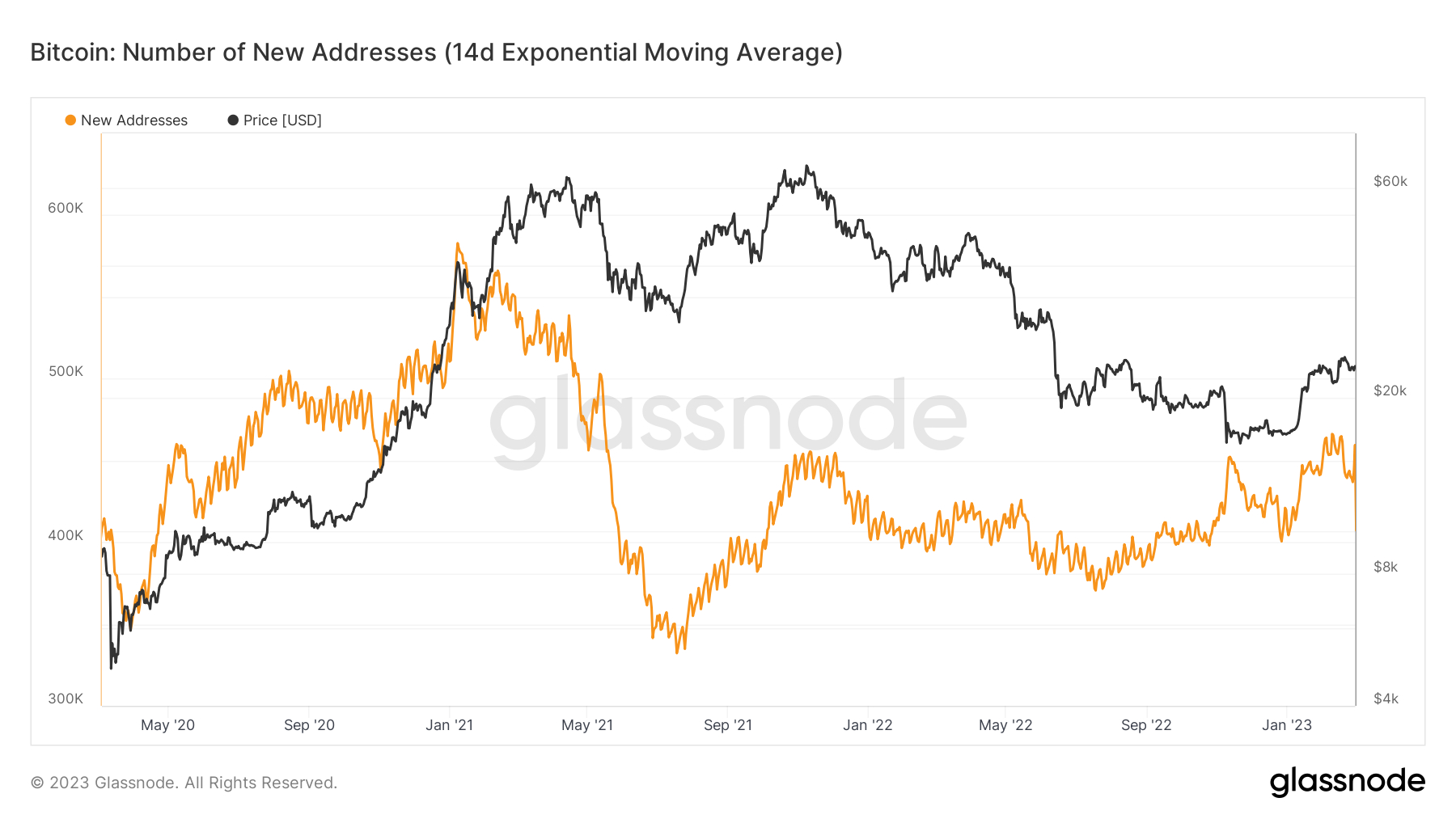

Likewise, the 14-day EMA of new Bitcoin addresses being created recently rose close to its highest since mid-2021, clocking in at 459,000. That’s up around 40,000 since the end of December. An acceleration in the number of new addresses interacting with the Bitcoin network suggests an acceleration in Bitcoin’s “adoption”, another proxy for demand.

