Bitcoin’s price has seen a significant increase of 14% over the past seven days, leading many to wonder where the cryptocurrency is headed in the near future. In this update, we’ll explore some of the prevailing Bitcoin price predictions and analyze the factors influencing the cryptocurrency’s recent price movements.

Bitcoin’s Network Difficulty Predicted to Experience the Biggest Increase of the Year

Bitcoin’s hashrate stayed above 200 exahash-per-second (EH/s) throughout 2022. Nonetheless, it appears that 300 EH/s will be the new normal by 2023. According to recent statistics, Bitcoin’s hashrate has averaged roughly 310.5 EH/s over the last 2,016 blocks, with block timings ranging from 8 minutes and 55 seconds to 8 minutes and 68 seconds.

These indicators point to a considerable rise in difficulty, which is expected on February 24.

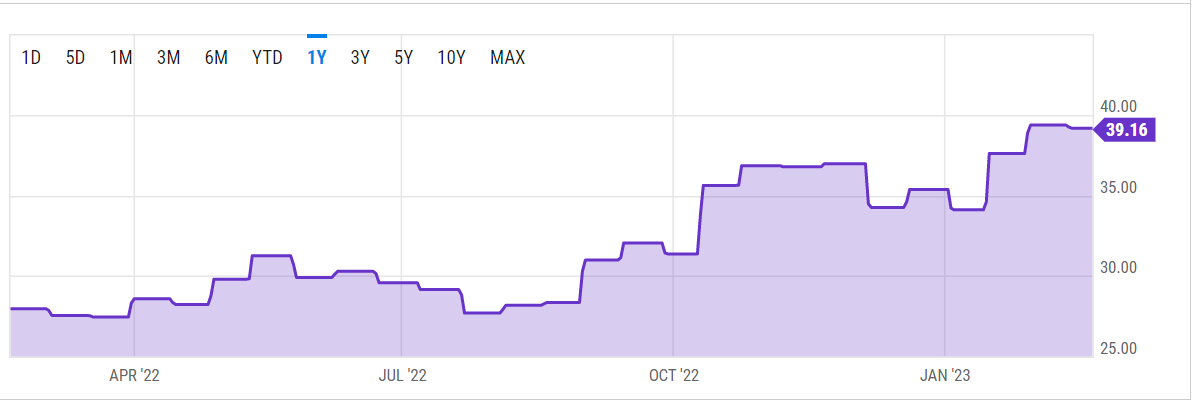

The following are the results of a survey conducted by the National Institute of Standards and Technology (NIST). The predicted increase for this modification will be between 10.78% and 11.5%. The present difficulty is around 39.16 trillion hashes, and the next adjustment will very certainly increase it to 40 trillion.

A 10.78% increase would yield a difficulty rating of around 43.35 trillion hashes. Whatever the decision, a rise in difficulty will make it more difficult for Bitcoin miners to discover new blocks.

The expected increase in Bitcoin’s network difficulty, combined with a high hashrate and shorter block times, means that it will become more difficult for miners to discover new blocks. This could result in a slowdown in the rate at which new Bitcoin is produced, and potentially cause an increase in its price due to its scarcity.

Moreover, the increase in Bitcoin’s hashrate and the concentration of mining power in a few major mining pools may also raise concerns about centralization and security risks. Nonetheless, the high hashrate and the concentration of mining power could also enhance the overall security of the Bitcoin network, making it more resilient against potential attacks.

In summary, the expected changes in Bitcoin’s network difficulty and hashrate could have a range of implications for its price, security, and decentralization. However, the full impact will depend on various factors, including market demand, regulatory developments, and technological advancements.

IoV Labs Presents RIF Flyover To Easily Transfer Between Bitcoin and Rootstock

IoV Labs, a blockchain technology company based in South America, has introduced RIF Flyover, an open-source protocol designed to enable seamless transfers between the main Bitcoin blockchain and the Rootstock sidechain, resulting in faster transactions.

RIF is a decentralized infrastructure protocol suite that allows for the development of scalable decentralized applications within a single ecosystem. RIF Flyover, also known as a Repayment Protocol, is a non-custodial bridging method that enables smoother and faster transfers between Bitcoin and Rootstock sidechain via third-party liquidity providers.

Its unique design allows for secure cross-chain transfers, as users don’t have to provide third parties with access to their funds or private keys, unlike traditional cross-chain bridges.

Potential Impact

The launch of RIF Flyover by IoV Labs can have a positive impact on Bitcoin’s usability and overall value. By enabling faster and smoother transfers between the main Bitcoin blockchain and the Rootstock sidechain, the RIF Flyover protocol can enhance the utility of Bitcoin and make it more attractive to users seeking a more efficient and seamless experience.

