- Analysts maintain that Bitcoin’s $100,000 target is still intact, and corrections are seen as a normal market movement.

- On-chain metrics suggest Bitcoin remains in a bullish phase, supported by continued accumulation from large holders.

The Bitcoin price faces strong selling pressure, correcting more than 5.6% in the last 24 hours and slipping all the way to $92,000 as of press time. Moreover, the strong selling pressure comes after facing several rejections at $100,000 levels.

The recent selling comes following Donald Trump’s decision to raise import tariffs on China, Mexico, and Canada. Thus, this announcement led the US Dollar to shoot up while sending the US equity market, Bitcoin, and crypto on a strong downside.

Bitcoin’s strong correction has reverberated further across the entire crypto market, with altcoins correcting by an even greater magnitude. Ethereum (ETH), Solana (SOL), BNB Coin, XRP, and Dogecoin (DOGE) all have corrected between 5% and 10% in the last 24 hours.

A short-term target of $100,000 per BTC remains intact, with analysts considering a correction of up to 10% from the peak (potentially dipping to $92,000) as a “normal market movement.” In a note to investors on Tuesday, CryptoQuant independent analyst MAC_D said:

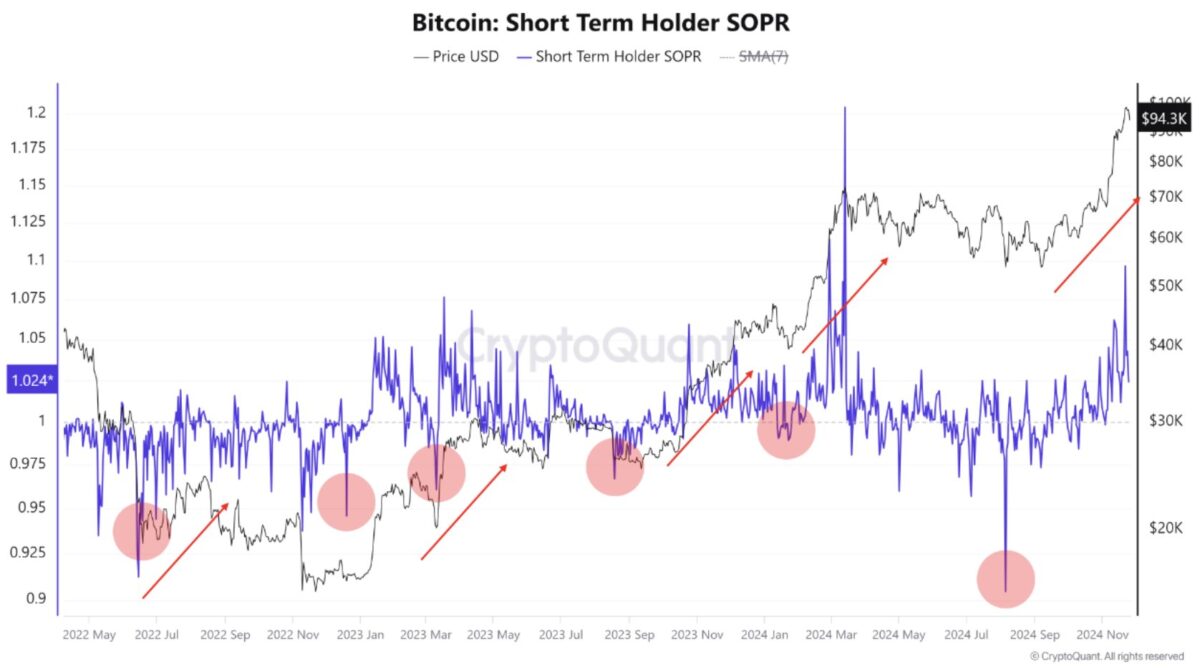

This correction occurred due to leverage overheating, as open interest and estimated leverage ratio reached annual highs. Therefore, a 10-20% correction can be seen as a natural phenomenon. From an on-chain perspective, cycle metrics such as MVRV, NUPL, and Puell Multiple still indicate that Bitcoin is in a bull market with upward potential. The key here is to identify major accumulation periods during corrections, with the ‘Short-Term SOPR’ metric being particularly useful.

Bitcoin Price Choppiness to Continue? What’s Next?

Analysts have mixed opinions as to where the Bitcoin price is heading from here. The crypto market is set for extreme volatility in the near term, as Bitcoin’s technical indicators signal overbought conditions, while a FOMO-driven public fueled by “animal spirits” continues to show heightened interest in the asset class.

Popular crypto analyst Ali Martinez stated that Bitcoin is showing a bullish divergence against the RSI which could help the BTC price rebound in the range $95,000 – $96,000!

The TD Sequential presents a buy signal on the #Bitcoin $BTC hourly chart, while a bullish divergence forms against the RSI, which could help #BTC rebound to $95,000 – $96,000!

Join me in this trade by signing up to @coinexcom using my referral link https://t.co/73n8mW9Y5p. pic.twitter.com/lKozxI8JVP

— Ali (@ali_charts) November 26, 2024

Since September 2023, Bitcoin has closely mirrored global M2 trends with roughly a 70-day delay. If this pattern holds, a 20-25% correction could be on the horizon, said analyst Joe Consorti. Of course, this might not happen immediately but is one of the important metrics to keep a watch on.

On the other hand, blockchain analytics firm Santiment reported that despite Bitcoin’s slight pullback below the $95,000 mark at the start of the week, large holders remain optimistic. In November alone, wallets holding at least 10 BTC have accumulated an additional 63,922 coins, valued at approximately $6.06 billion. The continued accumulation by these “whales” and “sharks” suggests a strong bullish outlook.

Moreover, Santiment adds that any price dip is likely to be short-lived as long as these investors continue to move their holdings in a positive direction.

Credit: Source link