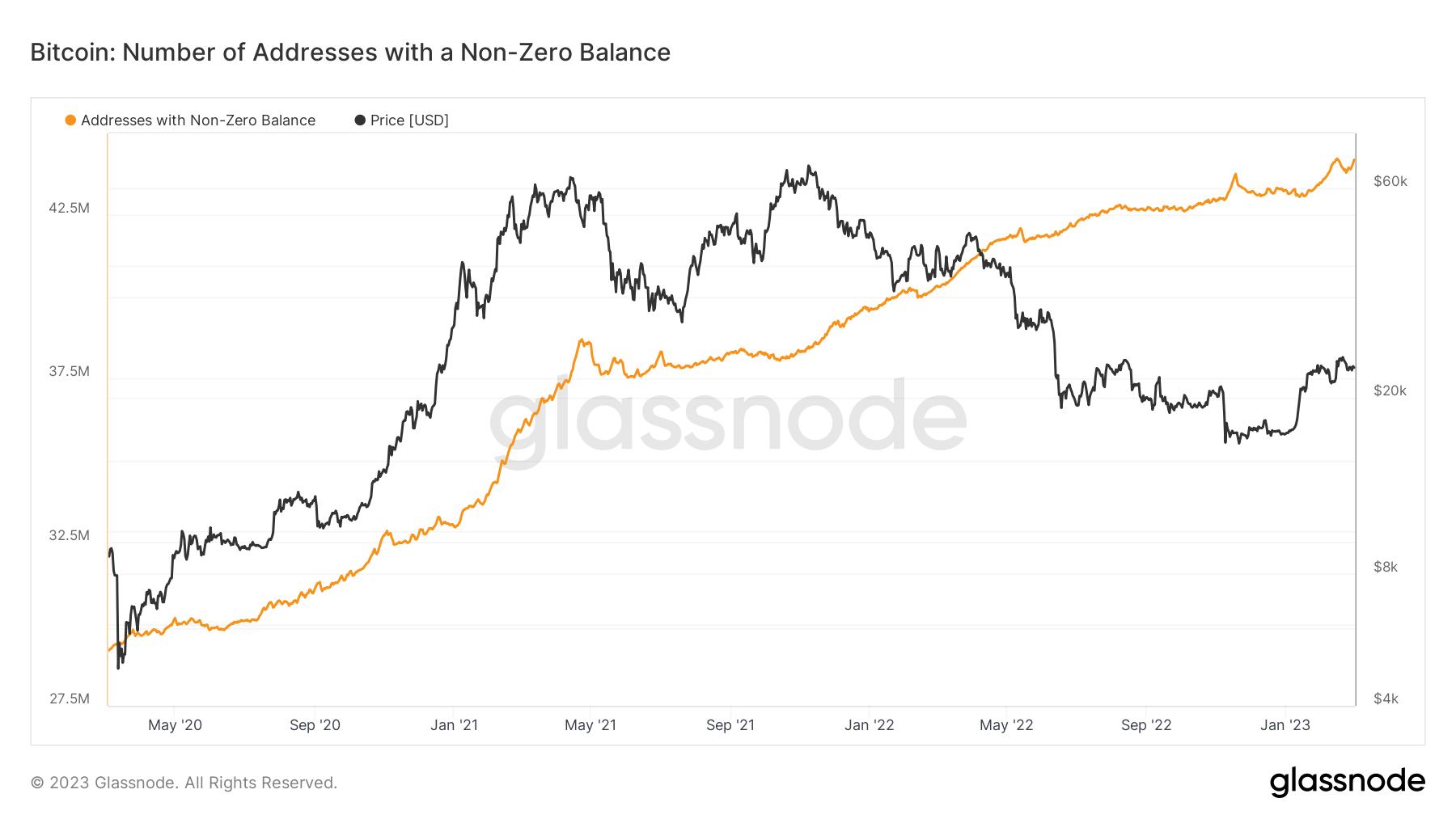

The rise in the rate at which new addresses are being created can also be seen in the recent uptick in the number of Bitcoin addresses holding a non-zero balance, which was last at 44.193 million on Thursday, close to the all-time high it set last month above 44.2 million. While addresses holding a non-zero balance have historically risen in both bull and bear markets, meaning its short-term correlation to price is pretty much non-existent, most still interpret rising non-zero balance address numbers as a positive sign in the long-term, given it implies continued Bitcoin “adoption”.

