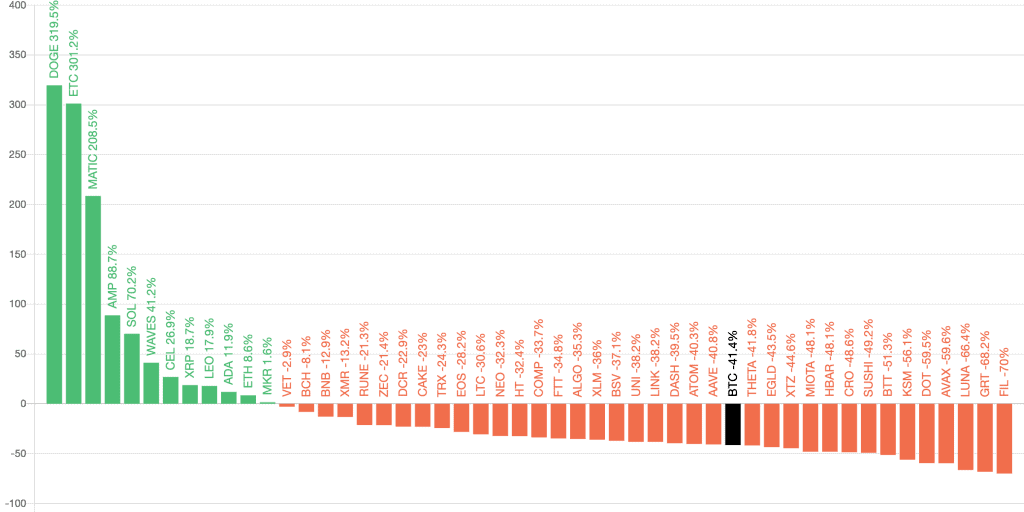

The cryptocurrency market has taken a step backwards after its recent recovery. After climbing as high as $1.528 trillion, the total value of the entire market has since fallen to $1.45 trillion. This is a dip of 5% in a single day, yet most major cryptocurrencies remain up over the past week. Ethereum (ETH) has risen by more than 14%, while dogecoin (DOGE) and ripple (XRP) have increased by 30% and 21%, respectively.

Given that much of the market is still down compared to a month ago, there still remains plenty of scope for further gains. As such, we’ve chosen a list of the 5 top cryptocurrencies to buy for best short-term returns.

5 Top Cryptocurrencies To Buy For Best Short-Term Returns

1. Dogecoin (DOGE)

Dogecoin (DOGE) remains a controversial cryptocurrency, yet there’s no doubt it’s susceptible to the occasional short-term jump. As stated above, it has risen strongly in the past week. It stood at $0.168 as recently as last Tuesday, but has since climbed to $0.247. This is an increase of 47%.

DOGE was as high as $0.731 as recently as May 8. This means its current price is 66% below its current ATH. By extension, it also means that DOGE still offers plenty of opportunity for further short-term gains. It continues to benefit from a steadily growing legion of fans and followers, with the Dogecoin subReddit now hitting 2.1 million subscribers.

2.1 mln subscribers in total pic.twitter.com/nDFU5XRW29

— skew (@skewdotcom) June 23, 2021

The meme-oriented, seemingly faddish nature of dogecoin investment has attracted a fair amount of criticism in recent months. Nonetheless, it remains a fashionable and well-supported crypto. This fact alone makes it one of the top cryptocurrencies to buy for best short-term returns. Admittedly, it may not have much long-term potential, but its 10,000% rise over the past year shows it’s susceptible to some outsized growth spurts.

