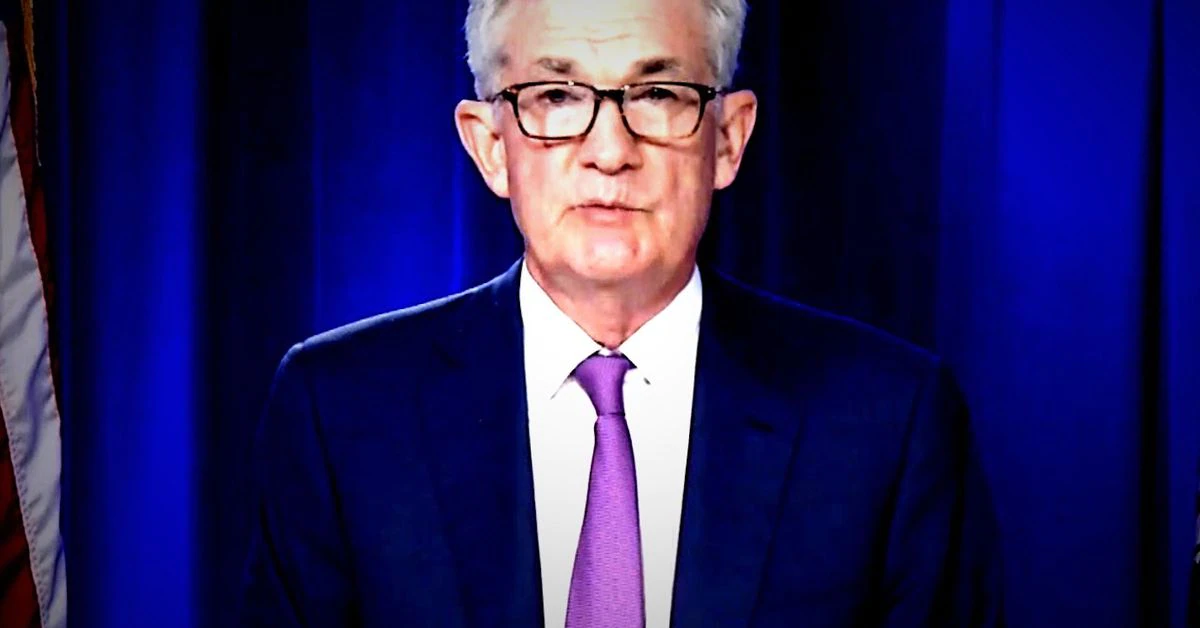

“On one hand, tightened monetary policy may lead to less rapid growth of bitcoin demand, as many use it to hedge inflation, and less QE in theory means less inflation,” said Joe DiPasquale, CEO of the cryptocurrency hedge fund BitBull Capital. “On the other hand, the effects of the largest QE in history may lead to the largest inflation in history, regardless of the Fed attempting to scale back. If this happens, we expect demand, and prices, for bitcoin to rise to new all-time highs.“

Credit: Source link