The Laundry List of Bullish Technical and On-chain Signals is Growing

Positive trends in the above-noted technical metrics come as a host of alternative on-chain and technical metrics all scream that 2022’s bear market is probably now over. As discussed in a recent article, the majority of on-chain and technical indicators tracked by Glassnode in their “Recovering from a Bitcoin Bear” dashboard are all flashing green.

The dashboard tracks eight indicators to ascertain whether Bitcoin is trading above key pricing models, whether or not network utilization momentum is increasing, whether market profitability is returning and whether the balance of USD-denominated Bitcoin wealth favors the long-term HODLers.

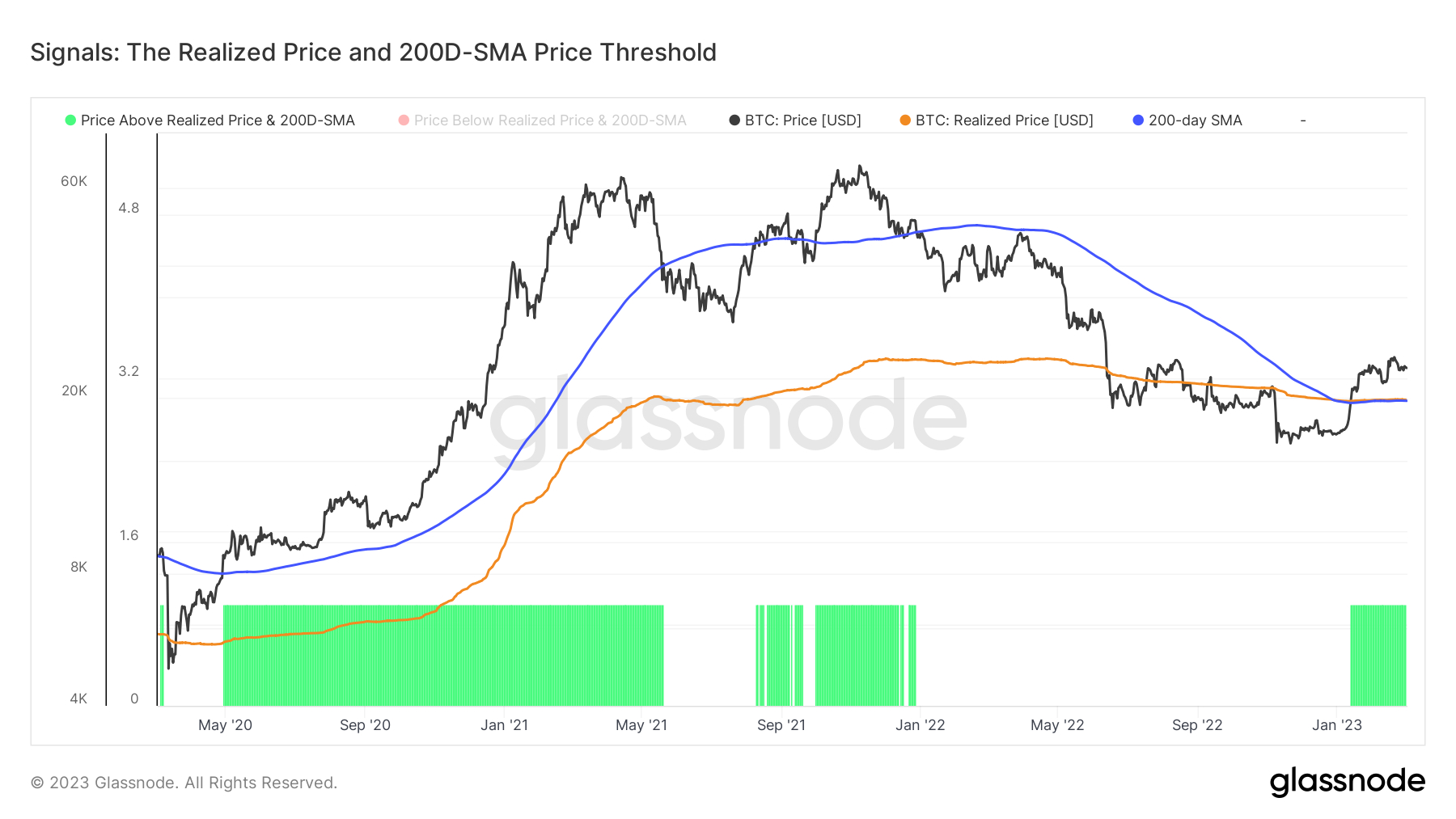

Regarding where Bitcoin is trading versus key pricing models, BTC this year surged above its 200-Day Moving Average and Realized Price, both of which sit just under $20,000, a dual bullish sign on the technical front. Another recent technical buy signal that got the bulls excited was Bitcoin experiencing only its seventh “gold cross” in the last 10 years.