Bitcoin Price

As of now, the current live price of Bitcoin is $24,650, and its 24-hour trading volume is $29.2 billion. In the last 24 hours, Bitcoin has experienced a decrease of nearly 1%. With a live market cap of $475 billion, Bitcoin is currently ranked #1 on CoinMarketCap.

From a technical standpoint, Bitcoin is currently trading sideways and has been confined to a narrow range between the $24,300 to $25,300 mark. It seems that many investors are waiting for the release of the US Federal Open Market Committee (FOMC) meeting minutes before making any major moves.

The FOMC meetings can have a significant impact on the cryptocurrency market as they provide insights into the monetary policies of the United States. Investors often closely follow the minutes to gain a better understanding of the future direction of interest rates, inflation, and economic growth.

Given the anticipation surrounding the FOMC meeting minutes, it’s no surprise that Bitcoin is trading in a relatively tight range. However, once the minutes are released, it’s possible that we may see some movement in the cryptocurrency markets as investors respond to any new information or insights provided.

If Bitcoin’s price were to drop below its current support level of $23,750, the next support level would be at $22,850. This level is determined by the 50% Fibonacci retracement mark, a commonly used technical analysis tool that identifies potential support and resistance levels based on the previous price action.

Buy BTC Now

Bitcoin Alternatives

CryptoNews has released an in-depth analysis of the top 15 cryptocurrencies that investors may want to consider for 2023. The report provides valuable insights to help investors make well-informed investment decisions.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

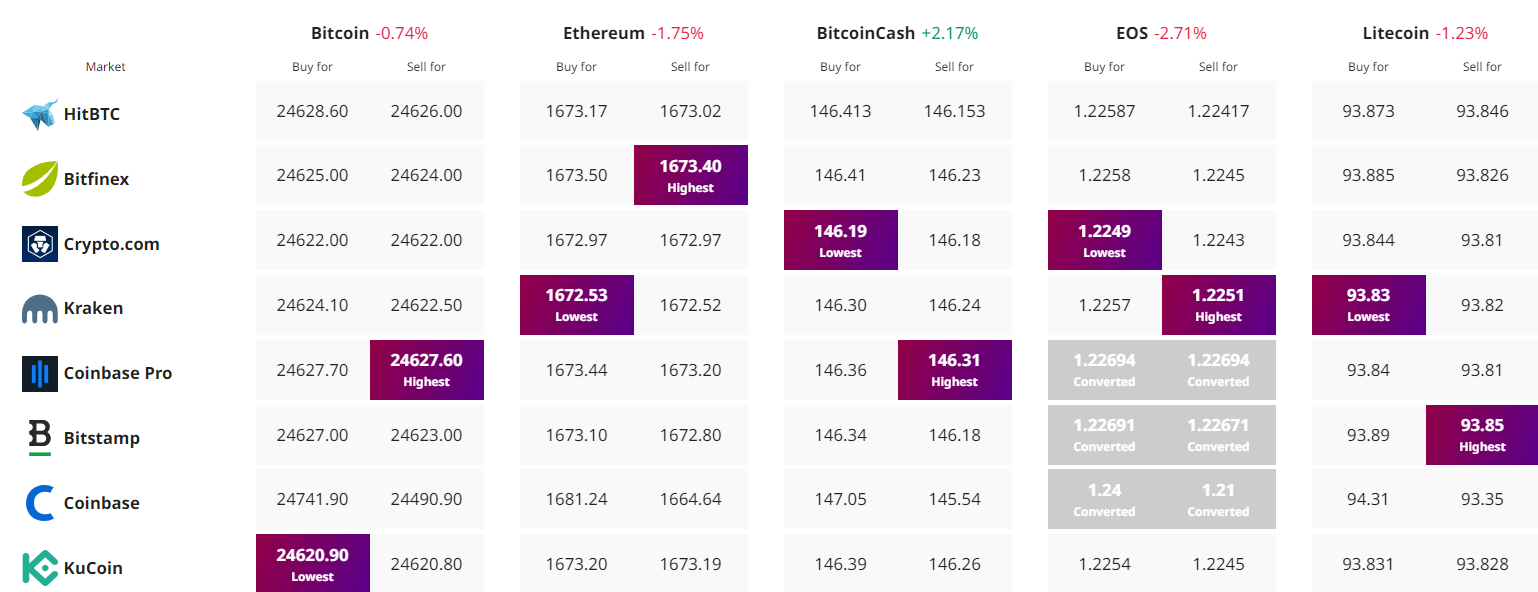

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link