DeFi has the potential to transform the world of finance and empower investors to build their financial future without the intervention of a centralized institution. As such financial transactions are bound to become more transparent, fast, less time consuming and cheaper as compared to traditional ways.

The interest in DeFi coins as a digital asset has been on the rise as more and more people are becoming aware of the potential it has in the future world of blockchain.

If you are looking to invest in DeFi coins, the following list of top 6 coins could be very beneficial for you.

6 Top Gainer DeFi Coins as of Today

1. Lido DAO (LDO)

Lido DAO is a decentralized liquid staking platform for ETH 2.0 and other POS blockchains, wherein assets can be liquefied and used for other protocols. It focuses on non-custodial staking thus helping resolve Ethereum’s ongoing challenges.

In the first year of the launch of Lido DAO, the value of staked assets on the platform reached over $13 billion. It offers a high rate of rewards for its staking assets, which is one important reason for its rising popularity and demand.

LDO is the governance token of the Lido DAO platform. It provides governance rights to the holders and the right to vote in the decision-making process for the development of the platform, deciding on fee parameters, and the addition or removal of any network nodes.

LDO is currently trading at a price of $1.07, with a 24-hour trading volume of $32.16 million. It currently has a market capitalization of $333 million. It has 312 million coins in circulation and a maximum supply of 1,000 million coins.

Buy LIDO DAO on Coinbase

Your capital is at risk.

2. Orion Protocol (ORN)

Orion Protocol acts as an aggregator of liquidity from major centralized and decentralized exchanges and provides everything at one place. This way it saves time and effort on the part of investors to go through different exchanges to find the best deal for buying and selling cryptos. It charges the lowest fees and zero spreads and features rich trading tools for traders’ assistance.

ORN is the utility token of the Orion Protocol. Its usage is integrated into the important transactions on the platform, besides facilitating discounted trading, access to advanced features and attractive staking rewards. The platform has built 18 revenue streams for ORN holders.

Its current market price is $1.41 and 24-hour trading volume is $17.49 million. It currently enjoys a market capitalization of $47 million. It has 34 million coins in circulation and a maximum supply of 100 million coins.

Buy ORN on Coinbase

Your capital is at risk.

3. Conflux (CFX)

Conflux is a state-endorsed scalable, decentralized and secure DeFi ecosystem. It enables cross-border collaboration in the Asian blockchain sector. It operates in China. It resolves the issue of DeFi Compartmentalization by supporting multi-chain interoperability. Its fees are cheaper than Ethereum. The network ensures high-throughput (around 3000-6000 tps) without compromising decentralization.

CFX token has multiple usages within the Conflux Network and can be staked for attractive rewards. Besides utility, it also serves governance power to the holders by providing voting rights and decision-making powers.

CFX is currently trading at a price of $0.09, with a 24-hour trading volume of $18.94 million. It currently has a market capitalization of $169 million. It has 1.83 B coins in circulation and a total supply of 1,697 million coins.

Buy CFX on Coinbase

Your capital is at risk.