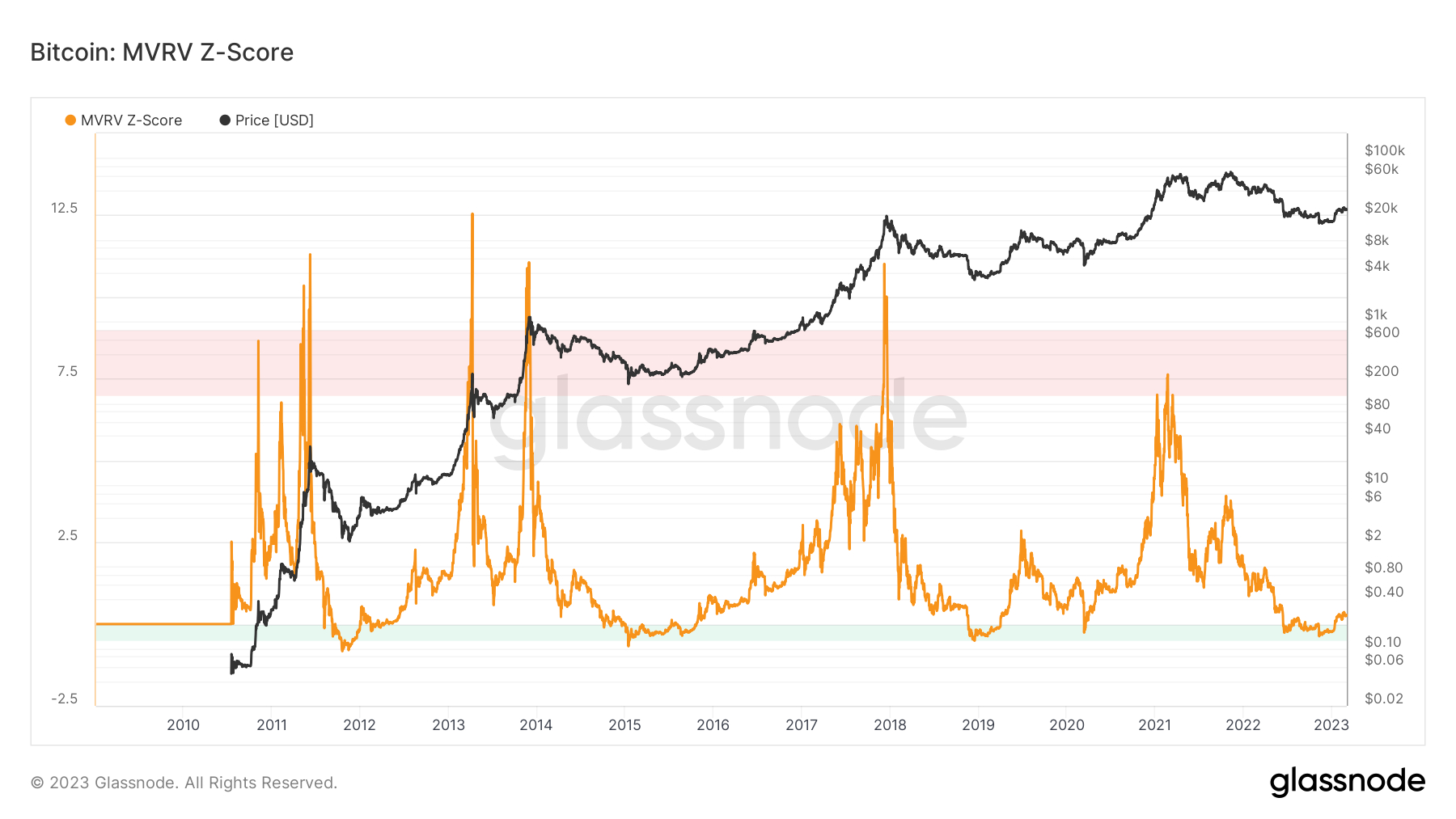

Other on-chain indicators tracked by Glassnode like Bitcoin’s Reserve Risk, as discussed in this recent article, and the MVRV-Z score, which “compares market value and realized value to assess when an asset is overvalued or undervalued”, are also screaming bull signals. The latter recently mustered a sustained recovery back above zero after a prolonged period below, which has historically occurred at the start of bull markets.

