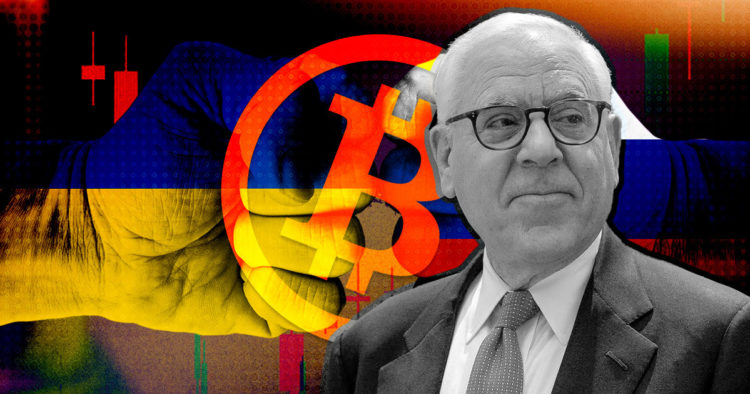

Billionaire investor David Rubenstein recently joined the “Invest Like the Best” podcast where he discussed the implications of Russia’s invasion of Ukraine. Rubenstein explained that the war had caused inflationary pressures in the healing post-covid economies of Europe and the US, pushing people towards cryptocurrencies.

In the podcast, he stated:

“I was skeptical of crypto in the beginning because I figured there’s nothing underlying this. But it’s clear to me now that many younger people don’t think that there’s much underlying the dollar or the euro or other currencies so they think, I really can’t get gold for my dollar anymore.”

David then further elaborated:

“So maybe the government’s promise to make it valuable isn’t maybe there when you have so much money you’re borrowing and you’re inflating your way out of the value of the currency.”

Alongside those comments, Rubenstein also mentioned how crypto financially aids residents of the war-affected regions. In that line, he said:

“If you’re in Ukraine or you’re in Russia and you want to have some assets and your country has got lots of challenges, having some cryptocurrency probably enables you to feel better that you can have something that’s outside of the government’s control and it’s not dependent on the bank opening up its doors to you.”

Rubenstein argued that crypto adoption would surge as inflation worsens in the following years.

Bitcoin is already used as a hedge by many nations against both war-related and non-war-related inflation. This tendency also captured the attention of many VIPs in addition to Rubenstein, such as the Prince of Serbia, who declared Bitcoin as the only way around inflation, and Max Keiser, who said, “Americans with less than 20 Bitcoin won’t make it.”

War’s effect on the global economy

Back to the effects of the effects of the war on the global economy, David Rubenstein said that the Russian invasion of Ukraine is delaying the much needed stimulus that post-covid economies needed to heal, stating:

“…as the global economy was beginning to recover from COVID, we now find ourselves in a free-fall a bit, in terms of the global economy. We’re seeing a dramatic decline in obviously the Russian economy and the Ukrainian economy — but it’s spilling over into the European economy, and to some extent, the US economy.”

Adding as well that there is no way to know how the global economy will perform in the future before this conflict is resolved.

Finally, he continued by saying that this uncertainty and hindrance to the global economy leads to inflation, saying:

“People who haven’t had to ever worry about inflation are now beginning to do so. The price of everything you buy day-to-day is probably going to go up…it’s getting to the point where people are nervous about it.”

Credit: Source link