Este artículo también está disponible en español.

Bitcoin (BTC) shattered the $100,000 price milestone yesterday, reaching as high as $104,088 on Binance crypto exchange. This historic price action has prompted analysts at the trading firm Bernstein to assert that Bitcoin is well-positioned to replace gold within the next decade.

Bitcoin Poised To Outshine Gold Over Next Decade, Bernstein Says

In a client note released earlier today, Bernstein analysts, led by Gautam Chhugani, expressed confidence that Bitcoin will eventually assume gold’s role as a reliable safe-haven asset. The note stated:

We expect Bitcoin to emerge as the new-age premier ‘store of value’ asset eventually replacing Gold over the next decade, and becoming a permanent part of institutional multi-asset allocation and a standard for corporate treasury management.

On a year-to-date (YTD) basis, Bitcoin is up an impressive 141%. However, the lion’s share of these gains came following the victory of pro-crypto Republican candidate Donald Trump in the November US presidential election.

Related Reading

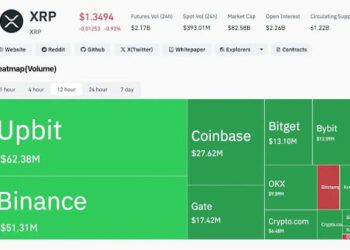

The cryptocurrency market has seen a surge in optimism following Trump’s victory, as the president-elect is expected to create a favorable regulatory environment for digital assets. Since November 4, the total crypto market cap has climbed from $2.4 trillion to $3.9 trillion at the time of writing – a staggering 62.5% increase.

In the note, Bernstein predicts that BTC may rise to $200,000 by late 2025. The trading firm’s forecast aligns with Charles Edwards’ – founder of Capriole Investments – prediction that BTC can potentially double in value within weeks, as its relatively smaller market cap enables more rapid price movements.

BTC Adoption Major Driver Behind Its Success

Bernstein’s bullish outlook was reinforced by Gil Luria, a D.A. Davidson analyst, who identified mainstream adoption as the key driver behind Bitcoin’s success. However, he cautioned that Bitcoin still has a “long path ahead” before it is widely accepted as a medium of exchange and unit of account. Luria added:

Bitcoin’s main current application as a store of value — an appreciating, low-correlation asset that replaces gold as a hedge against a decline in economic stability.

While Bitcoin is yet to achieve widespread use as a currency, it has gained significant traction as a reliable asset class for corporate balance sheets. Recently, Hut 8, a leading crypto-mining firm, announced plans to establish a strategic Bitcoin reserve.

Related Reading

In November, video-sharing platform Rumble shared its plans to bolster their BTC holdings. At the same time, declining BTC reserves on crypto exchanges are likely adding to the asset’s supply scarcity, subsequently pushing its price upward. At press time, BTC trades at $103,172, up 7.9% in the past 24 hours.

Featured image from Unsplash, Chart from Tradingview.com

Credit: Source link