Cryptoassets are a growing source of financial and job freedom in the US, providing life-changing levels of income to a rising number of persons, according to a recent survey by consumer trend intelligence provider CivicScience.

The survey collected almost 7,000 responses between April and November 2021, from various groups that were weighted by the US population’s structure in line with the country’s census data, according to the company.

11% of the respondents reported they personally quit their jobs, or they knew someone who has, as a result of their investments in crypto such as bitcoin (BTC) and ethereum (ETH), CivicScience said, of which 4% of the respondents pointed to themselves, and 7% declared they knew someone who had done it.

The Dallas Mavericks owner Mark Cuban has taken to Twitter to comment on the survey’s results and say that “[n]ow we know why so many people quit low paying jobs. And this was BEFORE the current runup.”

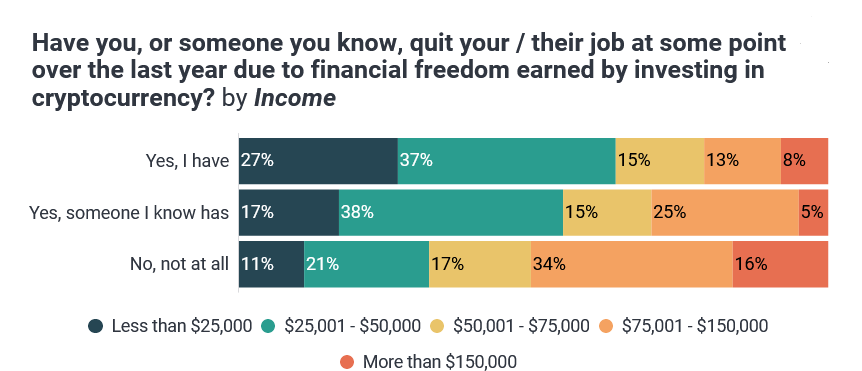

Among those who admitted to having quit their jobs owing to their successful investments in cryptoassets, the largest share, at 37%, said their annual crypto-based revenue was in the range of USD 25,001 and USD 50,000.

For 27%, the generated revenue was less than USD 25,000 per year. A further 15% declared crypto was bringing them a revenue of USD 50,001-75,000 per year. For 13%, this revenue was in the range of USD 75,001 and USD 150,000.

The top 8% of crypto investors said they were making USD 150,000 annually owing to their successful investments.

Within the same revenue ranges, between 19% (among those earning USD 25,001 to USD 50,000 from crypto) and 42% (among those who make more than USD 150,000 from crypto) admit that, owing to their crypto investments, they are now wealthier than they were last year.

The survey has also identified a link between investing in the stock market and in cryptocurrencies.

“Respondents who are active or occasional traders on the stock market are significantly more likely to have invested in cryptocurrency. So while heavier stock investors may not be quitting their jobs as a result of any crypto gains, they are the ones driving much of the market,” according to CivicScience.

Regarding their investments in crypto, the largest share of investors admit they view their involvement as a long-term growth investment, at 28%. Another 23% said that crypto is a short-term investment, while 16% use it for transactions. A further 11% consider such investments as a hedge against various adverse economic conditions, and 12% treat it as a means of securing independence from the US government.

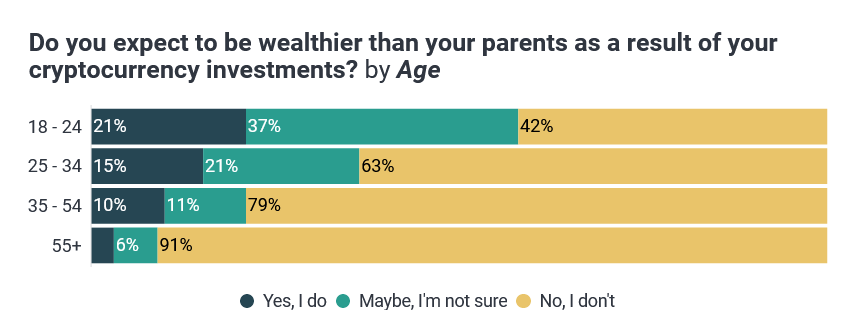

Many respondents in various age groups also find that they may be wealthier than their parents due to their crypto investments.

____

Learn more:

– Almost Third of Professional Investors Sidestep Advisors to Buy Crypto – Survey

– More US Crypto Investors To Hodl Than Eye Short-Term Profit

– Almost 1 in 2 Respondents Plan Use Crypto For Payments In 2 Years – Survey

– European, Asian Investors Drive Bitcoin, Ethereum Investments – Survey

– Lack Of Knowledge Is More Important Than Volatility For Crypto Newcomers

– Estimated Number of Crypto Users Reaches 221M, Spurred by Altcoins

Credit: Source link