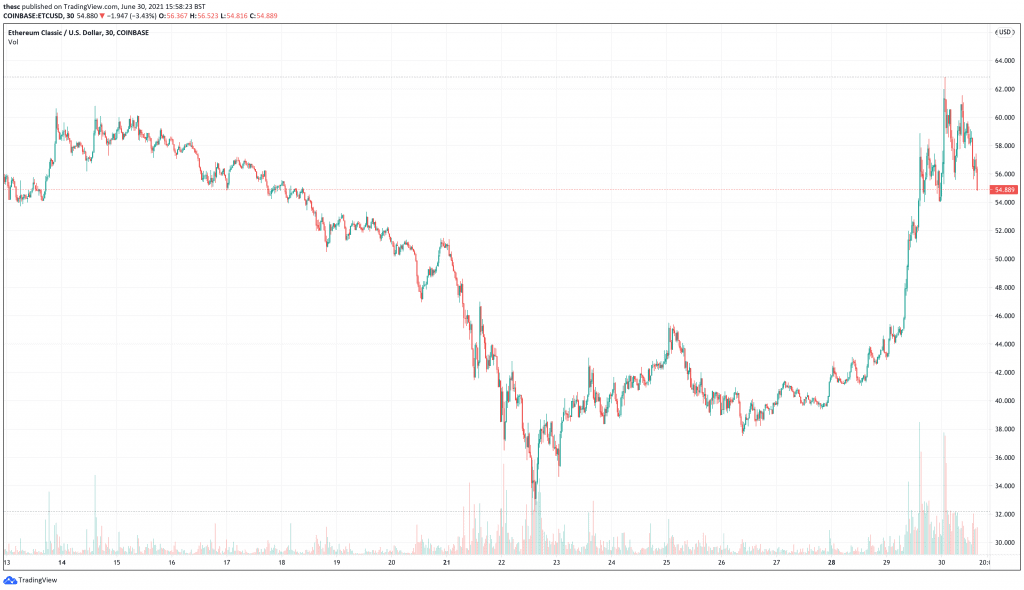

2. Ethereum Classic (ETC)

Ethereum Classic (ETC) is one of the best-performing cryptocurrencies in recent weeks. It rose by nearly 30% earlier today, to $61. It has since retraced its steps down to $55.75. However, this represents a 52% rise over the past seven days.

A 52% rise is good going for only a week. Yet ETC shows plenty of promise for experiencing a few more big short-term gains. It’s still down by 66% compared to its all-time high of $167, set on May 6. This is a bigger fall than most major cryptocurrencies, such as bitcoin (BTC) and ethereum (ETH). As such, it’s likely that it will rebound more strongly in the short-term.

Its performance will be helped by various pieces of positive development news. For example, it is in the process of rolling out its Magneto fork, which from July will introduce a number of improvements related to gas fees and transactions types. It will also optimize the cryptocurrency for Ethereum miners, who are likely to flock to ETC once Ethereum completes its long-awaited transition to a proof-of-stake mechanism.

Increased mining activity will boost Ethereum Classic’s security and power as a network. In turn, this may increase ETC’s price. So expect more short-term jumps as the market comes to price in its expansion.

