Join Our Telegram channel to stay up to date on breaking news coverage

The JasmyCoin price has surged 19% in the last 24 hours to trade at $0.05392 as of 3:30 a.m. EST on a 285% pump in trading volume to $2.4 billion.

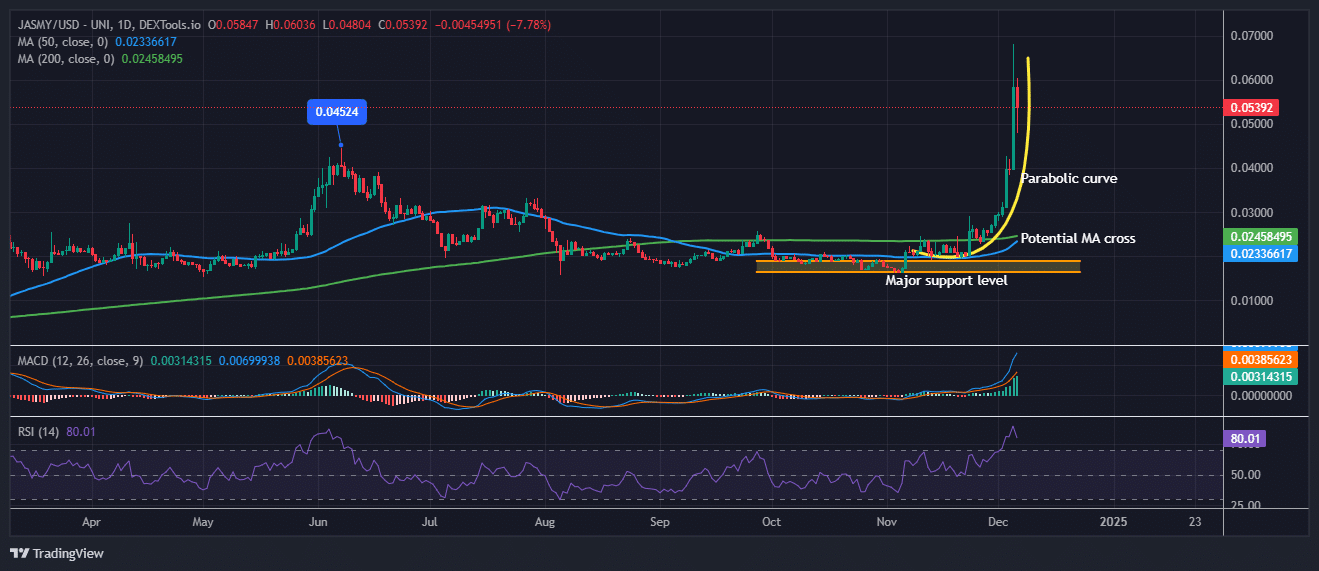

JasmyCoin Price Spikes In A Parabolic Curve

The JASMY/USD daily chart shows strong bullish momentum with a parabolic price movement. After consolidating around $0.01–$0.015 for quite some time, the price drastically surged, breaking out of its base and trading at $0.05392.

This is quite a rally, but a -7.78% pullback on the day indicates higher-level profit-taking or resistance. The parabolic curve formation indicates aggressive buying interest, but such patterns often correct once momentum slows.

JASMYUSD Analysis Source: Dextools.io

The formation of a golden cross, where the 50-day Moving Average (MA) is on the verge of crossing above the 200-day MA, generally indicates that long-term sentiment is shifting toward a stronger uptrend.

Supporting this view is the MACD indicator, which remains positive, with the MACD line staying above the signal line, reflecting ongoing bullish strength. However, the widening divergence between the MACD line and the signal line could point to diminishing momentum.

JasmyCoin Price Technicals Signal A Short Term Pullback

Additionally, the Relative Strength Index (RSI) stands at 80.01, well into overbought territory, suggesting the JasmyCoin price might reach exhaustion in the short term. This combination indicates that while the rally has been strong, caution is warranted as a correction could be imminent.

From a price perspective, key resistance lies in the $0.06–$0.07 region, where sellers may step in to take profits or where traders could encounter psychological barriers.

On the downside, $0.04524, the earlier high in June, will likely act as the first support level during any pullback. If the correction deepens, the $0.04 level becomes a critical zone to hold, as it is both a psychological level and a key structural support.

Furthermore, the area around the 50-day and 200-day MAs, at $0.023–$0.025, serves as dynamic support, aligning with longer-term trends.

Should the price retrace even further, the $0.01–$0.015 range, which served as a strong consolidation base before the breakout, could provide a solid floor for the price to stabilize.

Wall Street Pepe (WEPE) Presale Heads To $1.5 Million

Related Articles

Newest Meme Coin ICO – Wall Street Pepe

- Audited By Coinsult

- Early Access Presale Round

- Private Trading Alpha For $WEPE Army

- Staking Pool – High Dynamic APY

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link