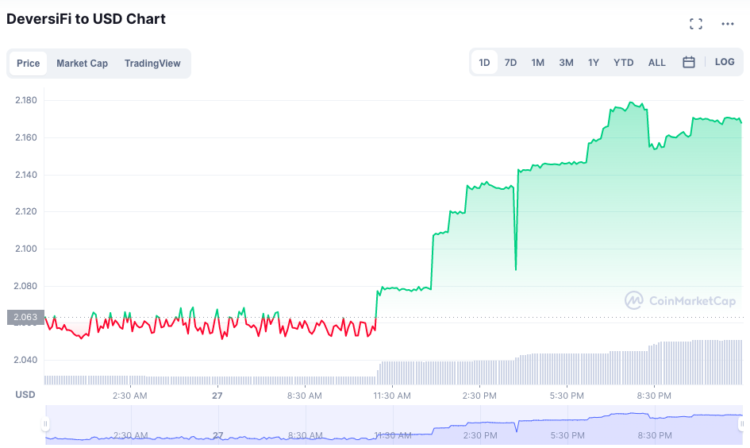

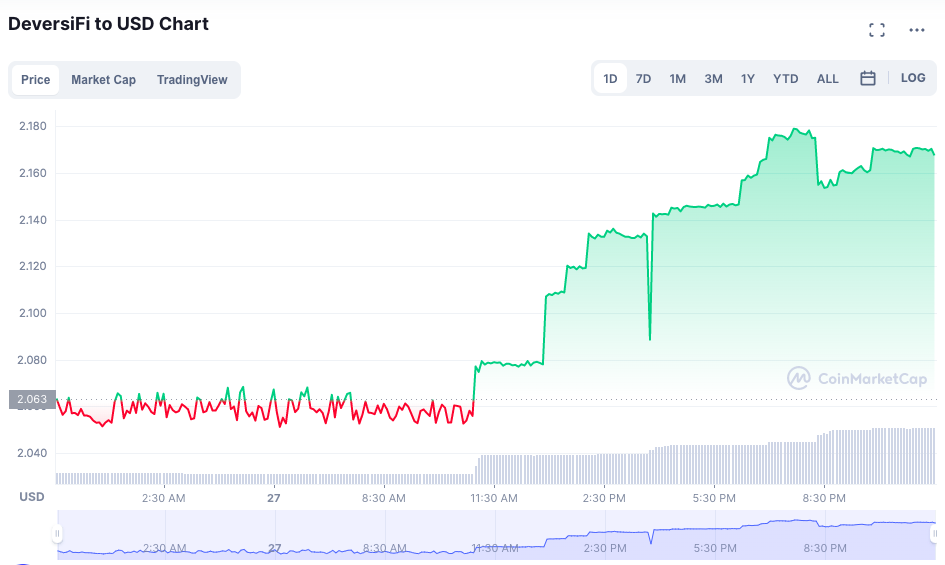

4. DeversiFi (DVF)

DeversiFi is a high-speed; layer 2 DeFi exchange that provides investors with the best DeFi based interest-earning investment opportunities without paying ETH gas fees. It seeks to provide a platform, which is easily accessible to everyone and where all DeFi investments can be managed under a single roof.

DVF is an ERC 20 token that governs the DeversiFi protocol. Holders can stake their DVF tokens to receive xDVF tokens and earn governance power by voting for bringing in major changes within the protocol.

Its current trading price is $2.17, with a 24-hour trading volume of $0.29 million. The current market capitalization is $52 million. It has 24 million coins in circulation and a maximum supply of 1,000 million coins.

Buy DVF on Coinbase

Your capital is at risk.

5. Augur (REP)

Augur is a decentralized ETH-based prediction market platform wherein users can wager on the outcome of events. Users are rewarded when they predict an outcome correctly. The rewards are paid in REP, the native token.

Traders do not need to own REP to bet on the platform. However, it can be used to create a prediction market, purchase participation tokens and dispute an outcome in the event of non-agreement.

REP’s current floor price is $8.91 and the 24-hour trading volume is $89.71 million. It currently has a market capitalization of $97 million. It has 11 million coins in circulation and a total supply of 11 million coins.

Buy REP on Coinbase

Your capital is at risk.

6. Reserve Rights (RSR)

The Reserve Protocol aims to host a decentralized stablecoin that will not be affected (depreciated or appreciated) by external factors like cryptos and fiat currencies. It enables users to convert their local currencies into digital dollars or global stable currencies to safeguard them from high inflation rate. Its stablecoin is RT Token.

Reserve Rights (RSR) is an ERC-20 token that can be used to insure the RT token through staking. Holders can further propose changes and vote on changes relating to the protocol’s configuration.

Its current market price is $0.005 and 24-hour trading volume is $37.26 million. It currently enjoys a market capitalization of $76 million. It has 14.80B coins in circulation and a maximum supply of 10,00,000 million coins.

Buy RSR on Coinbase

Your capital is at risk.

Where to Find Top DeFi Coins?

There are many reputed platforms that have listed various DeFi coins as tradable assets. However, one should carefully choose the platform as it plays a key role in the whole trading experience. Some of the important factors to consider are ease-of-use, safety standards, price structure and availability of top-performing tokens.

Following are the top 3 recommended platforms-

eToro

The “smart” DeFiPortfolio on eToro is quite useful for those looking to have a diverse DeFi portfolio to minimize risks and losses. The portfolio however requires a minimum investment of $500.

The reasonable cost structure makes trading cheaper. Also, being a highly regulated platform, it ensures the safety of your holdings and investments.

Visit eToro

Your capital is at risk.

Binance

To invest in DeFi on Binance, you need to buy BNB (BEP20) tokens from the Binance Smart Chain. You need to store these tokens in a wallet that supports dapp browser. You can trade these tokens from the wallet to buy DeFi coins on platforms like Pancake Swap, Venus, Uniswap, and others.

Visit Binance

Your capital is at risk.

Coinbase

Coinbase offers a plethora of DeFi coins to its users. You need to register on the Coinbase Wallet and buy and transfer ETH to it. Your ETH holdings can be used to trade DeFi coins.

Visit Coinbase

Your capital is at risk.

Read more:

Lucky Block – Our Recommended Crypto of 2022

- New Crypto Games Platform

- Featured in Forbes, Nasdaq.com, Yahoo Finance

- Worldwide Competitions with Play to Earn Rewards

- LBLOCK Token Up 1000%+ From Presale

- Listed on Pancakeswap, LBank

- Free Tickets to Jackpot Prize Draws for Holders

- Passive Income Rewards

- 10,000 NFTs Minted in 2022 – Now on NFTLaunchpad.com

- $1 Million NFT Jackpot in May 2022

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Credit: Source link