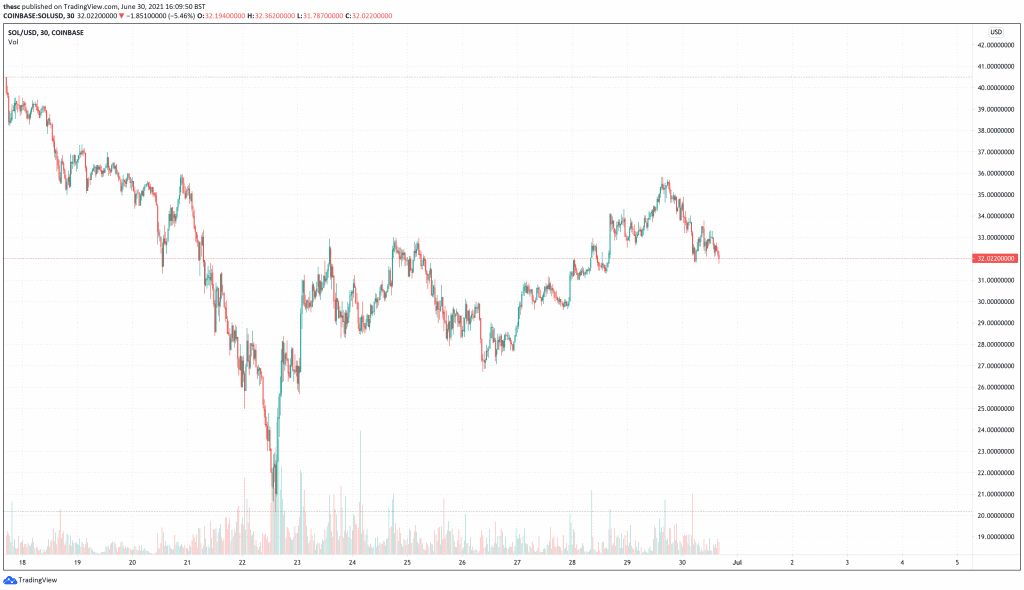

3. Solana (SOL)

Solana (SOL) is another cryptocurrency that has done very well in recent weeks. At $32.37, it has risen by 21% in the past seven days. It has also risen by 13% in the past month, as well as over 3,500% in the last year.

Data from Blockchaincenter.net shows that SOL is one of the best-performing altcoins over the past 90 days. It has risen by 70% over this timeframe, making it the fifth highest riser.

In keeping with the rest of the market, SOL is down from its ATH. Its current price is 44% below the record high of $58.03, which it set on May 18.

Solana has attracted plenty of interest as a platform, so it has plenty of potential for further big short-term gains. It’s a blockchain platform which uses a unique proof-of-history consensus mechanism, allowing it to timestamp transactions at a high speed. This mechanism also makes it less energy intensive than Bitcoin and other proof-of-work coins, which is part of the reason why it has attracted interest since Tesla stopped accepting bitcoin payments.

It has also witnessed a fair amount of adoption recently. For instance, the Switzerland-based 21Shares launched the world’s first Solana exchange-traded product (ETP) (which will be on the Swiss Six exchange) at the end of June.

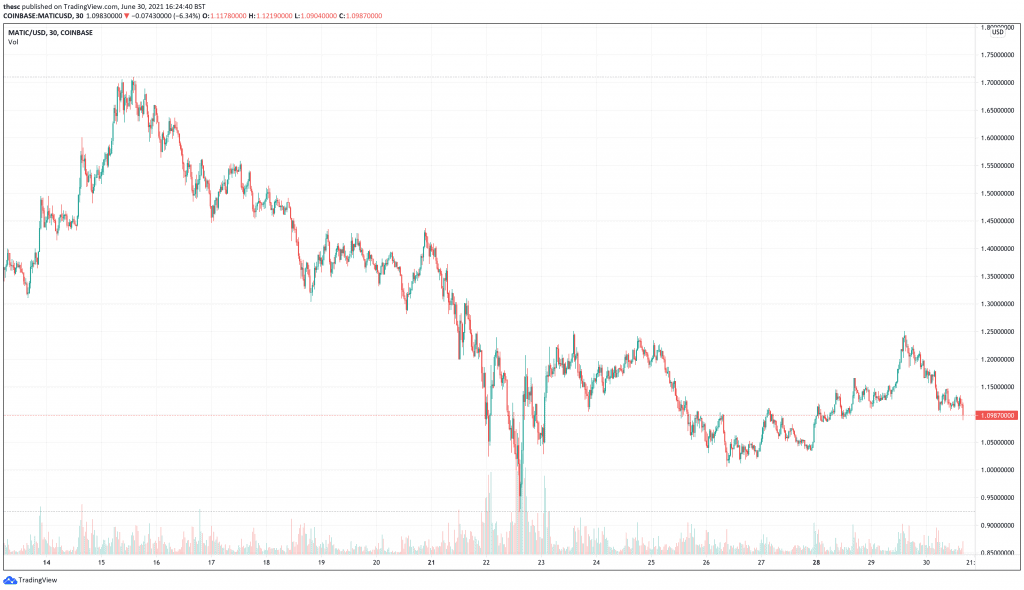

4. Polygon (MATIC)

Polygon (MATIC) has plenty of ground to make up. However, in its case, this is a good thing. At $1.11, it’s down by 57% from its ATH of $2.62, set on May 18. It’s also down by nearly 40% across the past month, and by 9% in the past 24 hours.

While such declines are a little above the average for the market right now, Polygon’s potential as a platform would suggest that some big short-term bounces are likely in the coming weeks. MATIC has risen by around 208% in the past 90 days, making it the third-best performing crypto over this timeframe. It’s also up 5,500% over the past year, so it now has a big base of holders ready to push its price upwards when conditions are more favourable.

