The first crypto industry-focused exchange traded fund (ETF) in Australia was launched on Thursday this week, and within 15 minutes of trading a new record in trading volumes on the Australian stock market was smashed. Meanwhile, new regulations have opened the door for spot-based bitcoin (BTC) and ethereum (ETH) ETFs to launch.

The Crypto Innovators ETF, brought to market by local fund management firm BetaShares and traded under the ticker CRYP, saw its trading volumes exceed AUD 8m (USD 5.9m) after just 15 minutes yesterday. By noon, the volume had skyrocketed further to AUD 24.5m (USD 18m), before closing the day with a daily trading volume of AUD 42m (USD 30.95m), market data showed.

The unusually high trading volume marked a new record for any ETF listed on the Australian Securities Exchange (ASX), Business Insider Australia reported on Friday.

Unlike the much-talked about bitcoin futures ETFs that have launched in the US, BetaShares’ new Australian ETF does not aim to track the price of any particular cryptocurrency. Instead, the fund aims to provide broad exposure to “global companies at the forefront of the dynamic crypto economy,” BetaShares’ website said.

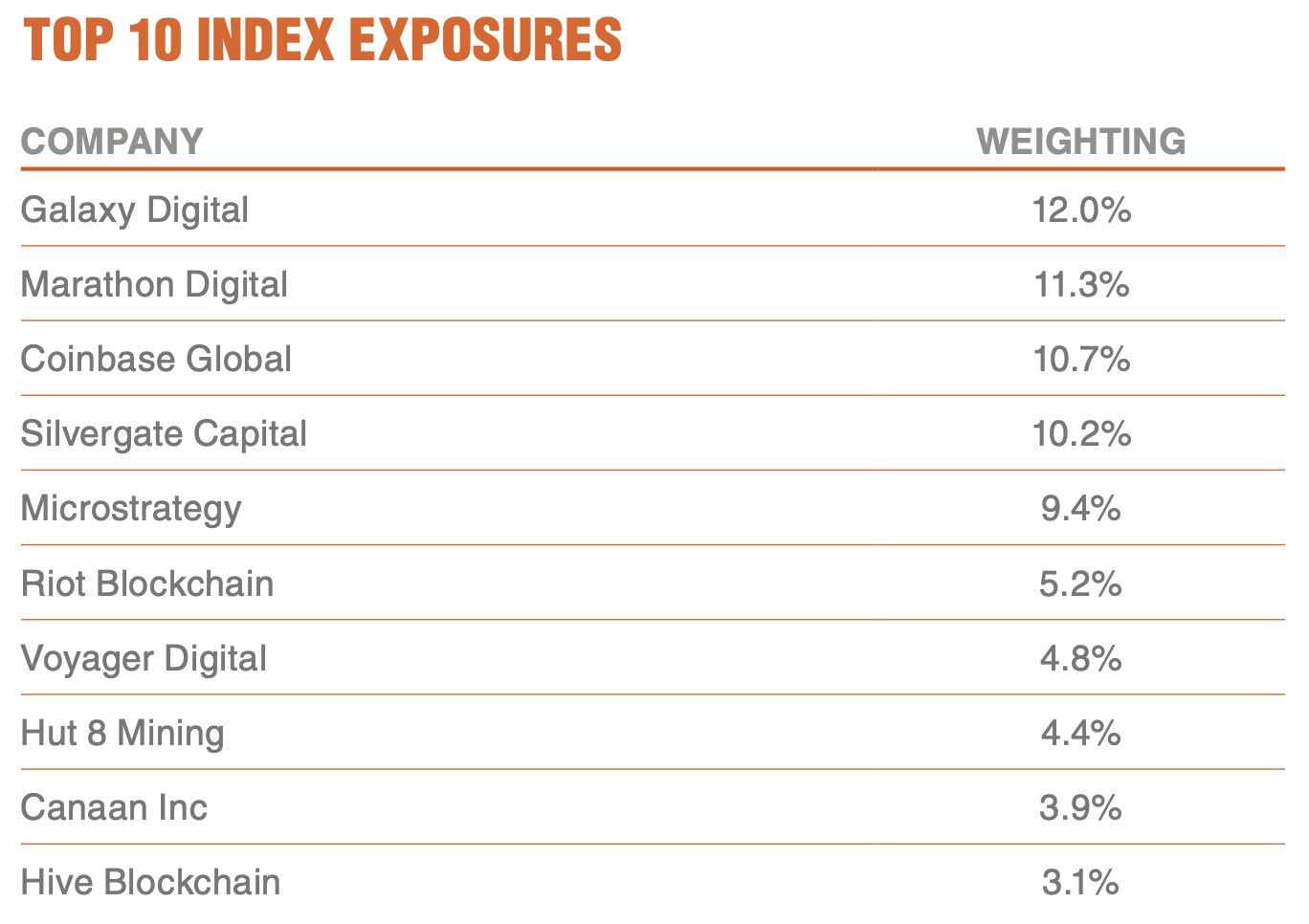

As of November 4, the ETF’s holdings consisted of well-known companies involved in everything from crypto asset management, to exchanges and mining companies. Among them were Mike Novogratz’s Galaxy Digital, bitcoin bull Michael Saylor’s firm MicroStrategy, and the US-based exchange Coinbase, to name just a few.

CRYP thus mimics other ETFs launched elsewhere, such as Volt Equity’s US-listed ETF with the ticker BTCR, that have gotten around strict regulations pertaining to crypto ownership by instead offering exposure to crypto-focused companies.

Meanwhile, BetaShares, the company behind CRYP, has now turned its focus to bringing both a bitcoin and ethereum-backed exchange-traded product (ETP) to the Australian market, the company’s CEO, Alex Vynokur, told Business Insider.

Explaining that Thursday’s record-breaking ETF launch shows that there is “considerable” appetite for digital assets in Australia, Vynokur said that the company is now working to build out a range of ETFs that directly track BTC and ETH spot prices.

The CEO said the plans include “the expected launch of the 1BTC and 1ETH” ETF, although no specific timeframe was given.

The plans to bring pure crypto-backed ETFs to the Australian stock market follows new guidelines on the subject from the Australian Securities and Investment Commission (ASIC) last month.

Under the new guidelines, companies interested in bringing crypto ETFs to the market will be required to adhere to a set of best practice guidelines, with custody of the digital assets highlighted as a key element.

CRYP went live on the ASX on Thursday at 10:30 local time at a price of AUD 11.23 (USD 8.28) per share. As of Friday’s market close in Australia, the ETF traded at AUD 11.28 (USD 8.32), up 0.8% for the day.

____

Learn more:

– Australian Regulator Gives Thumbs Up to Bitcoin, Ethereum ETFs

– First Bitcoin ETF Moves to November Contracts as Competition Heats Up

– MicroStrategy’s and Grayscale Bitcoin Trust’s Shares Now Compete with ETFs

– Following the First Bitcoin ETF, Ethereum Might be Next

– Here’s What You Need to Know About the Bitcoin Futures ETF

Credit: Source link