Elsewhere, another market profitability indicator tracked by CryptoQuant, another crypto analytics firm, is giving off a definitive buy signal for the first time since 2019.

Market Cycle Analysis Also Signal Incoming Bull Market

Bulls are also taking solace from analysis of the market cycles that the world’s largest cryptocurrency by market capitalization has historically followed. In early January, crypto-focused Twitter account @CryptoHornHairs identified that Bitcoin is following nearly exactly in the path of a roughly four-year market cycle that has been respected perfectly now for over eight years.

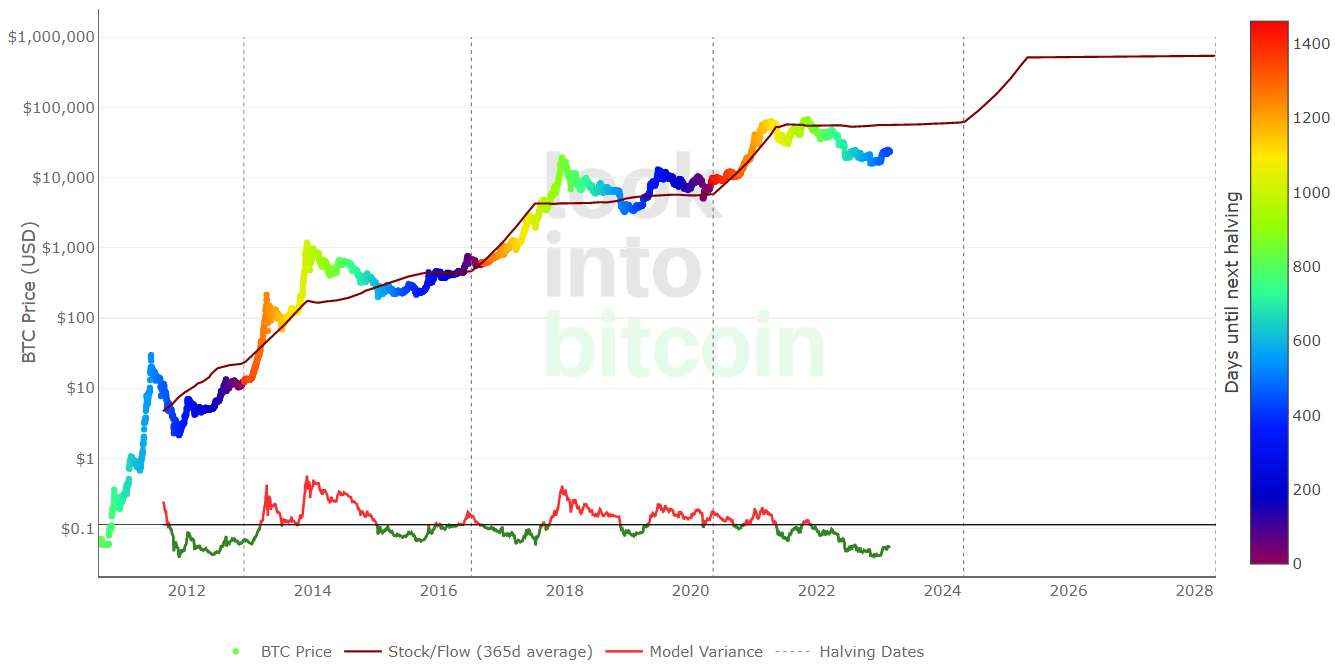

Elsewhere, a widely followed Bitcoin pricing model is sending a similar story. According to the Bitcoin Stock-to-Flow pricing model, the Bitcoin market cycle is roughly four years, which shows an estimated price level based on the number of BTC available in the market relative to the amount being mined each year, Bitcoin’s fair price right now is around $55K and could rise above $500K in the next post-halving market cycle. That’s around 20x gains from current levels.