And as a platform Polygon has attracted a considerable amount of use and adoption. Most recently, it launched a general-purpose blockchain called Avail, which is designed to provide chains with scalable transaction data.

1/ We are extremely excited to announce Avail – an important component of a completely new way on how future blockchains will work. #Avail is a general-purpose, scalable data availability-focused blockchain targeted for standalone chains, sidechains & off-chain scaling solutions. pic.twitter.com/xtsYKpJ3ur

— Polygon (@0xPolygon) June 28, 2021

Also recently, artist Beeple chose Polygon as the scaling solution for his new NFT platform.

1/4 🎉 Notable digital artist @beeple‘s new platform, “https://t.co/f9yT4mRefT”, opts for Polygon as its preferred Ethereum scaling solution.

🌐 Learn more: https://t.co/MT3hBURT6b https://t.co/q6t9JuQgYG pic.twitter.com/gX4aladNyl

— Polygon (@0xPolygon) June 27, 2021

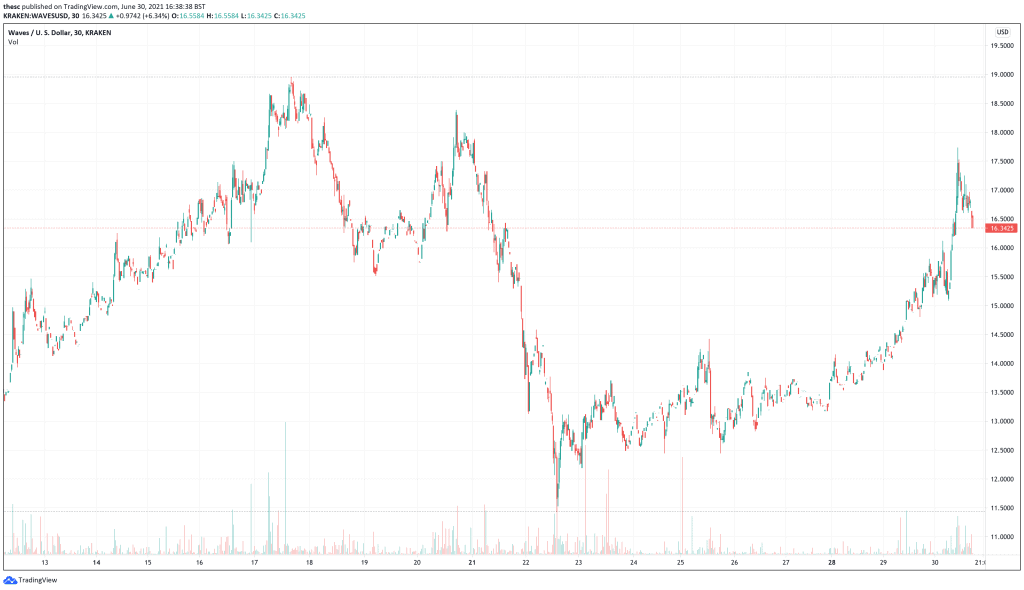

5. Waves (WAVES)

WAVES’ performance over the past few weeks has firmly staked its claim as one of the top cryptocurrencies to buy for best short-term gains. It has risen by 9% in the past 24 hours, to $16.51. This also represents a 32% increase over the past week, as well as 26.7% increase in the past 30 days.

Despite outperforming most cryptocurrencies over the past 30 and 90 days, WAVES is still 61% off its ATH. This gives it plenty of room to surge in the short-term. And given Waves’ function as a platform — helping users create and launch custom tokens — it’s likely to enjoy increased for as long as NFTs and DeFi continues to grow.

As an example, the Neutrino Protocol — a Waves-based platform which allows for the tokenisation of assets — celebrated $1 billion in total value locked in at the end of April. As Waves continues to build up its userbase, expect it experience more price surges.

Neutrino triumphs by surpassing $1 billion in TVL (Total Value Locked)! 🤩 Would you celebrate this milestone? 🥂 pic.twitter.com/YYuDvSl5H0

— Neutrino Protocol (@neutrino_proto) April 29, 2021

Capital at risk

Credit: Source link