Source: Pedrosek – Shutterstock

- The growth in DeFi sector is pushing the price of BNB and ETH to new all-time highs.

- While Bitcoin’s dropping dominance continues to favor price pumps for altcoins, investor participation from South Korea could be a key for to the trend.

With altcoins massively pumping and a total crypto market capitalization above $2 trillion, it seems undeniable that “altcoin season” has arrived. Bitcoin, on the other hand, seems to be stuck at its current levels. At the time of publication, all coins in the top 10 were showing gains.

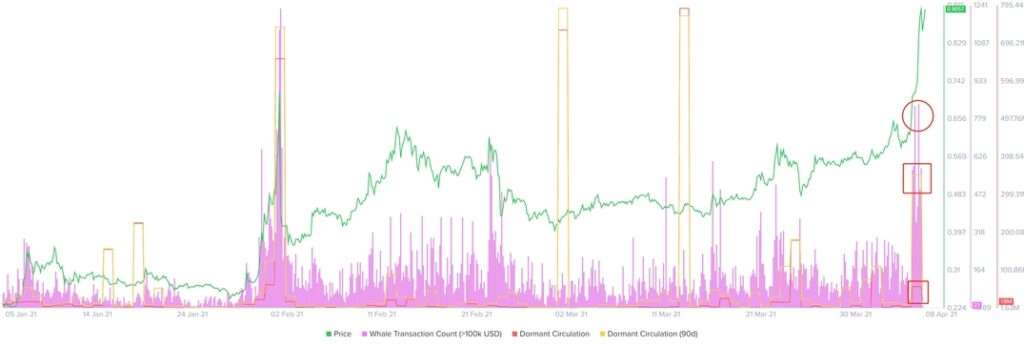

However, in the last 24 hours, XRP is the biggest gainer with an astonishing 46.7% surge to stand at $1.05, its highest price in 3 years, retaking its position in the top 5. As indicated by “Wu Blockchain”, XRP’s price increased rapidly towards the current levels after the participation of “big players”. Yesterday, more than 600 transactions worth $100,000 were recorded in less than 12 hours. Thus, the price rose in response to increased XRP whale activity, as the image below shows.

Source: https://twitter.com/WuBlockchain/status/1379352908785803272/photo/1

Following XRP, Litecoin and Binance Coin (BNB) post the largest gains over the same period with 10.1% and 7.5% respectively. On the higher timeframes, the weekly chart is dominated by XRP with a rise of 81.5%, BNB with 40.2%, Polkadot (DOT) with 29%, Ethereum with 16.2%.

The latter cryptocurrency reached a new all-time high by breaking resistance at $2,100. In the top 10, ETH presents the strongest fundamentals and sits on top of two sectors that continue to attract investors, non-fungible tokens (NFT) and DeFi. The latter reached a new milestone recently by surpassing $50 billion in total value locked (TVL).

Just like ETH, BNB has also reached an all-time high in recent days. The number of active addresses on the Binance Smart Chain exceeded 370,000 yesterday, which is 1.1 times more than Ethereum. Furthermore, the 24-hour on-chain transaction volume is exceeding 3.9 million, which is more than 300% of Ethereum.

Therefore, it is fair to assume that the activity and growth of the DeFi ecosystem continue to be a driving factor in the price performance for ETH and BNB. Also, it seems that there is no coincidence that UNI has made its entry into the top 10 and is showing a 7.6% rise on its weekly chart, accompanied by oracle service Chainlink (LINK) at 16.1%.

What is going on with Bitcoin?

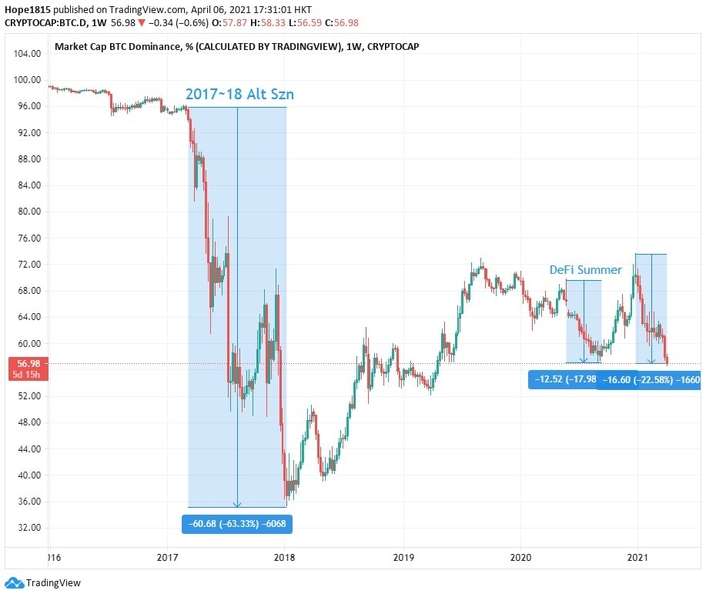

Another major driver of gains in altcoins is the drop in Bitcoin’s dominance. Sitting at its lowest levels since 2019, this metric has lost nearly 20% since the start of the year to 57% currently. In contrary, a rise of Bitcoin could hurt the altcoins gains. However, analyst “Molly” made a comparison between the price surge for altcoins in 2017-2018 and stated that the current “pump” is “nothing at all” hinting at more gains for these assets, as seen below.

Source: https://twitter.com/bigmagicdao/status/1379368155869368324/photo/1

The “Kimchi effect” may be also playing an important role. Having a tax exemption for cryptocurrency gains only to the end of 2021, investors in South Korea have rushed to allocate capital in many altcoins that promise a high return on investment in a short time.

Meanwhile, the crypto hype in South Korea is also reflected in Bitcoin’s local price there. Exchange platforms in South Korea charge their customers a premium (“kimchi bonus”). Last week, when the spot market price of BTC was $59,000, investors in South Korea had to buy bitcoin for almost $66,000.

However, a rally of the Bitcoin price seems to be only a matter of time. With BTC supply on exchanges at record lows, growing institutional participation and the possible announcement of another stimulus package in the U.S., the outlook seems pretty bullish.

Credit: Source link