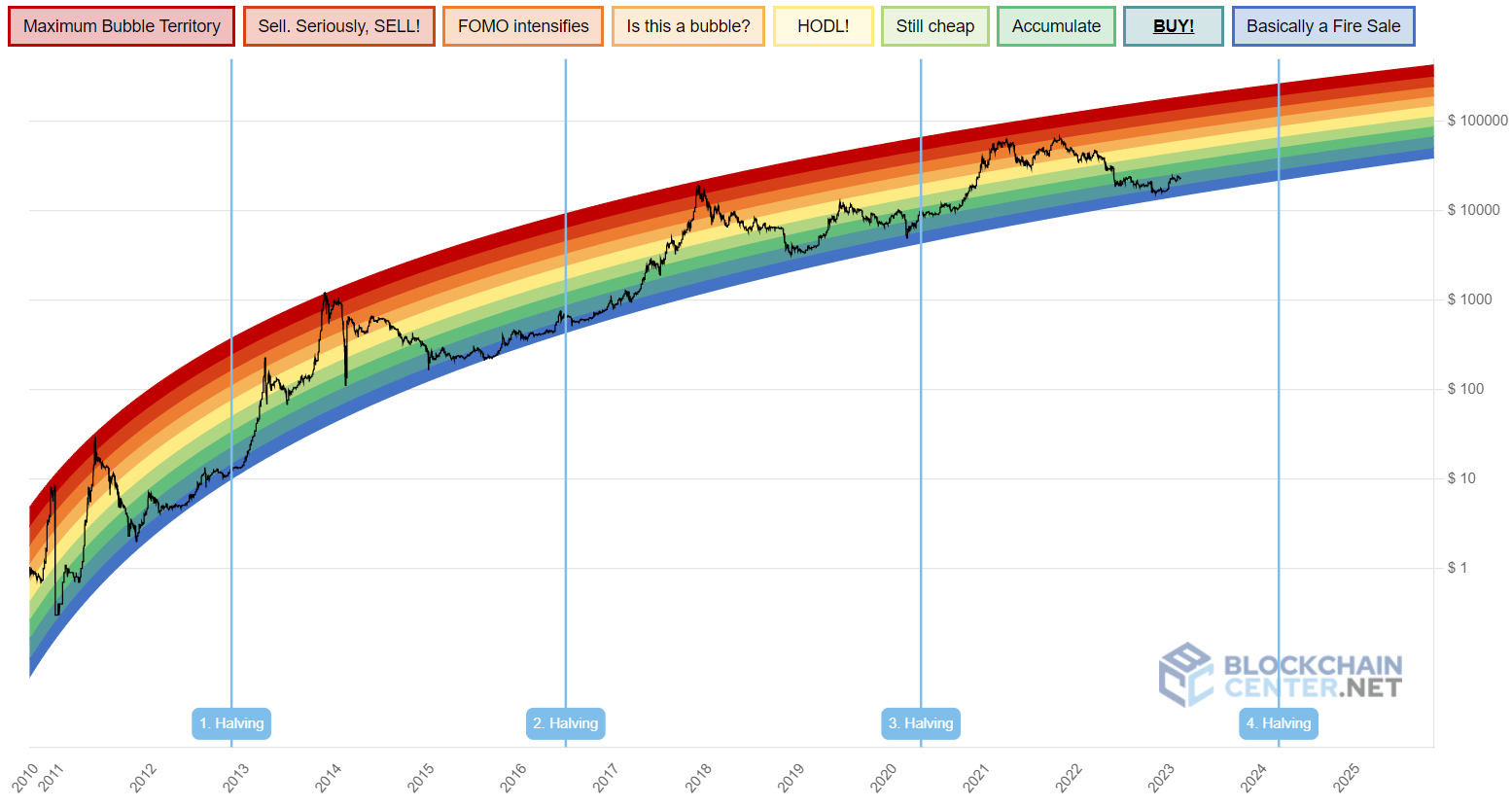

Finally, Blockchaincenter.net’s popular Bitcoin Rainbow Chart shows that, at current levels, Bitcoin is in the “BUY!” zone, having recently recovered from the “Basically a Fire Sale” zone in late 2022. In other words, the model suggests that Bitcoin is gradually recovering from being highly oversold. During its last bull run, Bitcoin was able to reach the “Sell. Seriously, SELL!” zone. If it can repeat this feat in the next post-halving market cycle within one to one and a half years after the next halving, the model suggests a possible Bitcoin price in the $200-$300K region. That’s around 8-13x gains from current levels.

Credit: Source link