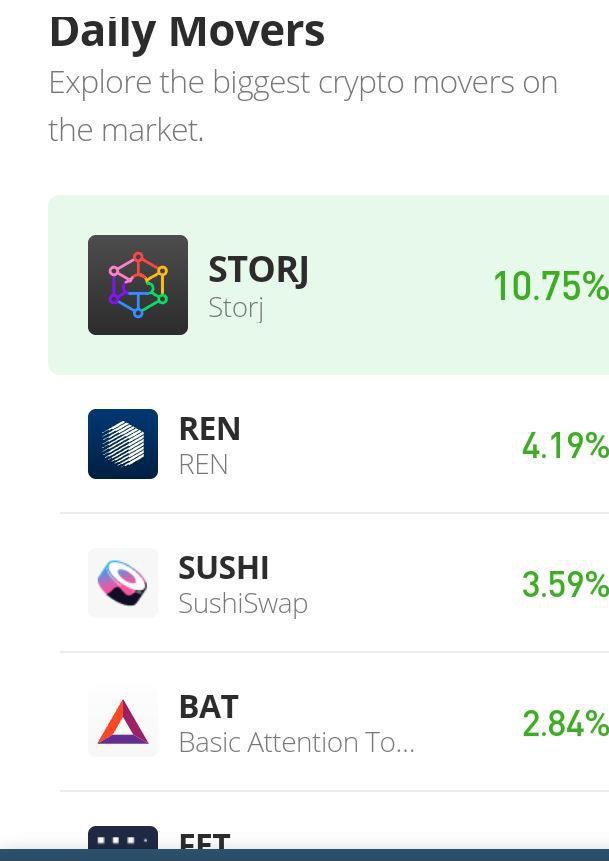

Storj (STORJ) Price Prediction – July 7

There has been a trading intrigue in the STORJ/USD market activities, suggesting the crypto economy may push higher over resistances in the following sessions. The market’s return on investment percentage rate is at 48.71 positives as the price currently trades around $0.77 or thereabout.

STORJ Price Statistics:

STORJ price now – $0.7764

STORJ market cap – $308.7 million

STORJ circulating supply – 397.6 million

STORJ total supply – 424 million

Coinmarketcap ranking – #95

Storj (STORJ) Market

Key Levels:

Resistance levels: $0.90, $1.10, $1.30

Support levels: $0.60, $0.50, $0.40

STORJ/USD – Daily Chart

The STORJ/USD daily chart showcases the STORJ/USD market may push higher over resistances at various trading capacities in the following sessions. The 14-day SMA indicator is underneath the 50-day SMA indicator. The Stochastic Oscillators are in the oversold region. And they are trying to cross back northbound from within against the 20 range to signal that a buying force is ongoing.

Has it been that the STORJ/USD market has found a strong baseline at the $0.40 level?

The current STORJ/USD market trading outlook portends the crypto instrument pairing against the US Dollar has built a strong baseline at the $0.40 level as it may push higher over resistances in the subsequent sessions. Recently, a correction took effect from a $1 resistance toward around the $0.60 level has let bulls regain their stances to re-start a northward-pushing process for another cycle.

On the downside of the technical analysis, selling orders have to suspend for a while. Price had initially reversed against some buying walls established to find support around the $0.60 level. The Stochastic Oscillators positioning in the oversold region suggests bears may not have the capacity to revert against the move as it earlier pushed for corrections against different support levels.

STORJ/BTC Price Analysis

STORJ market has now been trending aggressively against the trending ability of Bitcoin. The trading outlook stance between the pairing cryptos yet signifies the market may still push higher over resistances above the SMA trend lines. The 14-day SMA indicator has intercepted the 50-day SMA indicator to the upside. The Stochastic Oscillators are in the oversold region, trying to swing northbound. Yesterday’s emergence of a bullish candlestick found its bottom on the threshold of the buying signal side of the smaller SMA. Expectantly, the base crypto will have to continue to hold firmer against its flagship countering trading crypto in the following sessions.

eToro – Automated Copytrading of Profitable Traders

- 83.7% Average Annual Returns with CopyTrader™ feature

- Review Traders’ Performance, choose from 1 – 100 to Copytrade

- No Management Fees

- Free Demo Account

- Social Media & Forum Community – Trusted by Millions of Users

68% of retail investor accounts lose money when trading CFDs with this provider.

Read more:

Credit: Source link