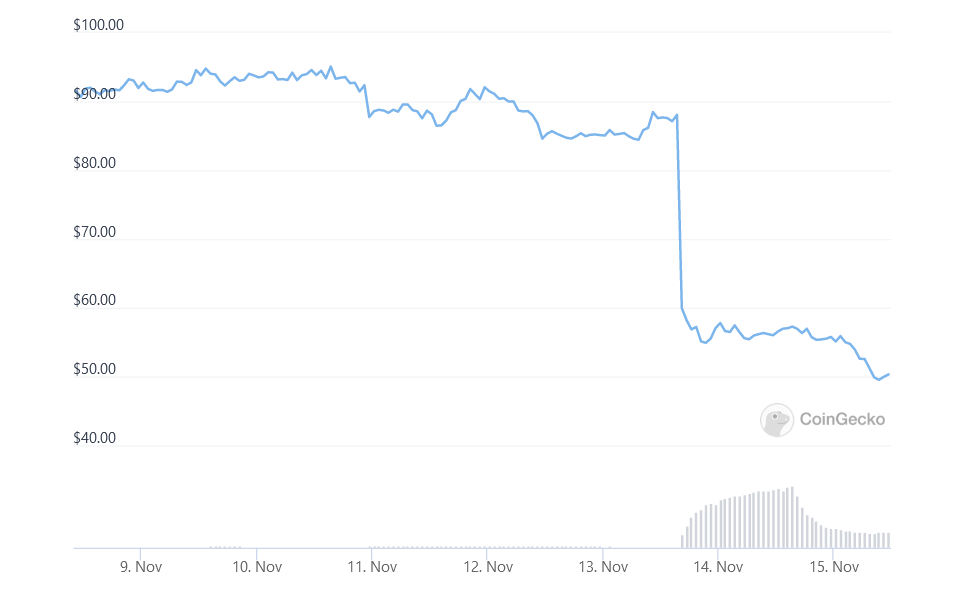

The decentralized lending protocol Cream Finance‘s native token has fallen off a cliff following the news that the project aims to increase CREAM’s supply in order to compensate users affected by the recent hack.

At 9:46 UTC Monday morning, CREAM is trading at USD 50.23 per coin, down by 10.8% over the last 24 hours. It’s also down 45.3% in a week and by 86.5% compared to its all-time high of USD 317 recorded earlier this year in February, according to data by CoinGecko.

In late October, Cream Finance was the target of an exploit that drained over USD 130m in funds from the project’s coffers. Following the hack, CREAM tanked to USD 111.61, dropping by almost 30%. Prior to that, the project had suffered another attack last August, losing over USD 25m worth of funds.

To compensate victims of the latest attack, Cream Finance aims to use new CREAM tokens from its treasury, which will increase the project’s circulating supply by more than 2x.

“We will distribute 1,453,415 CREAM tokens to impacted users. We are utilizing remaining CREAM tokens within the treasury, and removing the project team’s remaining CREAM token allocation. There will be no further CREAM allocations to the team,” the project said.

As of now, CREAM has a circulating supply of 766,534, according to CoinGecko.

Meanwhile, despite CREAM plunging by double-digit percentages, other digital assets have resumed their upward movement. Notably, bitcoin (BTC) and ethereum (ETH) have moved higher, gaining by over 2% over the past 24 hours.

____

Learn more:

– Cream Finance Suffers Another Exploit as Attacker Runs Away With USD 100M+

– Cream Finance Suffers USD 25M Flash Loan Attack

– DeFi Industry Must Tackle Lack Of Transparency, Pseudonymity: SEC Commissioner

– Current Cycle Less Speculative, Users Moving Beyond Bitcoin and Ethereum – Coinbase

Credit: Source link